Losing money sucks.

Loss aversion assures us we suffer twice as much in bear markets compared to finding joy when the bull roars.

Staring at flashing red screens and listening to overdramatic prophets of doom compound a bad situation.

What should investors do in these trying times?

Focusing on what you can control is always a terrific place to break ground.

Investment costs, portfolio diversification, and tax management are the usual suspects. The truth is they’ll make you feel less bad – not better.

If you’re pursuing a real bang for your buck, how about considering doing more reading and sleeping?

Flow states are the secret sauce for human happiness. Think about doing things you enjoy.

Did you ever get so lost in something you completely forget your sense of time?

Flow states focus rather than fragment attention. Sinking into a flow state makes you calmer, deeper, and more significant. Fragmentation does just the reverse.

It so happens sleeping and reading fit this category to a tee.

Sleep is our most underrated superpower.

Chronic sleep deprivation is toxic. The side effects make a bear market seem like a trip to Disneyland.

Two nights of missed sleep obliterate functionality. The same effect occurs by sleeping only 4-5 hours a night for a couple of weeks.

Why is sleep vital to your mental and physical health?

When you don’t sleep, your body takes this as a sign something is drastically wrong. It assumes your motivation for not sleeping is a state of emergency.

An alarm bell rings once the ball starts rolling, and a vicious chain reaction commences.

Johann Hari goes into detail on the side effects of sleep deprivation.

Uh-oh, you’re depriving yourself of sleep, it must be an emergency, so I’m going to make all these physiological changes to prepare you for that emergency. Raise your blood pressure. I’m going to make you want more fast food. I’m going to make you want more sugar for quick energy. I’m going to make your heart rate rise.

Next stop, obesity, diabetes, and heart issues. The NASDAQ collapsing pales in comparison.

Suppose you’re having sleeping problems. Worrying about the market is a poor choice.

On the other hand, attacking the issue head-on will change your life for the better. Trading a bear market in stocks for a bull market in sleep is an excellent risk management strategy.

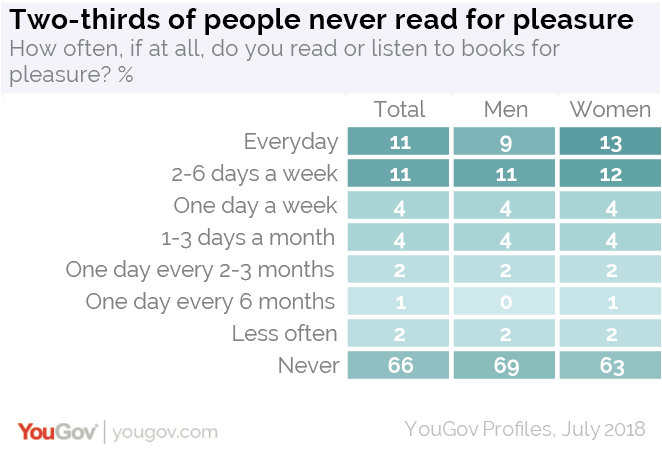

Sustained reading is a sure-proof remedy for market blues. Unfortunately, reading is becoming as rare as a NY Giant’s winning NFL season. The proportion of Americans reading books for pleasure is now recorded at its lowest level.

According to The American Time Use Survey, from 2004-to 2017, the number of men reading for pleasure cratered by forty percent. For women, it plunged by twenty-nine percent. Fifty-seven percent of Americans don’t read a single book manually. The most striking statistic is – The average American spent seventeen minutes a day reading books and 5.4 hours on their phone!

Why is the absence of reading so alarming?

According to Johann Hari, For many of us, reading a book is the deepest form of focus we experience – you dedicate many hours of your life, cooly. Calmly to one topic, and allow it to marinate in your mind. This is the medium through which most of the deepest advances in human thought over the past four hundred years have been figured out and explained. And that experience is now in free fall.

Letting inevitable bear markets determine your happiness is a huge mistake. It’s kind of like getting mad at the sunset. Be my guest.

Get a good night’s sleep, read books for fun, and go for long walks.

The market will still be there when you return.

Source: Stolen Focus by Johann Hari