Constructing a portfolio is straightforward compared to creating wealth.

A 60/40 stock-to-bond ratio doesn’t assure a fulfilling existence.

In his latest book, The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life, Sahil Bloom points this out and more.

Bloom ventures far beyond money in his analysis. He makes a compelling argument true contentment goes far beyond money. If time, social, mental, and physical wealth aren’t present, the die is cast for misery and worse.

A conversation with one of Bloom’s acquaintances inspired the book. The man sold his company and pocketed $100 million. Bloom inquired if this windfall upgraded his happiness quotient. The story that followed was eye-opening.

Esther Haynes of The Free Press recounts what transpired next:

To celebrate, he had rented a yacht for a week, but then one of his guests looked over to an even more luxurious yacht and said, “Whoa, I wonder who’s in that one!”

The comment deflated him.

Bloom’s point? “There’s always going to be a bigger boat.”

If Luxury Yachts don’t move the meter, what does?

Bloom’s template is an excellent starting point for anyone interested in discovering life’s meaning.

- Time Wealth: It is paramount to be aware of the impermanent nature of time and its value as life’s most precious asset. Not having control over your calendar or priorities is impoverishing, despite the presence of many fancy, disposable toys. To quote Naval Ravikant, Nothing makes you more productive than owning your time. Nothing will make you less productive than selling it.

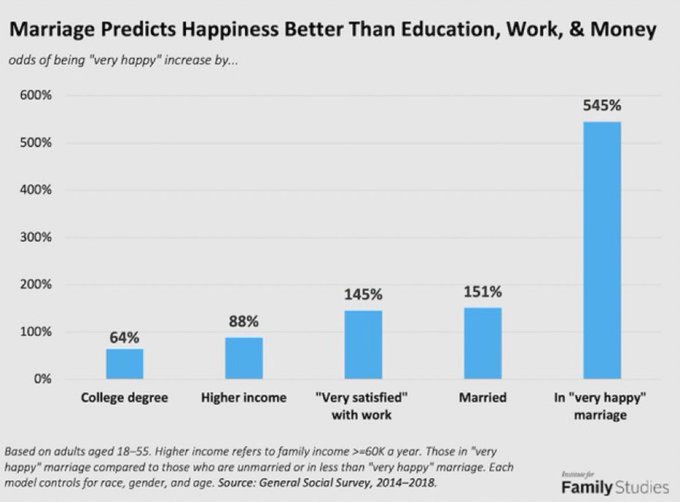

- Social Wealth: Without a network of deep, loving, and supportive relationships, who will you share your material riches with? Connection and a sense of being a part of something bigger than yourself are components of a portfolio that far outweigh stocks and bonds; for example, a good marriage is a superior predictor of happiness.

- Mental Wealth: Life without a clear purpose makes it easy to make bad decisions. Embracing growth opportunities and retaining a child-like curiosity about the world is essential to go beyond the generic definition of riches.

- Physical Wealth: A sick person is only concerned about one thing regardless of wealth. Enjoying life to its fullest is impossible without proper nutrition, exercise, and recovery protocols. Healthy habits are imperative to extending your lifespan and taking advantage of all the blessings on your doorstep.

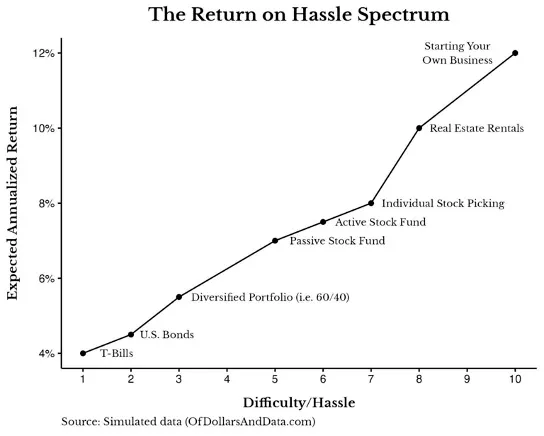

- Financial Wealth: If you can’t determine when you’ve acquired enough, real wealth will always be beyond your grasp. Growing your skills and expertise will directly lead to increased income. Thinking long-term and having a plan is indispensable. Keeping things simple increases the probability of achieving your goals. My colleague Nick Maggiulli provides an excellent chart on the various hassle factors you’ll encounter depending on your investing path.

An old saying goes like this: Everything I Lose Creates space for everything I need.

Why not turn 2025 into the year of addition by subtraction?

Remove judgment, comparison, and consumerism and replace them with what matters, like choosing the right spouse.

Designing your dream life isn’t easy, but it sure beats fawning over a colossal boat.