How did our financial services industry become so exploitative and predatory?

Blame the bankers. Move over, Jordan Belfort. Without the aid of Quaaludes, Charles Mitchell created the blueprint for modern-day miscreants.

After being appointed president of the National Security bank in 1921, Mitchell unleashed the hounds. Mitchell formerly lorded over National City Company, the bank’s security affiliate. The secret sauce for success was salesmanship. Mitchell co-mingled this culture into the conservative bank.

Commercial banks’ primary function is keeping depositors’ money safe, not putting it at risk through risky ventures. Blending commercial and investment bank never ends well. This case would be no different. Screwing with nations’ money supply is a dangerous game.

Mitchell’s method was relentless.

“Instead of waiting for investors to come, he took young men and women, gave them a course of training the sale of securities, and sent them out to find the investors. Such methods, pursued with such vigor and on such a scale, were revolutionary.”

Mitchel introduced terms like producers and sales quotas. The genesis of all that is wrong with the financial services industry started a century ago.

“There were sales contests for these salesmen of stocks and bond, just as there were sales contests in those days for men who sold vacuum cleaners and novelties: in one contest which began in September 1929, just as the prices of securities were about to go over the cliff’s edge into depression, The National City company offered $25,000 in prize money and the scoring was done on an elaborate point system-one point for each share of General mills common stock which they disposed of, 4 points for each share of Missouri-Kansas-Texas 7% preferred stock and so forth.”

Crummy incentives are ground zero for terrible behavior. A conflicted sales culture places little value on responsibly deploying the savings of hard-working Americans. Results were the only measurable goal complete with their predictable consequences.

When a companies principles are as pliant as wax under the sun, look out below!

Mitchellism became contagious, spreading to other banks. This gang of financial predators played a significant role in the subsequent 1929 stock bubble and subsequent crash. Retail investors became easy marks along with many small banks. Other banks copied Mitchell’s model. As the old saying goes, If you consort with someone covered in dirt, you can hardly avoid getting a little grimy yourself.

Eventually, the system blew up, resulting in massive wealth vaporization, the failure of thousands of banks, and the Great Depression.

Mitchell became the target of an extensive government investigation. Mitchell speculated in his own banks’ securities, made illegal stock transactions, and engaged in tax evasion. On a brighter note, Mitchell was primarily responsible for The Securities Act of 1933 and the Banking Acts of 1933 and 1935. Not the legacy he planned.

While Mitchell is long gone, the after-shocks are alive and well.

Big brokers and banks fight tooth and nail to prevent a strict fiduciary rule looking out for their client’s best interests from passing.

Insurance salespeople peddle expensive whole-life insurance even though these policies provide 99% of investors with little value.

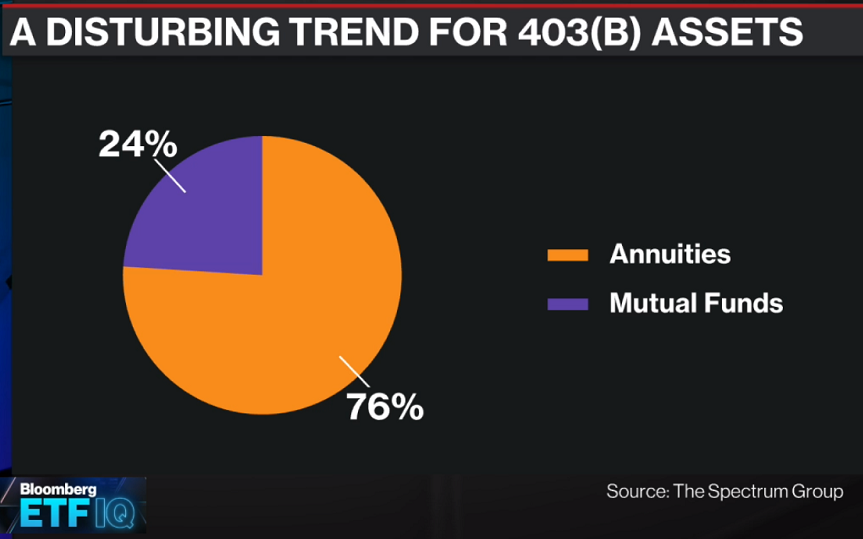

A teacher’s 403(b) market dominated by pricey tax-deferred annuities remains free of serious regulation.

Salespeople sparkle as top producers for exceeding their sales goals.

Twenty-first-century firms pursue his north star of exploiting the masses.

Mitchell famously remarked about how easy it was to fleece the innocent.

Speaking to one of his firm’s bond salesman, “There are six million people with incomes that aggregate thousands of millions of dollars. They are just waiting for someone to come and tell them what to do with their savings. Take a good, eat a good lunch, and then go down and tell them.”

Paraphrasing Jesse Livermore Nothing is ever new on Wall Street. Whatever happens, today has happened before and will happen again.

Selling sizzle instead of the steak is no exception.

Source: The Lords of Creation By Frederick Lewis Allen