Sometimes we do stupid shit, and everything works out. On most occasions, it doesn’t.

Many lack the most critical gene- Self-Awareness.

Confusing luck with skill is our default state. When things go well, it’s due to delusional brilliance. When they don’t, bad luck becomes the fall guy.

Things get messy when we try to repeat behaviors whose success is determined by causes beyond our control.

Charles Joughin is the poster boy for falling into this trap.

In April 1912, the supposedly unsinkable Titanic set out on its maiden voyage. The was composed of ten decks that could hold 2,500 passengers and 1,000 crew. The journey came to an abrupt halt in five days. A below-the-surface iceberg gouged the Titanic, and 1,500 passengers and crew vanished into the freezing Atlantic.

The ship’s Head Baker, Charles Joughlin, reacted uniquely to the unfolding debacle; he drank heavily.

According to History Defined:

Charles Joughin would rally his fellow chefs and bakers to assist in the evacuation. Between rounds of assistance, Joughin would step below deck to drink whiskey, which likely helped keep him warm.

As the ship continued to sink, Joughin maintained this pattern: assist others into lifeboats, go below deck to take another drink, then return to the deck to continue assisting others. Joughin assisted other crew members in ensuring women and children made it into lifeboats, sometimes even against their will.

At 2:20 am, the Titanic sank. Joughin rode the ship down as if on an elevator and calmly stepped into the frigid water. Remaining calm, he tred water for over two hours until the RMS Carpathia eventually rescued him. He suffered only from frozen feet.

How did this drunk survive this unmitigated disaster?

History Defined explains:

On one hand, alcohol dilutes blood vessels. Generally, this makes people more susceptible to hypothermia through a process called vasodilation. This process expedites heat leaving the body through increased blood flow to the skin.

On the other hand, most people who are submerged in cold water die of cold shock rather than hypothermia. The experience of being submerged in water below even 50 degrees Fahrenheit can lead to rapid shallow breathing, tightened blood vessels, and other panicked responses from the body.

Most people die from drowning or cardiac arrest before hypothermia can set in. In Joughin’s case, these two canceled each other out.

A once-in-a-lifetime perfect storm of conflicting systems saved his life and, in turn, the fate of others.

Becoming inebriated during a dire emergency shouldn’t be considered a best safety practice.

It worked this one time.

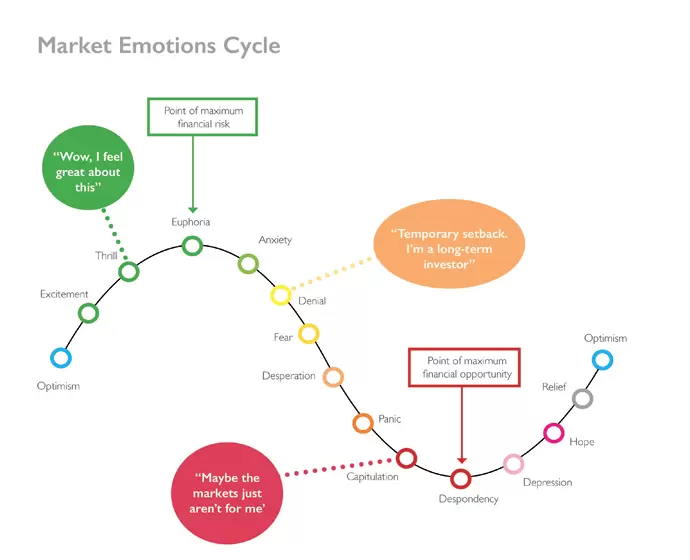

Investors can learn valuable lessons from this tale regarding confusing luck with skill. You are never as smart as you think during a bull market or as dumb during the eventual Bear. Never confuse a bull market with intelligence.

Source Investor.com

These three guidelines set the guardrails keeping you from overstepping your boundaries.

- Stick To Your Original Plan: Most sound investment strategies, such as value, growth, or momentum-based investing, work over long periods of time. Switching out when they are out of favor is a recipe for portfolio disaster. Abandoning a well-crafted financial plan isn’t advisable because your brother-in-law made a ton of money in Crypto due to blind luck.

- Maintain Emotional Composure: FOMO is the biggest ETF to avoid during irrational exuberance. The only thing you have to fear is the fear of missing out. Focusing on what others do with their money and ignoring their differing time frames, liquidity, investing acumen, and risk tolerance is a surefire way to lose your own money.

- Seek Out Contrarian Viewpoints: Investing in an echo chamber is a financial version of the Titanic. Every investment has positives and negatives that need to be weighed non-emotionally. Odds are, receiving advice in a Reddit Chat Room overflowing with fanboys isn’t going to end well.

Drunken heroes arise from the ashes once a generation. Don’t confuse bad behavior with a sustainable, repeatable strategy.

None of us are as smart as we think we are.