Who’s your master?

Money and possessions are appalling candidates.

People crave happiness despite looking in all the wrong places.

We sell ourselves at a discount.

We want what we can’t have.

We don’t understand property rights.

External events emerge as the source of all misery.

Epictetus stated;

The more we value things outside our control, the less control we have.

The operations of the will are in our power: not in our control are the body, the body’s parts, property, parents, siblings, children, country, or friends.

Many wealthy people ignore these indisputable facts.

Allowing unruly externals in, they metastasized.

First-world problems offer valuable lessons. A psychotherapist to ultra-high net worth individuals provides provocative insights.

What could be challenging about being a billionaire, you might ask. Well, what would it be like if you couldn’t trust those close to you? Or if you looked at any new person in your life with deep suspicion? I hear this from my clients all the time: “What do they want from me?”; or “How are they going to manipulate me?”; or “They are probably only friends with me because of my money.”

Billionaires can’t control others’ actions but insist on doubling down on their children.

Too many of my clients want to indulge their children so “they never have to suffer what I had to suffer” while growing up. But the result is that they prevent their children from experiencing the very things that made them successful: sacrifice, hard work, overcoming failure, and developing resilience. An over-indulged child grows into an entitled adult with low self-confidence, low self-esteem, and a complete lack of grit.

The hit show, Succession, isn’t way-off.

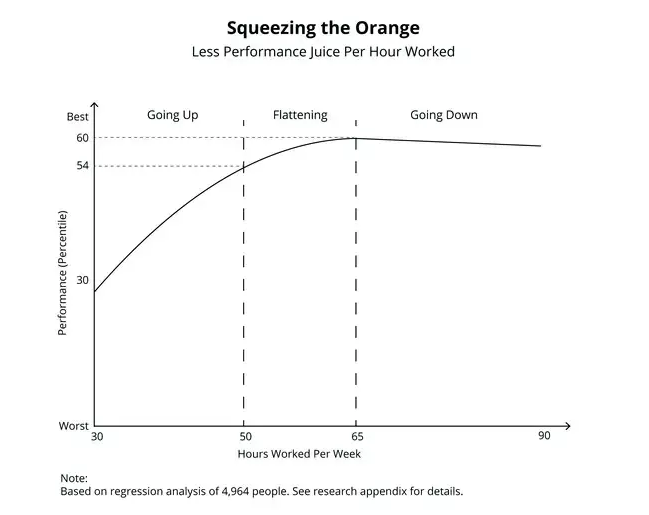

Creating a lopsided work-life balance is ruinous.

High earners are working more than ever.

Is this worth missing your kid’s little league game?

Source: Quora

External events have a toxic way of appearing during inopportune moments.

Despite our hubris, we’re all terminal patients.

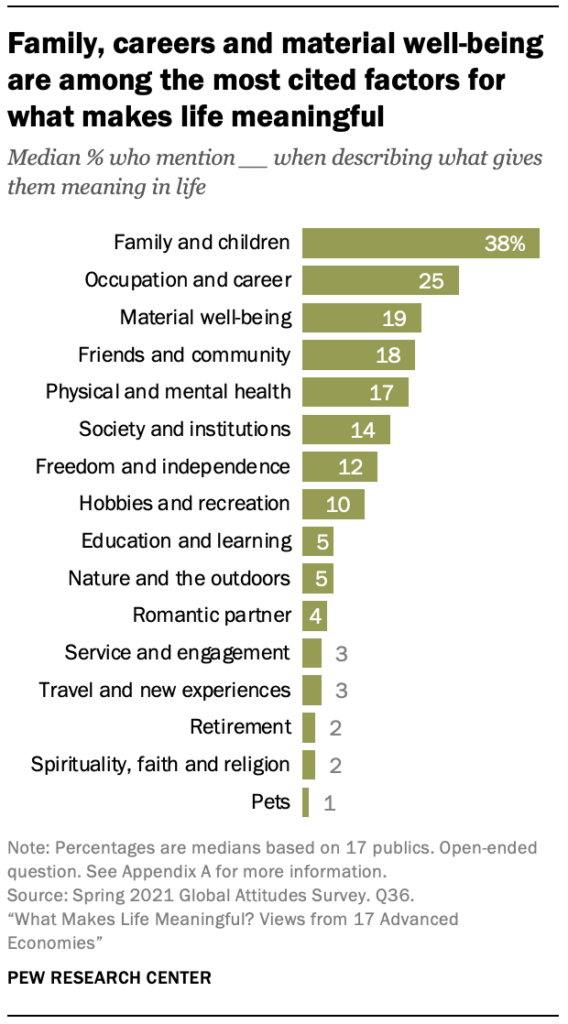

Sacrificing precious moments with friends and family is a dangerous gamble.

You may love your work, but it doesn’t love you back.

This well-intentioned sacrifice provides unintended consequences.

My colleague Josh Brown agrees.

In truth, talk to a typical advisor circa 2021, and they’ll tell you that the hard part is convincing clients to spend their money. To use these savings, accumulated over decades and decades of working, to do the things they want to do. These things – sailing, traveling, vacation home-ing, RVing, gifting, sports car driving, etc. – do not become more fun in your late 70’s or early 80’s. They would be fun now, in your 60’s. Easier said than done – when you’ve been programmed over forty years to save, save, save, save, it’s hard to flip the switch and start spending. Spending on the necessities, sure, but did you trade forty years of labor for only the necessities? Certainly not. The rewards should be bigger; otherwise, you’ve made a bad trade.

Epictetus, a slave for thirty years, enjoyed more freedom than his masters.

Let that sink in.

Many obsess about counting wealth that matters least.

As Thomas Merton put it, “People may spend their whole lives climbing the ladder of success only to find, once they reach the top, that the ladder is leaning against the wrong wall.”

Make sure the right people are holding your ladder.

Source: Epictetus, Discourses and Selected Writings, Penguin Classics