“Nature abhors a vacuum.” – Aristotle

Empty space fills. No law that says it has to be with something good.

After World War I, the United States decided to follow a policy of Isolationism, the 1920’s version of “America First.”

The war quickly became a deadly fiasco. The treaty ending it wasn’t much better. Americans vowed to never again to engage in European follies and said Adios Amigos to the world stage.

Creating the League of Nations was supposed to fill the gap. By refusing to join, The United States guaranteed its failure.

Flappers, Speakeasies and Babe Ruth took turns occupying our empty international void.

It didn’t take long for Europe to begin burning again.

Tyrants like Hitler, Stalin and Mussolini began occupying countries like ants to sugar.

Unfilled spaces push back against the laws of nature and physics.

Leading us to the retirement disaster A.K.A. – public school teacher’s Non-ERISA 403(b) plans.

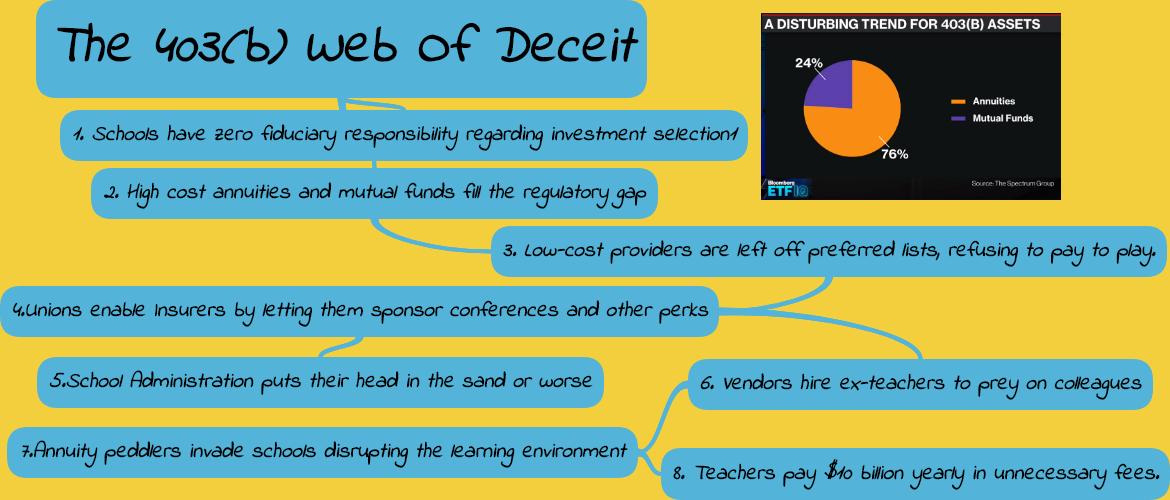

There are regulatory gaps insurers and broker-dealers are driving the equivalent of fee-filled Mack Trucks through.

How did things get this way?

403(b) plans are much older than their private-sector cousin, the 401(k).

Beginning in 1958, 403(b)’s were more of a tax-deferred “program” than a plan.

According to Scott Dauenhauer, “For many years 403(b) products were sold on an individual contract basis with little employer involvement and almost no structure. Unfortunately, despite several regulatory changes, in many cases, the same distribution structure still exists.”

Up until 1974, the only products offered derived from insurance companies and were distributed by a commission-based structure.

The code changed, allowing mutual funds. Despite occurring 45 years ago, only 25% of public school teachers assets are in products other than annuities.

The IRS passed new regulations requiring districts to create a plan document, trying to curb the wild west tendencies of sending contributions basically anywhere.

This well-meaning reform backfired. Schools were required to hire Third Party Administrators, or TPA’s. Many of these TPA’s offered to administer the plans for “free.” The inmates officially took over the asylum.

Pay to play was instituted. Low-cost providers were kicked off preferred lists. large insurance companies and broker-dealers rushed in, filling the opening with terrible products. These TPA deals became the most expensive “free” deal on earth.

It’s estimated the current system costs teachers a staggering $10 billion dollars in unnecessary investment fees.

William Bernstein, one of the sharpest minds in finance stated, “The typical 403(b) plan contains some of the most egregiously expensive choices in the entire universe of investing.”

Many Insurers and others are instituting policies of hiring ex-teachers and students to sell harmful products. Infiltrating schools with false levels of trust is the name of this conflicted game.

Too many unions willingly feed the beast, accepting all-expense-paid conferences and other perks from conflicted vendors. In return, steering teachers toward expensive and unnecessary annuity products.

School administration plays an outsized role in this organized fleecing of teachers. Many business officials accept similar perks from the TPA’s in order keeping the current “preferred list” system intact.

In other cases, Unions and Administration aren’t averse to allowing their children and other relatives to work for vendors. This massive conflict of interest pressures many teachers into purchasing annuities. Fearing retribution, they reluctantly hand over their hard-earned money.

Instead of strong private sector ERISA protections, the void oozed with conflicted insurance agents and brokers.

Violating the laws of nature is never a good idea.

Involving a teacher’s life savings in the unholy process makes this bad idea much worse.