There aren’t any loans for retirement.

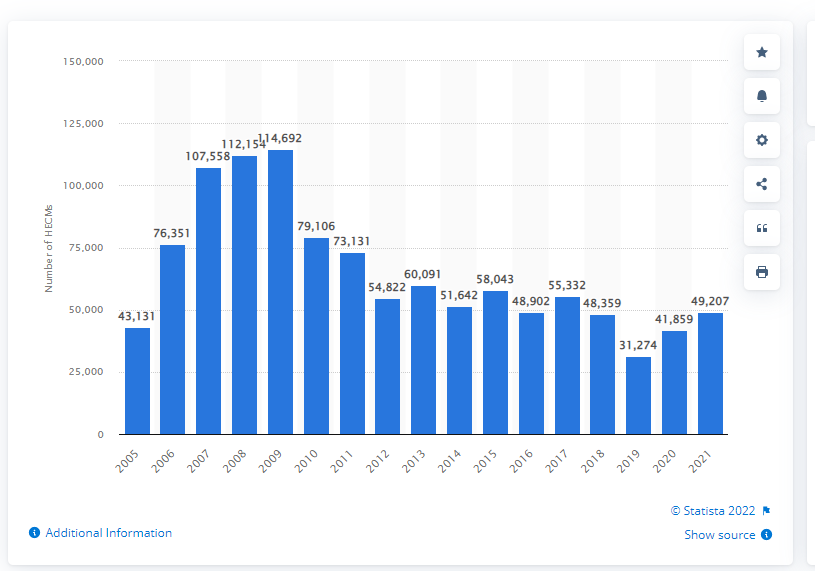

Should we count reverse mortgages being pitched on daytime TV by Grade-C actors?

While this product makes sense for some, it’s not close to reaching critical mass.

Financing college is a different ball game. Too many Americans jeopardize their retirement security by screwing up late-stage college planning.

Nobody’s saying not helping your child with college costs. Some methods make more sense than others. The convoluted admissions process offers little guidance for the most significant family financial decision other than a home purchase. If you’re sending multiple children to college, the costs may exceed the purchase price of your residence.

High School guidance counselors are overwhelmed and have little training in finance. School admission offices often offer conflicting advice. The admissions officer’s objectives are filling the class and not making sure your family isn’t overreaching. Over a trillion dollars in student loan debt confirms the dilemma.

The outcomes are drastically different depending on your available resources and what school you choose.

Source: College Aid Pro

What does a typical American family do?

Like most good solutions to complicated problems, avoiding extremes is strongly advised. There is a middle path to satisfy both goals.

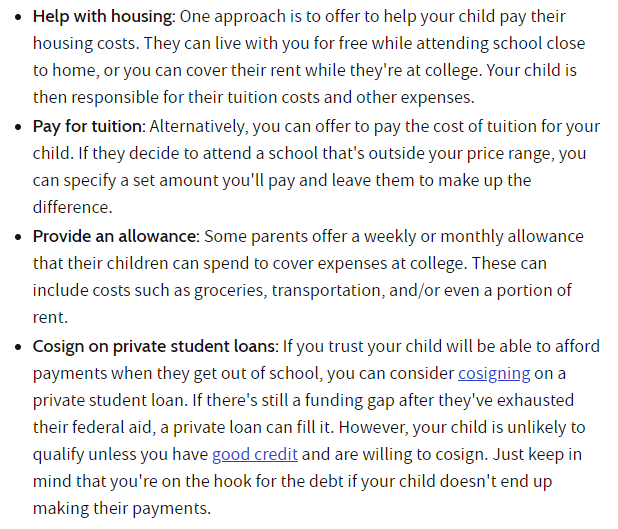

Investopedia offers an excellent solution for this multiple-layer puzzle.

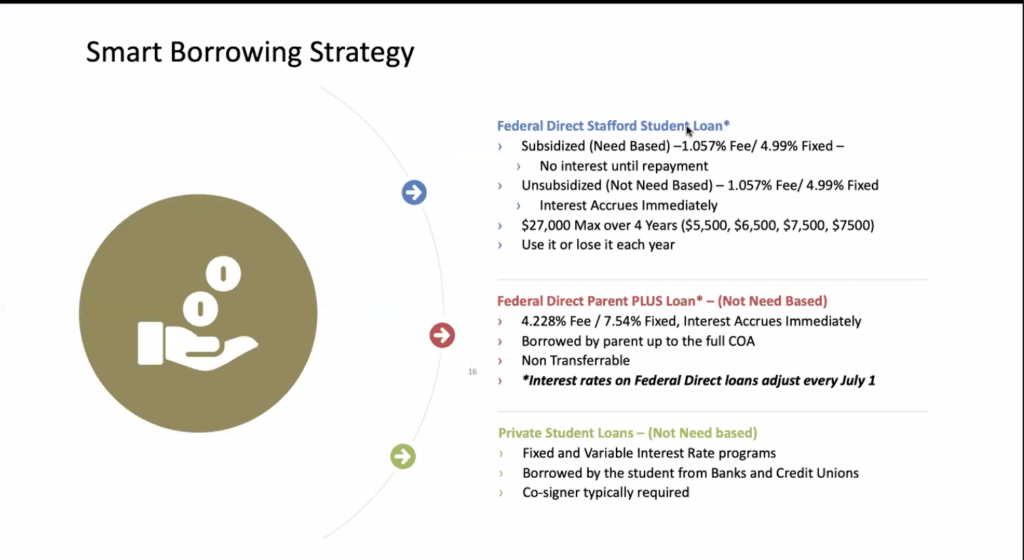

In addition to these suggestions, debt management is a critical piece of the puzzle. The Federal Direct Loan program must be your first destination if loans are required. There are several reasons why borrowing from the government is preferable to the private counterpart.

- Federal Direct Loans are in the students’ names, not yours. If there’s a default, it has no impact on parents’ credit scores. Poor credit scores and excessive debt during retirement aren’t the optimal situations.

- Most students are limited to borrowing $27,000 under this program. It’s strongly recommended students keep their debt under their first-year starting salary to avoid a host of unpleasant situations.

- If a family meets specific income requirements, the government won’t charge any interest until the student graduates.

- The student has an opportunity to learn personal responsibility and build a healthy credit score by having skin in the game.

Source: College Aid Pro

To qualify, parents must fill out the FAFSA form. All families are eligible for the subsidized program regardless of income. Unfortunately, many receive terrible advice from family and friends and never submit this form. Saying this is a colossal mistake is an understatement.

Parents must wear their oxygen masks first before attending to their children during an air emergency. The same goes for college planning.

The worst retirement plan burdens your children with retirement expenses because of emotional and short-term decision-making.

Putting yourself first isn’t always selfish behavior.

If you need some help, let me know.