Markets can be very scary.

China Devalues Its Currency To 7 Yuan To The Dollar And Markets Plunge! – scream the headlines.

The media loves throwing kerosene on investors combustible emotions.

When markets fall 5% in a week, it’s pretty frightening. Even scarier is not knowing why.

We have hundreds of teacher clients and other common folks relying on us to guide them through these tumultuous periods.

Accomplishing this task without industry jargon and with respect to their understandable fears is essential.

Here is my take on the latest “crisis” in English, not Wall Streetese. Full disclosure – I was once a very average currency trader

China is super pissed off because President Trump imposed new tariffs on their exports.

Exports are a tax on trade, making Chinese goods more expensive for U.S. consumers. Rising prices lowers demand for Chinese goods.

The President did this because he believes the Chinese engage in unfair and illegal trading practices. Resulting in lost jobs and lower wages for American workers.

The President wants China to purchase more U.S. goods. and sell less stuff to the United States. In theory, this should create more jobs for Americans.

China has a long history of being dominated and humiliated by outsiders. They are very sensitive to any criticism of their current system.

Not surprisingly they retaliated. This is called a trade war.

Responding to the tariffs, China weakened its currency against the dollar. Formerly only 6 Yuan (The Chinese Currency) was needed to buy 1 dollar, now it takes 7. That’s called a devaluation.

A weakened Chinese currency makes Chinese goods less expensive for American consumers. The Chinese are hoping this will offset the price increases caused by the tariffs.

For good measure, the Chinese decided to halt purchases of American agricultural products. This move was specifically targeted at President Trump’s rural farm base of voters.

In retaliation, the U.S. Treasury Secretary declared China to be a “Currency Manipulator.” This could lead to sanctions and fines from the World Trade organization.

Markets rarely exist in a vacuum. Civil unrest in Honk Kong and a trade war between South Korea and Japan are not helping things.

Why do markets hate this type of stuff?

Markets despise uncertainty. Nobody knows how this trade war will play out and how long it will last. Fearing the worst possible outcome becomes the default choice.

When professional traders don’t know what’s going on, their first reaction is to shoot first and ask questions later. They sell and sell some more. Over 90% of daily market trading is done by machines using computer programs called algorithms.

Unlike 401(k) investors who have time frames measured in decades, the computers measure theirs in milliseconds.

Many of these Algos are designed to sell stocks at the same levels, compounding the stampede to the exits.

Trade wars slow global economic growth. Corporate profits go down. Stock prices are based on a companies future earning power. Thinking future profits will be lower, traders sell stocks.

Markets rise and fall based on something called sentiment. When investors feel good about things, they ignore the bad news and focus on the positive. When sentiment shifts, the reverse occurs. This is where we are currently.

What should the average 401(k)/403(b) saver do about this?

For 99%, absolutely nothing.

Not meaning this shouldn’t scare the crap out of you.

There is a big difference between experiencing strong emotions and acting upon them.

Charlie Brown investing doesn’t work. Lucy constantly conned Charlie into kicking a football she would pretend to hold, leading to poor Charlie falling on his ass every time.

The same result is in order for investors who insist on selling their stocks during every market hiccup.

Having done this for 20 years, I speak from experience. EVERY single time it would have been a terrible mistake to sell stocks during market corrections. Abandoning carefully created financial plans is a terrible look.

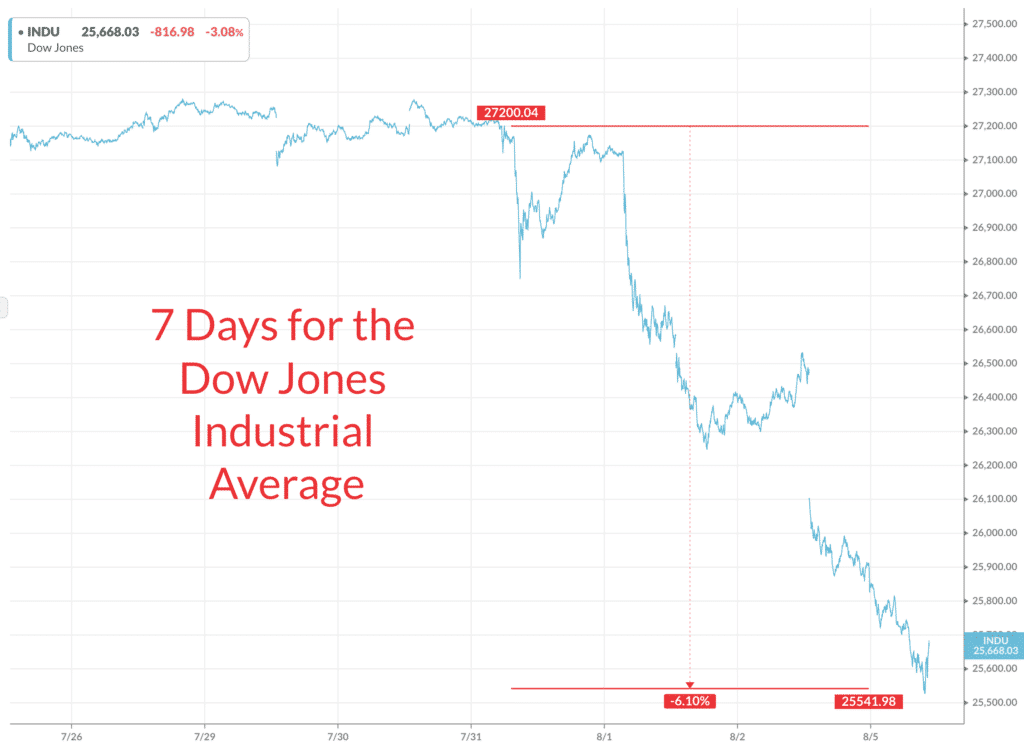

Focusing on a chart like this isn’t helpful unless you’re a short term trader.

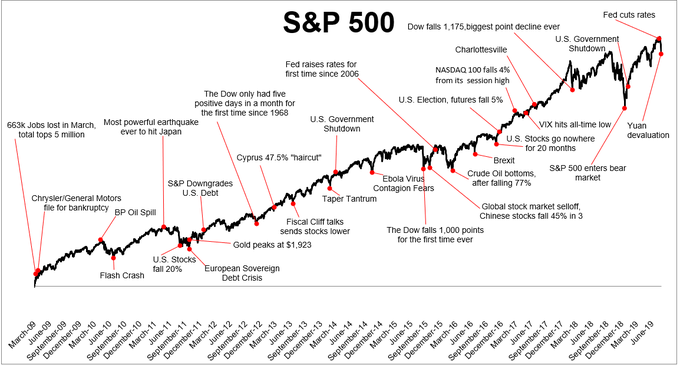

The chart below gives a much better perspective for the majority of us. The problem being, we all live in the short term but plan for the long. The basic concepts of investing are pretty simple but they are far from easy to implement without the help of a good advisor.

Unfortunately, markets temporarily going down are the reason they go up. My colleague, Josh Brown, cuts to the chase.

“Stock investors get paid for facing these fears because som many others will not face them. When nobody fears anything, stocks no longer work for investors long-term return needs. when the possibility of loss goes away, so does the probability of gain.”

It’s the price of admission.

As Jason Zweig once said, “In investing, only the survivors get paid.”

While bad market days are not common, they also aren’t rare.

According to Ben Carlson, “The S&P 500 has been down 2% or worse on a single day 70X this decade. It’s been down 3% or more on a single day 19X.”

During these moments, Charlatans emerge from their caves making scary predictions and dangerous statements. Your long term financial health is the last thing they care about. Their motivation is purely selfish in nature. Attracting eyeballs with ever-increasing outlandish proclamations is their game plan. Enriching themselves is their top priority.

Others advise getting back into the market when the smoke clears. Good luck with that!

According to Daniel Crosby, this is pretty much impossible.

There will always be worries, some founded, others not and investors who are paying attention will never have a sense that it is “all clear.” This uncertainty, this pervasive not knowing, is the hallmark of both life and capital markets and those that have mastered both come to love and embrace it.

Nothing that’s worthwhile comes easy.

Place investing near the top of the list.