In case you missed it, On Monday, the world ended.

The Stock Market Crashed! It fell 1,000 points, equivalent to a whopping 3%!

If you were watching the media coverage, it seemed like your next destination was a one-way ticket to Hooverville. Great Depression 2.0 had indeed commenced.

Diving deeper, something called the Carry Trade was the catalyst for financial mayhem. The Japanese raised their interest rates, which put a monkey wrench into borrowing yen at near-zero interest and using it to finance the purchase of other assets.

Warren Buffet also sold half of his AAPL stock. For good measure, World War 3 was imminent because Iran was about to attack Israel and create a Malestrom in the Middle East.

These events are concerning but have happened before and will happen again.

In an alternate universe, the media would act as faithful public servants instead of clickbait addicts.

They could have used my colleague Ben Carlson’s post as a guideline instead of attending the William Randolph Hearst School of Yellow Journalism.

From 1928-2023:

94% of years, the stock market experiences a drawdown of 5% or more.

64% of the time, the market takes an annual dip of 10% or more.

40% of years, the market falls at least 15%

26% of the time, the market goes down 20% or more.

Ben points out:

From 1928 through 2023, the S&P 500 was up 70 out of the 96 years (73% of the time). In 35 of those 70 years with positive returns, there was a double-digit correction along the way. So half of all years with a gain experienced double-digit losses to get there.

In other words, the world is not ending. Volatility is typical market activity. You only make money in the stock market over the long term because stocks sometimes go down.

All the overhyped drama would be entertaining, except that people are watching these histrionics and taking action.

Never mind that the media has no idea of your time frame, risk tolerance, or personal situation—you better sell everything because things have just started, and they’ll get a lot worse!

Daniel Crosby explains the science behind why people outsource the management of their retirement portfolios to crazy screaming strangers they find in the media.

Studies show that listening to financial experts (say, on television) actually shuts off some brain functions associated with critical thinking. While this cognitive respite might be efficient for bodily functioning, it’s dit’smental to making sound financial decisions. Simply put, when you start listening to some talking head, you stop thinking critically. Much like a cyclist drafting behind a competitor to conserve energy, our brains eagerly coast on the ideas of others, switching to energy-saving mode.

Can you imagine liquidating your entire portfolio and blowing up your long-term financial plan because of the Yen Carry Trade?

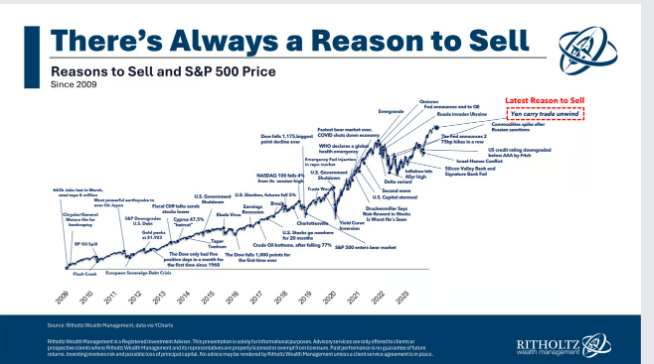

My colleague Josh Brown put this brilliant cartoon up on LinkedIn.

Your most precious asset isn’t your financial portfolio; it’s your attention.

Media outlets are fighting tooth and nail to capture bandwidth by any means necessary. Their favorite tactic is to scare the hell out of you.

If you don’t believe me, tune into the Weather Channel during a Thunderstorm.

The next time the Market Crashes, (and it will ) take my advice.

Turn off the T.V. and go for a walk.

No news is better than fake news any day.