Bear markets function as full-body cleansers for investors’ psyches.

Vaporizing financial toxins is essential. Nobody said it’s fun.

The bottom line – greed, anger, and delusion are the ultimate purifiers.

Eastern philosophy believes humans fall into three categories: Greed/Grasping, Anger, and Delusion. Many possess multiple personality types that emerge at disparate moments. Responding to any situation based on these traits is prevalent.

A Greedy Personality knows what it likes. Everything points toward harmony. In meetings, Greedy Personalities believe everything works out. Possessing the tendency to say all things are possible, discounting genuine faults is their specialty.

An Angry Personality spotlights what’s wrong. Exploring what’s obstructing the chosen path is an obsession. The Angry Personality picks out trivial faults while discounting general virtues. This trait needs nurturing to provide value.

The Deluded Personality would instead take a nap. They’re slow processing things and find trouble making up their minds. Uncertainty leads them to follow the crowd. Praising or criticizing without thought gets them into trouble.

Bear Markets expose the best or worst extremes of these personality types.

Heeding advice from conflicted sources or ratings-obsessed news media halts the purification process in its tracks. Similiar to tossing kerosene on a raging forest fire, no good arises from inflaming unproductive behavior.

The Greedy Personality refuses to acknowledge reality. A bull market financial plan looks indestructible, but its shelf life diminishes dramatically when the band stops playing. Their optimism leads to the demise of their portfolio. The old world is dead. Long live the new world.

The Angry Investor feeds on negativity. Never believing things will get better. A bear market environment is target-rich with disaster. Confirmation bias prevents them from seeing the forest through the trees. They won’t make it to the other side without deprogramming their pessimism.

Delusion comes with its concerns. Following the crowd is the worst thing to do in a market crash. Delusional Investors can’t make up their minds. Their default view becomes the current sentiment. Not possessing a viewpoint couldn’t arrive at a worse moment. Salivating financial charlatans step into the breach.

Evidence-based financial advisors administer attitude adjustments just in the nick of time. Instead of stoking investors’ worst qualities, the purification process blossoms with the right plan and a rules-based investment process. Keeping clients safe and sorting lies from truth is their North Star.

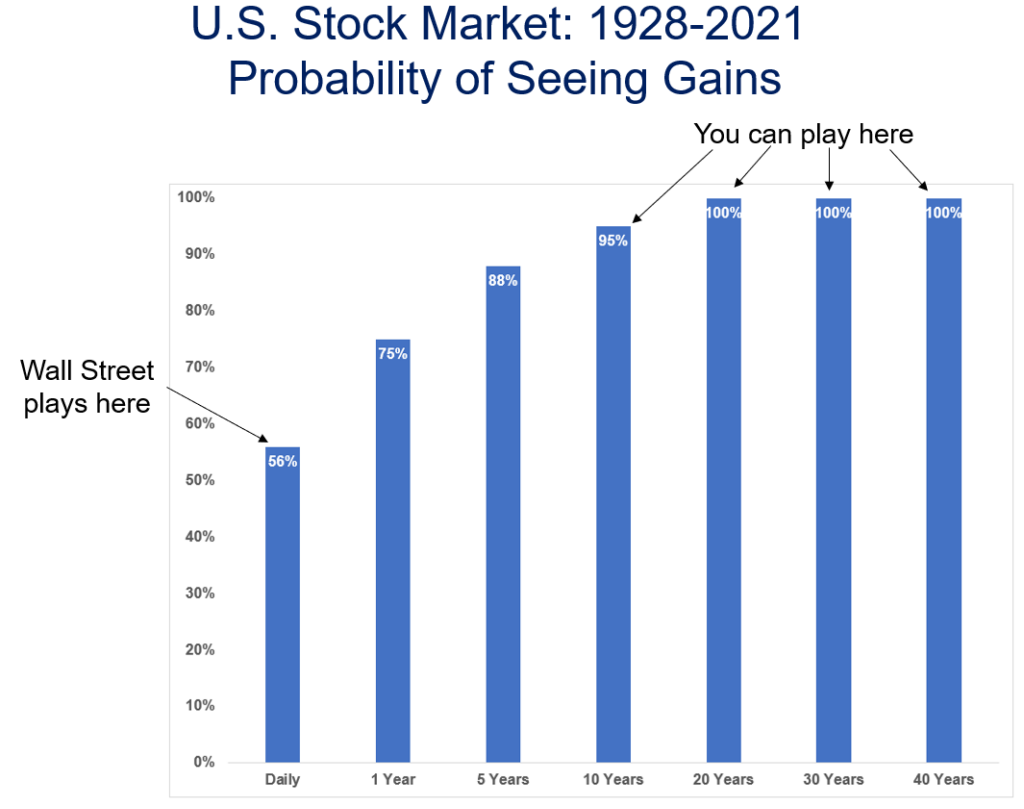

Source: A Wealth of Common Sense

Greedy investors receive their bounty comprised of a basket of low-cost index funds. Their optimistic nature melds with faith in capitalism, not individual companies. Human beings constantly desire to better their fate. Owning the market rewards their faith in humanity.

Angry investors’ skeptical nature craves evidence, not hope. They can see the logic of diversification, costs, and the value of a long-term goals-based plan. Instead of focusing on all the negativity above, they pivot positively into the future based on their analytical strengths and skeptical nature.

Finally, the Deluded Investors’ lack of consensus becomes a positive. Their modus operandi cannot predict the future and focus on things they can control. These qualities emerge with the proper guidance. Instead of following the crowd, they take their time and grasp the logic other advisors failed to provide.

Without a Bear Market and competent guidance, these investor types would continue their automatically responding ways. We’re not flawed. We’re human.

Crisis creates more crisis – or opportunity. What path will you choose for your financial future?

You can speak with us right here if you want to learn more.