The incentives found in the healthcare, food, and finance industries are anything but customer friendly.

There are valid reasons why 73% of Americans are obese or overweight. Health at any size is ingrained in our culture.

Americans are sicker, heavier, more depressed, and possess shorter life expectancies than recent generations. Modern medicine is a miracle, staffed by many outstanding people dedicated to saving patients’ lives. There’s a dark underbelly to the system, churning workers through a meatgrinder of conflicting interests.

We can take our hats off to our dedicated health care workers and put them on again when mentioning their work arrangements.

The blame falls on the perverse incentives of the healthcare and food industrial complexes.

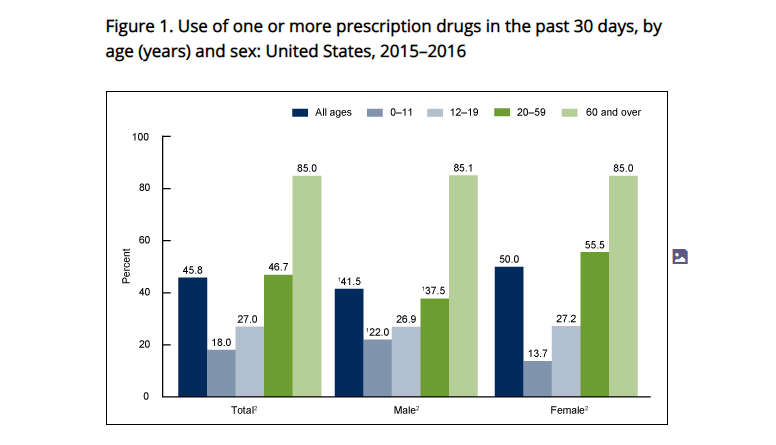

A system based on billing codes determined by never-ending stays on prescription medications is core to the problem.

Source: NCHS, National Health, and Nutrition Examination Survey, 2015–2016.

The business model of healthcare companies relies on long-term sick patients staying in the system- not getting better.

Though 90% of the cost of chronic disease reflects diet and lifestyle, prescription drugs are the solution of choice.

Physicians who base their practices on diet and lifestyle solutions are gaslighted and wimpified.

Somehow diet and exercise are labeled as elitist, ableist, and racist.

Why is it in Government’s interest to keep people sick?

It’s not a conspiracy theory. Follow the money.

The two largest industries in America are Food Service and Hospital Staffing.

In seventy-eight percent of states, Walmart or the Hospital System employs the most people.

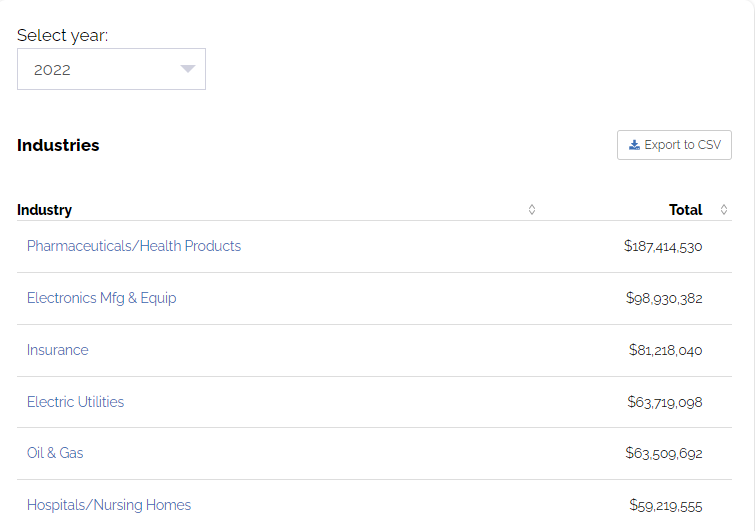

Healthcare is the most prominent industry lobbyist, double their closest competitors.

Source: Open Secrets

Both industries’ tentacles stretch further than the eye can see. Costly healthcare interventions are the predictable result.

Forty percent of The American Diabetes Association’s budget derives from Pharmaceutical companies. Is it any wonder costly medications, not lifestyle changes, are the preferred treatment method?

The ADA receives millions from food companies like Coca-Cola.

Is it any shock they license their logo to appear on sugar-laden foods like Snapple?

Nowhere in the USDA’s mission statement does it state improving Americans’ health is a goal.

The system reeks of similar perverse incentives.

Pharmaceutical companies underwrite eighty percent of medical school budgets. Many medical school deans receive six-figure or more payments from the industry.

Industry quality measures predicate how many patients doctors can get on medication and keep them there.

Medication compliance defines good outcomes.

Long-term medical assistance rather than cures are the North Star of industry standards.

Americans’ health suffers in exchange for steady profits flowing into the prescription drug and processed food industries.

Some of these outcomes make the scalawags of the financial service industry seem like Knights in King Arthur’s Court – Almost.

Perverse incentives similarly dominate financial services like the pill and junk food slingers regarding our health.

No need to invoke QAnon; the money trail tells the story.

Perverse financial incentives pillage the accounts of many retail investors.

Zero-sum game commission structures explain why:

Over 70% of public school teachers have high-cost variable annuities in their 403(b) accounts rather than index funds.

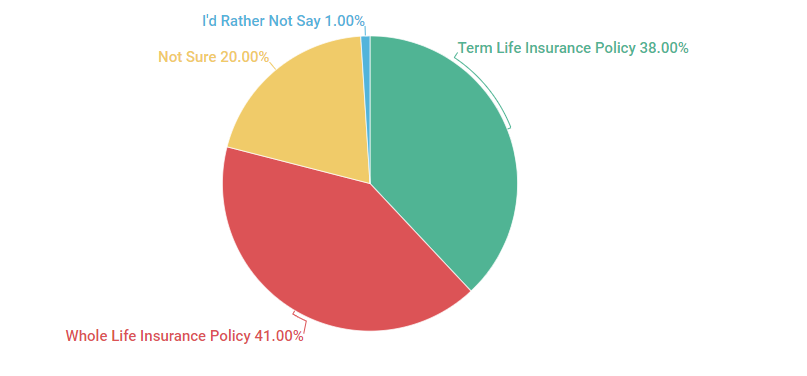

Why are Expensive and insufficient whole life insurance policies pushed to the masses instead of affordable permanent policies???

We find the answer in two words – High Commissions

Source: LendEDU

Most of the industry fought tooth and nail to block a fiduciary rule bringing transparency to ordinary investors.

Firms offer expensive proprietary products as solutions instead of alternatives that fit clients’ best interests.

High-cost and underperforming Hedge Funds and other alternative investments comprise large parts of portfolios of public pension funds.

Regulators leave their jobs for high-paying positions in companies they formerly regulated.

Top Producers strive for commissions rather than acting in the client’s best interests.

Anticipating regulatory fines flow into business costs for most large banks, insurers, and brokers.

The reality is that regarding our health and wealth, we rely on companies acting in direct contradiction to our needs.

The first step is understanding the systemic tidal wave endangering our health and wealth.

The second is doing something about it.

Source: Honestly, with Bari Weiss