We love helping young people with their finances.

When they’re military veterans, all the better.

Our North Star is serving those who serve. Nurses, police, firefighters, and an army of teachers top the list.

We had the pleasure of meeting a terrific young couple; Marine Corps veterans who were looking for fiduciary advice but were having a tough time finding it.

Entering the Marines they were 100% healthy; upon leaving, they were something less. The husband returned at 90%; his wife, at 10%.

They both collect military subsidies to help compensate for the injuries/wounds suffered during their respective tours of duty in Afghanistan and both take advantage of the G.I. Bill. This pays for college tuition and subsidizes living expenses.

They’re on the right track but needed some extra guidance.

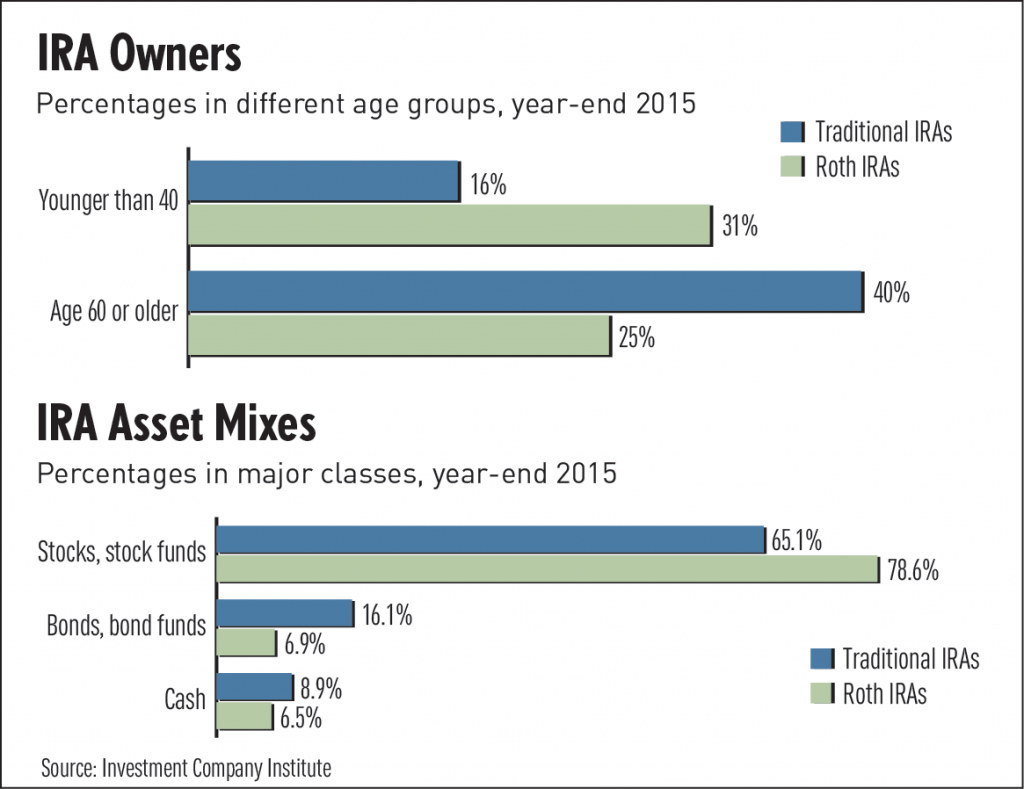

For example, their professor lectured about the benefits of compounding and Roth IRAs but said nothing about how to apply this concept.

We served them a menu of healthy financial advice, providing an excellent template for all the young people we encounter.

Starting with their retirement account, our advice was to leave it alone. The government TSP is a prototype for what all plans should aspire to be: low cost with a few great choices. Our only recommendation was to allocate more money to stocks. Luckily, they did not seek the counsel of a financial salesperson working under the ridiculously loose suitability standard who would have had them say goodbye to the TSP and hello to an 8% commission-laden variable annuity.

Next, we looked at insurance. A salesperson already got to them and sold them an expensive permanent life policy. Our advice: we need to analyze the value of the whole life and increase the term life insurance.

Term life will never be cheaper than it is today.

If the whole life policy is cancelled, the savings on the $2,000 annual premium would shift to a real wealth accumulation vehicle – a Roth IRA.

Holding excess funds in their savings account, they could frontload their Roth contributions. They have until April 15 to fund 2018 Roth accounts with $5,500 each, then they can take advantage of 2019 increased $6,000 limit. One could do worse than being 26 years old with $11,500 each in Roth IRAs.

Young people with low incomes don’t need the before tax benefit of regular IRAs. Imagine a retirement account you’ll never again pay taxes on.

We discussed the differences between savings and investing.

Savings is designed for short-term needs and returns that at best match inflation. Investing is for long-term goals; investments must grow to beat inflation. Knowing the difference between a return on and a return of your money means everything.

We suggested moving funds from a traditional money center bank; transferring it to an online version would more than double their interest rate.

Discard the advice from your crazy uncle and others trying to scare the crap out of you.

We injected reason: “A crash would be a gift from the Gods for young people like yourself because it would provide an opportunity to buy the world’s greatest companies at a steep discount. Owning low-cost index funds is making a bet on global capitalism; that people will continue to invest in new things, spend money, and desire to make the world a better place for their children. Quite frankly if this doesn’t work there’s no plan B.”

We are grateful for the opportunity to guide young people along the road to wealth

Paying things forward to those willing to make the ultimate sacrifice is the ultimate ROI.