Timeshares and investment never belong in the same sentence.

Replacing Timeshare with Indexed Annuities leads to similar results.

Many are marketed with the calling card of Charlatans since the beginning of time – Low risk, high returns.

95% of funds invested in Indexed annuities go into bonds. The rest is allocated to derivates, or call options on a specific index.

Missing out on dividend reinvestment makes it virtually impossible to come close to matching stock market returns.

Historically, dividends contribute to almost half of stock’s long term performance.

According to Gary Baker,” You’re not in the market, you’re on the sidelines watching the market.”

Incredibly, salespeople often show charts leaving out dividends to mislead investors.

These products are more complicated than Antonio Brown’s relationship with the Raiders.

AB just posted this on IG and said he wants the Raiders to release him 👀 pic.twitter.com/dcHNdbBt1N

— B/R Gridiron (@brgridiron) September 7, 2019

Containing more conditions and demands than Brown, the Raider’s receiving Diva, Index Annuities aren’t drama-free.

Caps are used to limit the upside. For example, if the market rises 10% you may only receive 5%.

In addition, these caps often change depending on market conditions. Heads insurers win, tails you lose.

Index Annuities usually guarantee a return between 0-3%.

Including this caveat, the money must be invested for a decade to avoid any surrender fees.

Surrender fees are onerous. If an emergency arises, withdrawing funds leads to a loss in principal despite assurances to the contrary.

This is a far cry from a guaranteed return.

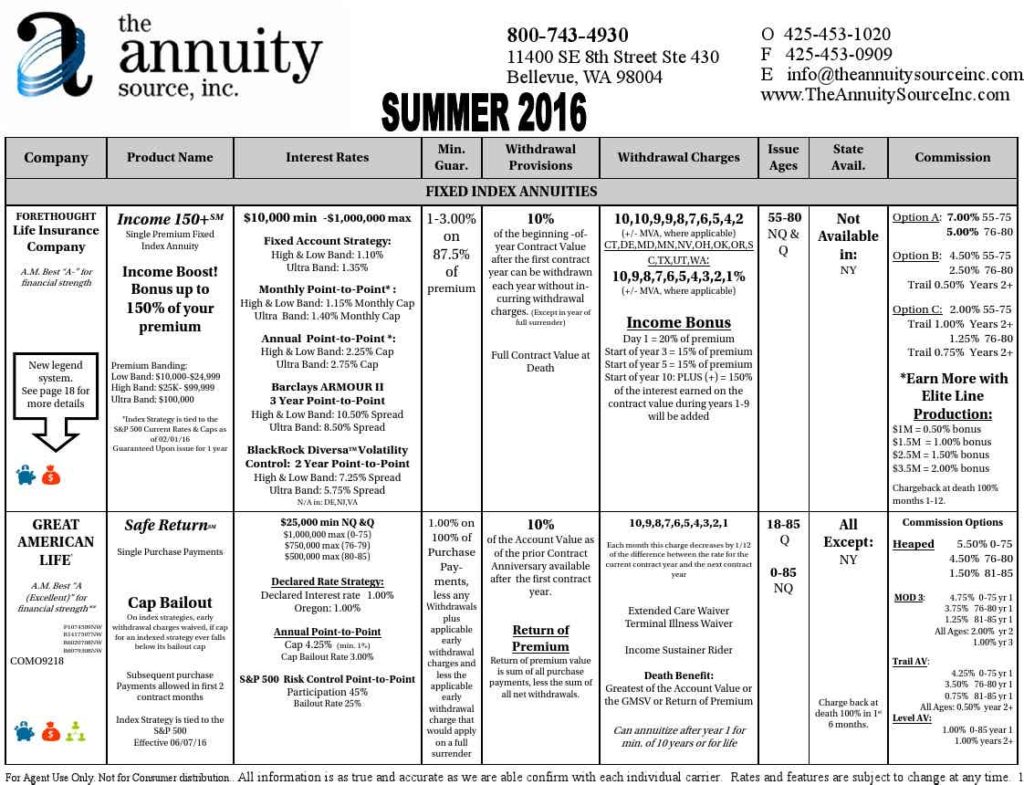

Surrender charges are egregious because salespeople often receive extravagant commissions.

Source: The Teachers Advocate

Insurers get their money back using high surrender fees. If a client bolts after a short holding period, they cover already paid out commissions.

It’s common practice to reward top producers with free trips

Source: The Teachers Advocate, a terrific blog by my friend Scott Dauenhauer

Index Annuities are sold not bought. Teachers are regularly carpet-bombed with these and other annuities in the conflicted ridden Non-ERISA K-12 403(b) market.

Tending to be very conservative and nervous investors, Teachers provide a perfect mark for predatory salespeople.

Preying on their fears, salespeople confiscate decades of market returns from these public servants.

Similarly, elderly investors suffer a different horrible side effect. The Illiquidity of Index Annuities isn’t a good thing for someone in their seventies.

Of course, there are some scenarios when these products may be useful. Investors looking for an alternative to a C.D. (Without FDIC insurance) or desiring a bond alternative, may be appropriate candidates for Indexed Annuities.

Warning: The credit quality of an insurance firm is not the same as a U.S. Treasury Bond. another inconvenient fact salespeople neglect to mention.

There are other more suitable, less complicated and expensive options available for these needs.

Unfortunately, “free” lunches and dinners don’t mention the comparison to boring C.D.”s and Treasury Bonds. Focusing instead on unattainable stock returns without the corresponding risk. This pitch serves as dessert, complimenting semi-cooked Chicken Marsala at a “free’ seminar.

For most people, avoiding Timeshares is a smart idea. Falling for the typical Index Annuity sales pitch is no different.

“These annuities are like investment timeshares,” says Tony Isola, a certified financial planner in New York City. “You can’t get out of them easily, the costs are high, and the salespeople are often misleading about your returns.”

Penelope Wang of Consumer Reports spoke to me about these products last week

You can read the rest of the article right here – Why Indexed Annuities May Promise More Than They Deliver