Interviewer: What’s your prediction for the fight?

Clubber Lang: My Prediction?

Interviewer: Yes, your prediction.

Clubber Lang: Pain!

Tuning in to Markets in Turmoil is no better than gawking at car crashes. It messes with your mind and slows everyone else down.

Expose yourself to your worst fears. The optimal way to defeat anxieties is to let them in. Continuously leaning into phobias dilutes their power. Doing this brings an end game to imaginary bogeymen. Worst case scenario, they become more manageable.

There’s a reason why exposure therapy works. Our brains are like onions. Primal functions like fear exist near the core: the outer layer houses logic and critical thinking. The center developed far earlier than our reasoning ability and quickly reacted to perceived dangerous stimuli.

Telling yourself to calm down sounds good, but the inner beast is out of its cage. The way to overcome this disconnect is repeatedly doing what frightens you. If public speaking terrifies you, the best plan is to speak in front of others more often gradually. Avoidance doesn’t work.

Jaimal Rogis explains this concept well.

It may sound like bad news that it’s so hard to talk yourself out of old fears. Still, just like we use our more developed brains to guide our children toward positive exposure to, say, the dark or a new school, once we understand how fear works, we can create healthy exposure experiences for ourselves. That might sound a little, well, babyish. But if we don’t, the primal brain will draw its own conclusions based on life’s random events—often prioritizing the negative, our failures, for survival—and integrate those experiences into a personality.

Some suggest doing one scary thing a day. Lifestyle change doesn’t happen overnight.

How does this relate to stock market volatility?

Some investors run away when the market goes south—refusing to open their retirement statement or log in to their accounts. Avoidance may keep them from acting rashly, but it doesn’t solve their simmering anxiety. Pent-up jitters eventually surface. Erupting volcanoes are never pleasing for your portfolio.

The best way to overcome fear is to face it head-on. Educate yourself rather than becoming cannon fodder for hysterical pundits and media. These groups don’t have your best interest at heart. Getting attention by any means necessary is their modus operandi. Don’t be a sucker.

The good news is there are plenty of terrific and free resources out there.

My colleagues provide lovely material for dipping your toe into financial exposure therapy.

Ben Carlson wrote a terrific post for launching this journey.

The first step – understanding your financial plan lords over your investments.

I’m a much bigger fan of creating a portfolio that takes corrections and bear markets into account when creating your investment plan. You should strive to create a saving and investing process that is durable enough to handle both up and down markets.

Are you a visual learner?

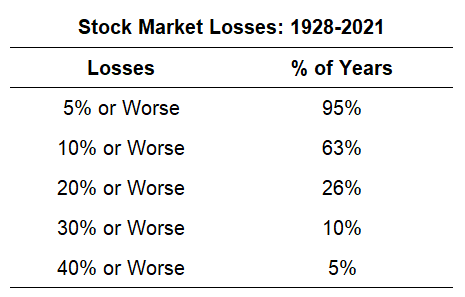

This chart should help explain the normalcy of market hiccups.

Josh Brown comments.

Find something else to focus on so, if you’ve committed to riding this out rather than panicking, good for you. You’ve made the right choice. Now what? Try to make this decision easier to live with. Shut off the “news alerts” that are only designed to earn money for someone else’s advertisers. Close your laptop. Stop checking prices. Log out of that f***ing brokerage app.

Tuning in to Markets in Turmoil is no better than gawking at car crashes. It messes with your mind and slows everyone else down.

Do you see the difference?

You’re no longer acting like an Ostrich hiding its head in the sand. After understanding how markets and financial plans work, the natural progression is walking away from the craziness. Not out of fear but out of confidence.

Your plan should include unpleasant scenarios. Throw in a dash of historical perspective, and exposure therapy isn’t as bad as it sounds.

Seneca said: We suffer more in imagination than reality.

Don’t make perfectly normal market events into something they’re not.

Panic and avoidance are easy. Educating yourself is more complex but well worth the trouble. Real education is distinguishing what’s in your power from what’s not. Expose yourself to your greatest fear. You might find it’s not as bad as you imagined.

Epictetus remarked. No, I cannot escape death, but at least I can escape the fear of it – or do I have to die moaning and groaning too?

The same advice applies to 2022 investors gaping at shattered growth stocks.