Anything can happen at any time in life and the financial markets.

The more extensive the number, the greater the range of possible scenarios. The greater the range of possible scenarios, the more likely previously thought improbable events will occur.

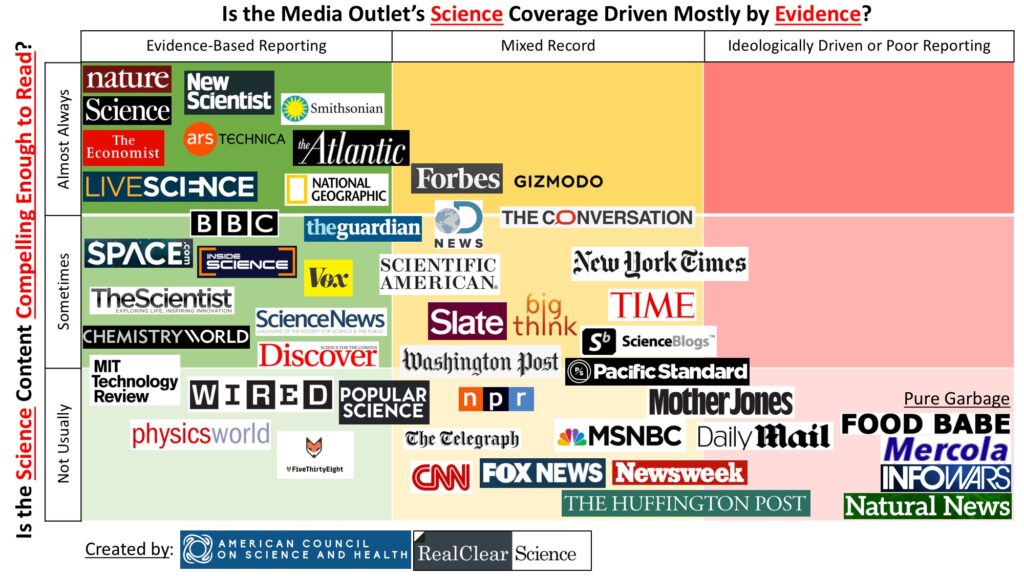

Combine this statistical fact with the news media’s propensity for covering negativity over progress, and we have the formula for a wild and ridiculous worldview.

Unsurprisingly, many believe we live in the worst times when the opposite occurs.

Morgan Housel highlights this feature in his fantastic book, Same as Ever.

There are about eight billion people on this planet. So if an event has a one in a million chance of occurring every day, it should happen to eight thousand people a day, or 2.9 million times a year, and maybe a quarter of a billion times during your lifetime. Even a one-in-a-billion event will become the fate of hundreds of thousands of people during your lifetime. Given the news media’s insatiable appetite for shocking headlines, the odds are nearly 100 percent that you will hear about these events when they happen.

Since there are so many people and combinations of possible once-in-a-lifetime events, unwelcome surprises are a feature, not a bug.

The late Daniel Kahneman stated, “Humans cannot comprehend very large or small numbers. It would be useful for us to acknowledge that fact.”

The financial markets aren’t immune from this phenomenon.

Why do investors let random events play them, like Lucy pulling the football away from Charlie Brown as he’s about to kick a field goal?

Social media occupies an outsized role in fanning the flames of our collective neuroses.

In the past, radio and newspapers were our primary sources of information. The world was localized, not connected. Local news centers around parades, high school sports, and annual picnics, but it’s hard to raise cortisol levels thinking about these pleasantries.

Television, and now the internet, replaced local reporting. Real-time global news changed everything.

Now, we have a front-row seat to genocides, tsunamis, Coups, and exotic infectious diseases, regardless of proximity.

Even though events in far-off lands will likely not affect investors’ lives, the media tells them a different tale, and all hell breaks lose daily.

In addition, human beings hate uncertainty. Evolution conditioned us to make rapid decisions to save our hides, which makes us more susceptible to authority voices on social media and other platforms.

The new pandemic of certainty is contagious and deadly for our mental health and money.

Everything we learned in probability and statistics class flies out the window when your house is on fire.

The world has no shortage of media arsonists fanning the flames of continuous anxiety. Having the choice to have no opinion isn’t an option in the hyper-competitive angertainment landscape. If broadcasting your opinion on current global and domestic events, which you know little about, was illegal, Incarceration is likely for 90% of the population.

Financial market surprises are an oxymoron that should be the default view.

It’s difficult to ignore the daily 24/7 media firehose of carnage blasted into your news feed.

Awareness of probabilities and perverse media incentives is a significant component to add to your investor suit of armor.

Fighting evolutionary impulse is no walk in the park.

It’s worse not being mindful of the forces rallying to separate you from your money.

Start your self-defense class by directing your energy toward items that you can control.

One in a million surprises occur more often than you think. Plan accordingly.