Numbers matter.

Some more than others.

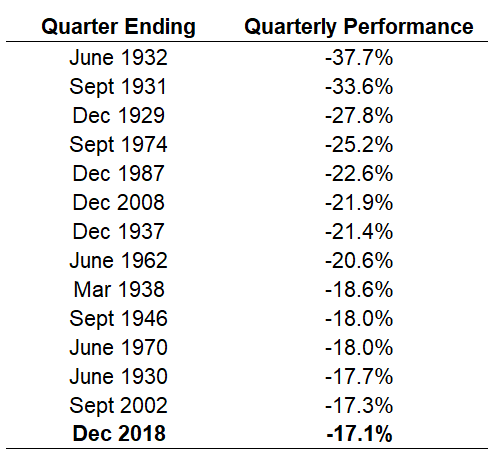

The fourth quarter of 2018 puked out some bad double digits

We have to go back to the chaos of the Great Depression to see worse results.

Is it time for all of us to become Doomsday Preppers?

It depends on what numbers you’re focusing on.

A full out masochist spends irreplaceable time worrying about the following:

How many hundreds of points the Dow has fallen on any particular day.

The annual percentage loss of the S&P 500 from its peak to trough on a quarterly basis.

The decrease in the share price of the FANG stocks (Facebook, Apple, Netflix, and Google) since their all-time highs.

How many cabinet officials President Trump has said “You’re Fired” to over the last month.

The temporary dollar loss of your portfolio regarding money you won’t need for decades.

The amount of times CNBC runs promos on its “Stocks Plunge” lead stories.

These numbers are individual emotional time bombs. Detonating your chances of achieving your long-term financial goals.

Nobody said this was easy. Making money in the stock market is dependant on occasionally losing some. This is the iron law of finance.

Describing seemingly abnormal market behaviour as normal is a difficult job. Understanding this concept is the key to success.

Just like a roller coaster, the only market participants who get injured are those who jump off. In market speak, this means selling stocks during market corrections with no rules-based plan to jump back in.

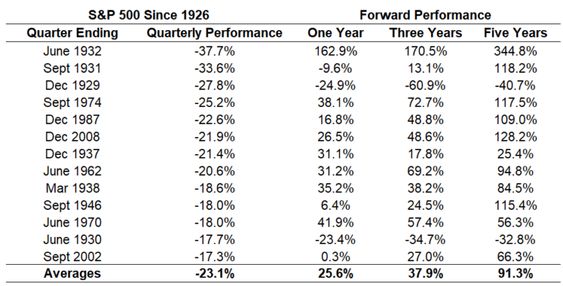

My colleague, Ben Carlson crunched some numbers and came up with this amazing data.

In a nutshell, five years after horrendous quarters, stoic investors are rewarded – and then some.

To the tune of a 91.3% return. This doesn’t include any additional savings on your part.

These numbers, like everything else in the markets, aren’t guaranteed. All investors can do is make high probability bets. This falls under that category.

Data won’t make short-term market madness less painful. It will protect you from doing something really stupid.

The stock market doesn’t care about Christmas Eve or your impending retirement. It is an unfeeling beast.

Taming its primal instincts requires time and data.

Having a rules-based process based on evidence, not emotion is crucial.

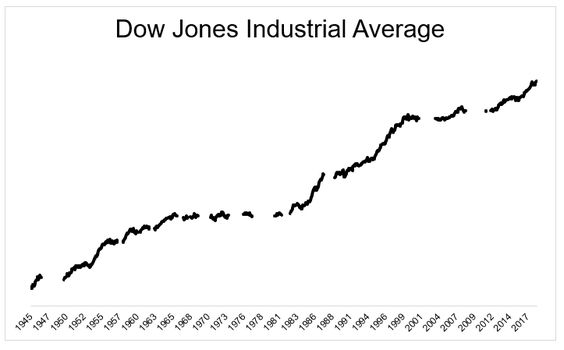

The temporary “white space” as our Director of Research Michael Batnick refers to seems like a relentless form of waterboarding when experienced in real time.

No one cares about the long-term upward trend when the market loses 4,000 points in a month.

If you don’t have a plan, now is the time to make one.

All things in the universe revert to entropy. Things that can go wrong – will.

Sh*t happens, just don’t let it happen to you.

We can’t stop the market from falling but we can help you understand why it sometimes does.