Rule #1: Everything ends.

Rule#2: Remember Rule #1.

Keep this in mind the next time you find yourself freaking out about the markets. (Or anything else)

Recognizing proper perspective about our puny existence is simultaneously shocking, and comforting.

Humans have existed a little over one minute in a 24-hour context. That includes everyone from the first Cavepeople to The Kardashians.

If this fails to motivate you into creating an evidence-based financial happiness plan – Nothing Will

Spending money in retirement for things like extending a vacation, or upgrading an airline ticket shouldn’t turn into Sophies Choice.

What should you be spending your precious and dwindling time on?

Listening to the spend shamers won’t make you happy. According to my colleague Barry Ritholtz,

“ Money does not buy happiness, or at least not very much of it. But — and this is an important “But” — it does lead to greater life satisfaction, which over the longer term may matter more. And that is a huge reason to appreciate money and what it can do for you.”

We ‘re not speaking about wild consuming, just maximizing life satisfaction with selective purchases and actions.

The Atlantic provides an excellent target for spending wishes.

“Researchers have found, spending money in certain ways can make people feel better; it generally helps to funnel more funds toward charity, memorable experiences (as opposed to material goods), and paying others to handle one’s most dreaded tasks, such as washing the dishes or cooking.”

It’s vital to understand what NOT TO aim at.

Keeping up with the Joneses is a No-No. The effects of this are dramatic. A Canadian study found when someone won the lottery, it led to very adverse effects for their neighbours.

Many ran up huge debt and filed for bankruptcy trying to keep up with their neighbours’ random luck.

Don’t play this loser’s game of catch-up.

An excellent way to increase money happiness is to keep track of it. Keeping tabs of what’s coming in compared to what’s going out can be a real eye-opener.

Michele Tascoe, a financial coach made this keen observation.

“I can have clients that make half as much money as another client, but they’re happier because they have clarity around where their finances are at,”

Sharpening goals turbo-charges life fulfilment.

For example, instead of creating vague plans, define them with clarity.

“I would love to have a vacation home.”- Meh

“I am going to save $50,000 over the next five years to buy a small cottage in New Hampshire.” – Much better.

Keeping things in their proper perspective is vital.

In the big picture, the universe laughs at our perspective of a long life.

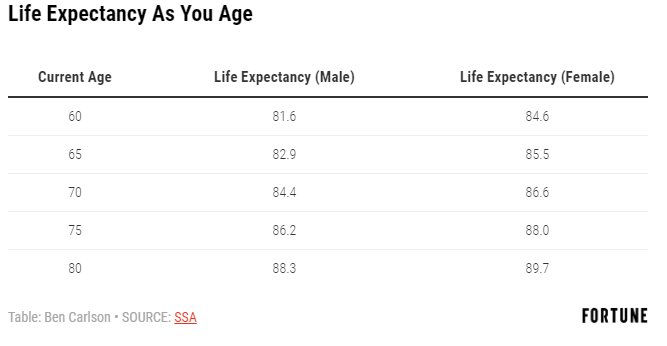

Money can help purchase happiness but our most valuable commodity is time. Time is running out much faster than you think.

We are all going to die, the only question is when?

What are you going to do?

I don’t know about you but fretting over the daily machinations of the market or worrying about what my neighbours are purchasing is at the bottom of the list.

Let the Earth Clock be a stark reminder.

We are not as important as we think we are.

In other words, have some fun in your 1 minute and 17 seconds of existence.

Memories may be short but they’re well worth the price.

Base your financial plan on the most important investment factor – Happiness