Know Thyself.

Knowing what you are not capable of is an underrated superpower.

The financial markets aren’t the place to discover a weakness. Stocks sometimes go down -a lot. Without this baseline of knowledge, things go south quickly.

After graduating college, one of my first jobs was on an FX trading desk. On October 19, 1987, the market fell 508 points, or more importantly, 22.6%! God help us if Twitter existed. I assumed the tumble was 5.08 points after casually looking at the screen. After rearranging the decimals, that idea painfully vanished.

The lesson was unforgettable at age 22.

Sh*t happens.

As a side note, my image would regularly come up during CNN telecasts during their 1990s business promos. Looking back, screaming into two phones simultaneously like a deranged orangutang on amphetamines wasn’t a good look.

Financial risk tolerance rises exponentially, knowing volatility is the baseline. I’m no cowboy. Plenty of things rattle my cage. Driving on NY’s treacherous roads are scarier to me than the markets. Don’t mention tidal waves. All of us carry a cross of neuroses. Allocating over 90% of my retirement portfolio to stocks is my comfort zone. Most 57-year-olds don’t swim in this pool. The top holdings are a diverse group of global index funds/ETFs with a smattering of 10-12 blue-chip stores. My risk tolerance allows the iron law of investing to blossom – Owners of capital earn more than lenders.

When the market falls, reinvesting dividends and maximizing retirement plan contributions turbocharge wealth creation. Nobody said it’s easy.

Guardrails are still essential.

A bucket of safe assets covering 3-5 years of expenses does the trick. Cash provides cover for the portfolios shock troops – Stocks.

Understanding historically there’s a high probability of even the worst bear markets ending within this period provides a degree of comfort.

A low volatility barometer is a prerequisite. Paying little attention to daily market insanity is the secret sauce. I was locked out of my 401(k) account the last year and still haven’t got around to resetting it. View this trait as similar to not reading newspapers. The news changes every day, so who cares?

Lindy Effect-type books are a better use of time. Good books and a long-term investment outlook are synonymous in value.

We have two sons in college and implement their 529 funds less aggressively.

Feed short time horizon goals with conservative investments. There’s a strong possibility one or both will attend grad school in 4-5 years. Owning some stock helps finance the intermediate goal. Allocating 20% of their funds to stocks makes sense.

Many might disagree with these strategies, but that doesn’t matter. Human beings aren’t spreadsheets. Create a plan that works for you, not a questionnaire. Sticking to it is more important. It’s as simple as that.

We didn’t build the conservative bucket overnight. Working in a high-paying profession greased the wheels, and many don’t have that luxury.

The main idea – don’t screw with your time horizons and risk tolerance. Invest Long-term funds in the highest returning assets class. For the remainder, focus on the return of capital rather than the return on capital.

As Seneca stated, Without a ruler, you can’t make crooked straight.

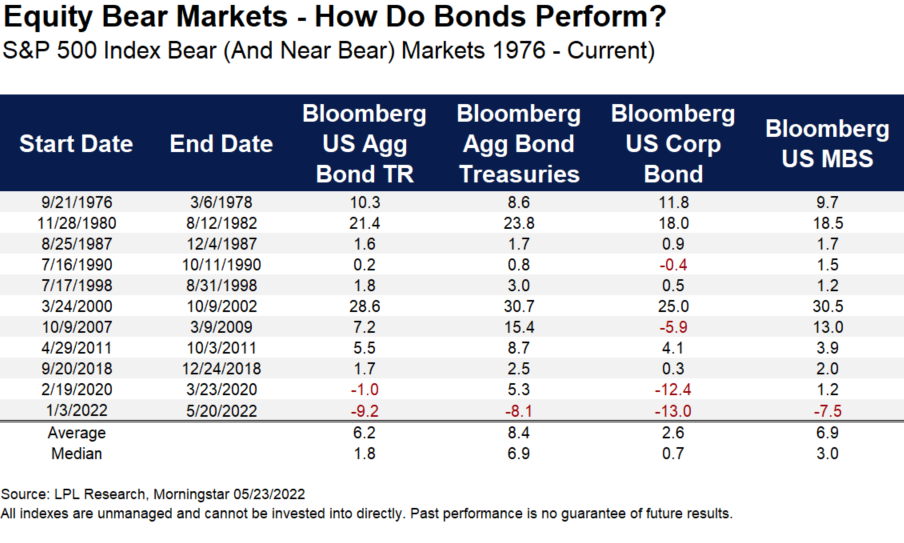

Bonds are critical components of long-term portfolios for diversification and rebalancing purposes. There’s no shame in saying the markets frighten you. Most investors can’t handle the wild swings that accompany higher long-term returns. Bonds keep people from panicking.

Everybody’s different.

Celebrate these traits. Don’t neutralize them in a cookie-cutter model. Bizarrely, an aggressive personal strategy helps our clients during turbulent periods. Giving calm guidance is reassuring from someone with a ton of skin in the game. Clients smell fear a mile away. It’s impossible to convincingly state ‘Everything’s going to be Ok’ in a trembling voice.

Self-awareness is vital for any plan.

If you don’t know yourself, you don’t know anything.