Rule #1 Never Mix Investing with Politics.

Rule #2 Always follow Rule#1.

Political stress is toxic to both your health and wealth. The constant vitriol affects your mind, body, and portfolio.

Psychologists have coined a term for this syndrome- Headline Stress Disorder.

Before discussing money, let’s dive into why this affliction is so prevalent and dangerous.

Gabor Mate dishes out some arguments for these compulsions.

The toxicity of political life might be of less concern if we could even get a momentary breather from it. Our phones have become handheld stress machines buzzing urgently with updates, from the banal to the grave, about matters of conflict and uncertainty-matters primarily out of our control. Social media feeds “feed” us all we can eat and more still. It never stops.

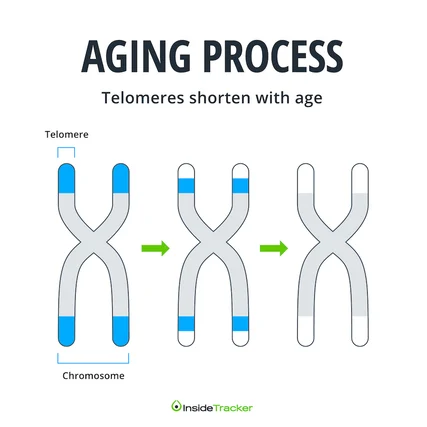

Dr. Elissa Epel, a Telomere researcher, suggests that the daily toxicity of political rancor may make our bodies age more rapidly. Her research suggests constant exposure to political negativity may damage telomeres by shortening them. These are vital health-maintaining chromosomal structures imperative for healthy living.

The body keeps score.

The absurd display of Debt Ceiling Political Theater is a prime example.

Many investors altered their portfolios or decided to subtract years off their lives by needlessly fretting over a politically contrived artificial crisis. As an attendee of too many of these financial rodeos, I acted proactively and implemented a DEFCON ONE strategy- I ignored the entire charade.

Guess What?

Armageddon never arrived. Catastrophic default was averted, and the media moved on to the next in a never-ending series of crises.

I love the crew at Bespoke’s take:

As you read this week’s report, you’ll see minimal mention of the ongoing debt ceiling negotiations. That’s for two reasons. First, we don’t want to give politicians the satisfaction. The debt ceiling has been raised dozens of times over the last decades and will get raised again……. Second, there’s no way to game the entire process. If the U.S. defaulted, it would be catastrophic for all involved. The short answer to what would happen in that event is stocks and bonds would go down sharply, and we’d all have bigger things to worry about.

Like in life, one’s worst fears seldom come true in the markets. If they did, it’s game over.

Why burn precious seconds worrying about them?

My colleague Cameron Rufus likes to say – They’re Just Trying To Scare You.

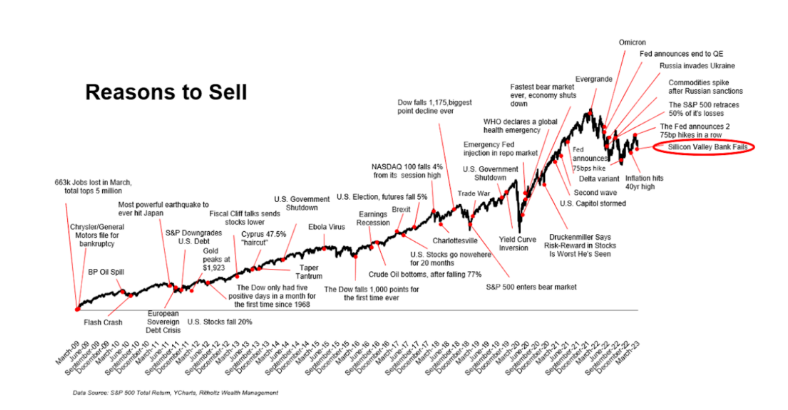

This isn’t a one-off. The fear industrial complex is preparing the recipe for the next Crisis DuJour. Luckily, over the long term, the markets mock their cynicism.

Almost every bit of financial media I read is trying to convince me that you all—we—are scared shitless for the future. Quoting “experts” and top executives who are all but too sure a recession is only imminent. For months, they’ve been pushing the potential for a recession from Q1 to Q2 to Q3 to 2024.

The excellent news is HSD is curable.

Unlike most chronic diseases, the antidote is accessible to all those afflicted. Turn off the T.V. and go for a walk. Exercise your demons, literally and figuratively.

Trust me; you won’t miss anything.

Your Telemores will thank you later.