Overwighting distraction is the new black.

We have all seen videos of people walking into glass doors, fountains, etc., while mindlessly staring at their smartphones.

Drenched clothes or needing a few stitches are the least of our problems.

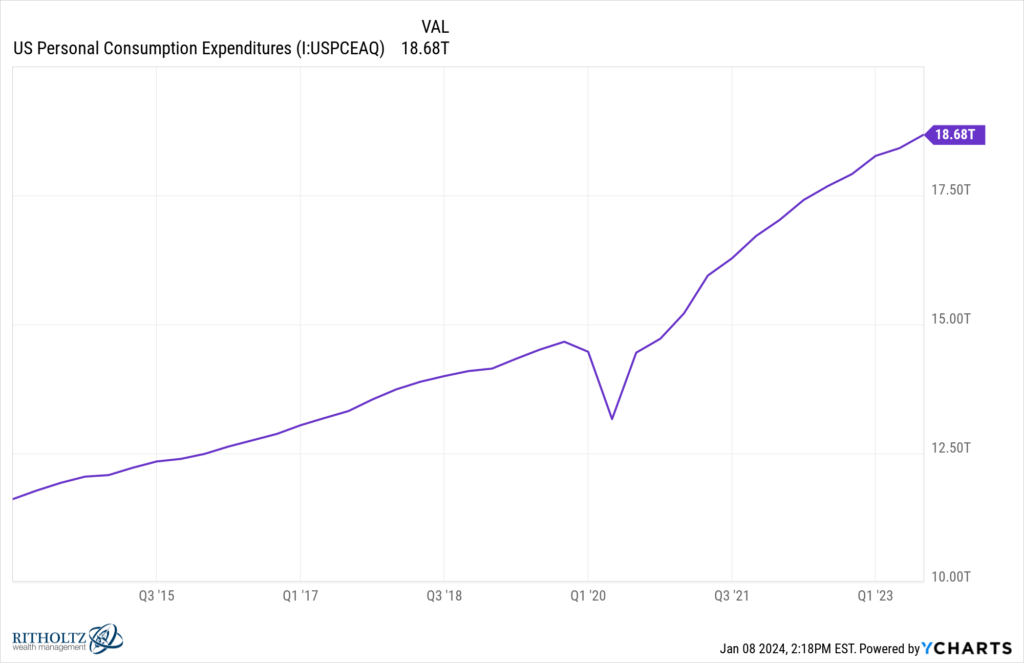

Americans notoriously spend billions of dollars on stuff they don’t want or need. This is more commonly referred to as impulse buying.

Americans love opening up their wallets.

I figured out a way to buck this trend. The critical component of the plan is creating two budgets. The first is for the stuff that gives the most lasting pleasure. The second is for everything else.

Plants, workout equipment, books, travel, and good food fall under the former category. Spending is virtually unlimited on these Five categories. The hidden money secret is not feeling guilty about spending while indulging in meaningful purchases.

These numbers add up, and I avoid bankruptcy because of my passionate disinterest in everything else.

My car is from 2007. I don’t enjoy driving, being a passenger, hearing, or looking at automobiles. I considered allocating the money for a new vehicle purchase to an Uber/Car Service fund.

My wardrobe comes from birthdays, Christmas, and my son’s hand-me-downs. I don’t drink and couldn’t care less about most new technologies since I can’t figure them out anyway.

If I were dead, I wouldn’t be less interested in Country Clubs or Golf.

You can see where many funds are freed up for native plants, Gourmet Ravioli, and Pull-Down Machines.

It turns out there’s a name for this stuff – Conscious Spending. Thinking about whether a purchase contributes to overall happiness and well-being is the overriding premise of this practice. Aligning purchases with one’s values, priorities, and long-term goals is the antithesis of our consumer culture.

According to the Wall Street Journal, many people spend money to create an illusion of success.

The trouble is the markers of wealth that can be purchased only tell part of the story. The invisible signs of success—savings, and investment—remain opaque to the lifestyle creeper.

There’s a better way.

Critical Aspects of conscious spending include:

- Budgeting: Creating a budget that allocates funds to your highest priorities makes this task more accessible and more efficient. The 50-30-20 is a nice starting point.

- Value-Based Decisions: Conscious spenders invest in experiences that bring lasting happiness. Their motivations are value-based and not boredom. Rethink your values if they’re based upon lifestyle creep.

- Avoiding Impulsive Purchases: Resisting spending on things you don’t want or need is difficult. Professional marketers are experts at dopamine addiction. The deck is stacked against most people because almost all the info regarding your interests and purchasers is sold to the highest bidder. Technology isn’t your friend in this instance. Unfortunately, if you can’t control your Amazon habit, there won’t be any money left for the stuff that matters.

- Mindful Consumption: Understanding the long-term impact of your purchases makes all the difference. Asking yourself if this purchase is necessary and if it provides any long-term value is an excellent first step. Waiting a day or two before pulling the plug on any major purchase can be a valuable skill to add to your toolbox.

Adopting conscious spending habits fosters a healthier relationship with money. Replacing the Dopamine rush with a path toward a more sustainable and fulfilling lifestyle is a goal to strive for. Nobody is telling you what to buy; just don’t consume mindlessly or strive to keep up with the Joneses.

If Country Clubs, designer clothes, the latest iPhone, jewelry, and brand-new cars rock your world, have at it. It’s not my job to be the consumption police.

Just ensure your values and not some algorithm steer your purchases.