Imagine paying jurors on their conviction rates?

Defendants wouldn’t stand a snowball’s chance in hell of getting a fair shake.

Not much different from current financial services models that pay salespeople high commissions to sell the most expensive products.

Incentives matter – A LOT!

Someone recently told me a story of a school custodian who threw leftover composition paper into the furnace at the end of each year. Why?

Higher-ups were afraid of future budget cuts if they didn’t use all their allocated resources.

Wells Fargo’s management required employees to sign up customers for eight different products at their bank’s “stores.”

Billions of dollars of U.S. government fines later proved the destructive effects of perverse incentives.

Safi Bahcall discusses the discovery of the Dead Sea Scrolls. “When the Dead Sea Scrolls were first discovered by Bedouin shepherds in a desert cave near the Dead Sea in modern-day Israel, archaeologists offered to pay the shepherds for each new scrap they found. That encouraged the shepherds to rip any scrolls they found into tiny scraps.”

Right idea, wrong incentive

What if firms created a new position called a Chief Incentive Officer?

Would this lead to better outcomes for clients?

What effect would this have on firms who hired a C.I.O.?

Safi Bahcall writes about such scenarios in the terrific book, Loonshots.

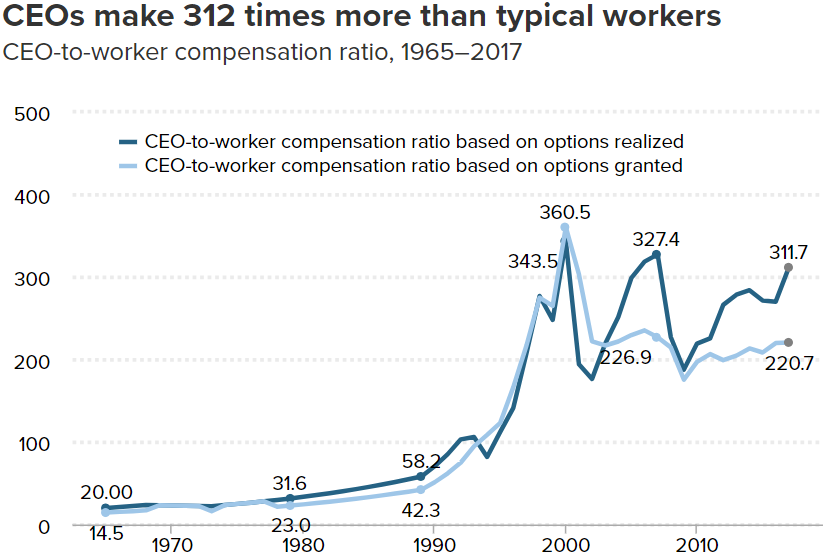

Bahcall laments the way stock equity awards are distributed to middle management.

Top executives receive large grants, while low-level employees get a small fraction.

Source: Michael Batnick

What happens in the middle is where the real action is taking place.

Middle managers see they are on the cusp of receiving large bonuses.

The incentives for getting there are bad for all stakeholders.

Bahcall states, “The steep curve creates a middle-manager version of Survivor, a giant jackpot for those who succeed in crushing their colleagues and staying alive……..It turns the vulnerable middle into a scene from Lord of the Flies.”

Office politics becomes the main determinant of promotions and corresponding higher pay.

Rank becomes the prized goal. Privileged perks like “Parking spots, a special cafeteria, or trips to Hawaii” don’t benefit underlings customers or shareholders alike.

How can a good C.I.O.? eliminate the perverse incentives found in many firms?

Celebrating results, not rank, is a good start.

Shifting awards toward projects and less toward promotion greatly reduce the political influence.

Tapping the power of non-financial rewards is a terrific idea. These include things like peer recognition, reduced commute times, choice of assignments, and freedom to work on so-called Passion Projects.

Finally, the team, rather than individual rewards, should be stressed.

Forward-thinking organizations will leapfrog their competitors.

“Those skilled in using tangible and intangible equity and can spot perverse incentives – are likely to do a better job than their competitors in attracting, retaining, and motivating great people. in other words, they will create a strategic advantage.”

Imagine applying this philosophy to the Kings of Perverse Incentives – Insurers selling unnecessary annuities to teachers in their 403(b) plans?

Changing the incentives from price gouging teachers to turning them into lifelong clients and long term advocates would cut profits in the short term in exchange for big dividends later.

How about creating incentives to lower costs for teachers while providing an increased venue of services a teacher needs?

Eliminating all-expense-paid trips to exotic sales locales and replacing them with more non-financial rewards that improve an often dog-eat-dog sales environment would do wonders for worker morale.

Is this a moonshot for these organizations?

Absolutely, but every game-changing success starts out the same way.

Sir James Black, who won the Nobel Prize for medicine, famously stated about drug discovery, “It’s not a good drug unless it’s been killed at least three times.”

The world is full of haters.

The right incentives attract the right people.

In the end, how you treat people is all that matters.

Start by giving them the right incentives and see what happens next.

You might be surprised by what you find out about their real motivations.

Source: Loonshots, by Safi Bahcall