Investing isn’t hard science.

According to Tadas Viskanta,“The first law of finance is that there are no laws.”

Part of what determines investing success is influenced by forces beyond our control.

Nick Maggiulli, stated, “You need to be in the right place at the right time.”

J. Paul Getty agreed: “My formula for success is rise early, work late, and strike oil.”

What should we do?

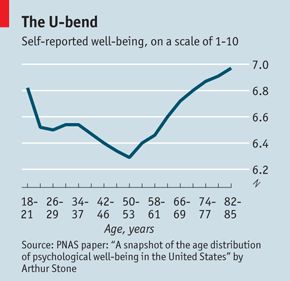

The answer lies in a formula in Jonathan Rauch’s brilliant book, The Happiness Curve. “In mid-life years of cumulative disappointment about past years, life satisfaction combines with declining optimism about future life satisfaction to produce a nasty feedback loop.”

H = S+C+V+T

H = Enduring level of happiness

S = Emotional set point

C = Life’s circumstances

V = Factors under voluntary control

T = Time

Mid-life is when happiness bottoms out.

Investors pay heed.

Emotional Set Point is when we reach our goals and are inexplicably miserable.

According to Psychologist Jonathan Haidt,”Our inner incentive system rewards us with immediate but short-lived bursts of satisfaction for making progress toward a goal. Whereas actual arrival delivers fleeting pleasure but soon becomes the new baseline.”

Now what? This becomes an overriding unhealthy preoccupation. Think of unfortunate extremes like Anthony Bourdain and Kate Spade.

We become trapped on a Hedonic treadmill. A way to avoid this is to focus on process, not outcomes. The investment journey is most important. Trying to time or beat the market subtracts from the happiness formula.

Who cares if you kill the S&P but are miserable in the process?

Social comparison is a bitch.

The only benchmark worth worrying about is: Will I be okay?

Factors Under Voluntary Control. A key to investor happiness is NOT stressing about things we can’t change. Trying to guess which asset class outperforms annually is a waste of time. Targeting things like fees, savings rates, and diversification provide the most satisfaction in the long run.

Don’t Overdo It. Worshipping at the temple of the narcissism of small differences isn’t a good look. Stressing yourself to save two basis points on an index fund isn’t time well spent.

Time. Time is a Baby Boomer’s temporary enemy but an investor’s best friend. Rauch states, “Waiting is not a passive strategy. It’s not doing nothing. Waiting is a way of working with time and letting time work for us. Patience is not the whole answer for almost anyone but it is a part of the answer for almost anyone.” Few describe compound interest any better.

Life’s Circumstances. We cannot control market circumstances; we can control our attitude towards them. Josh Brown once said, “Fate is the cards you are dealt, destiny is how you play them.” Investors need to live in the present and realize that bull and bear markets aren’t permanent fixtures. The Market Gods owe you nothing.

Embrace the hard times. This is where you will learn the most.

Pain + Reflection = Progress (Ray Dalio)

“Disappointment about the past and pessimism about the future squeeze out fulfillment in the present.” Rauch is discussing middle-age angst, but could easily be describing an investor’s psyche.

Cheer up!

The happiness curve is on your side. The best years of your life and portfolio may lie in the decades ahead.

Remember that during your next mid-life or market crisis.

Source: The Happiness Curve, Why Life Gets Better After Midlife, by Jonathan Rauch