Is it possible that even though President Trump’s tax reform proposal preserves the standard deductions for retirement plans, it will still provide disincentives to save?

Maybe.

The effect of unintended consequences is always the wild card.

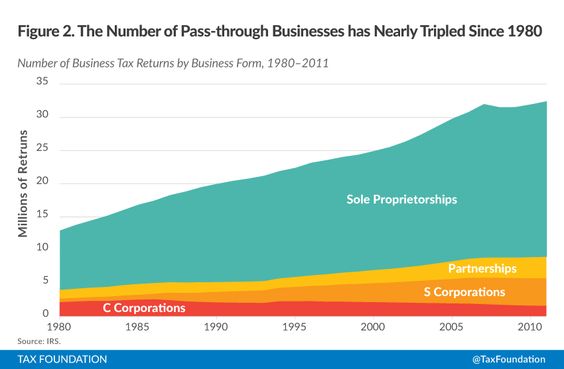

The potential problem has to do with pass-through entities, which include sole proprietorships, S-corporations, partnerships, and limited liability corporations. The number of these pass-through businesses has tripled since 1980. Under this plan, the tax on these structures will be a maximum of 25%. Currently, this stands at 39.6%; more when you include state taxes and the 3.8% ACA tax on all income above $200,000.

Business owners use these entities to avoid double taxation on corporate income. Dividends are taxed twice when distributed to shareholders; once on the corporate end, and then on the distribution side to shareholders.

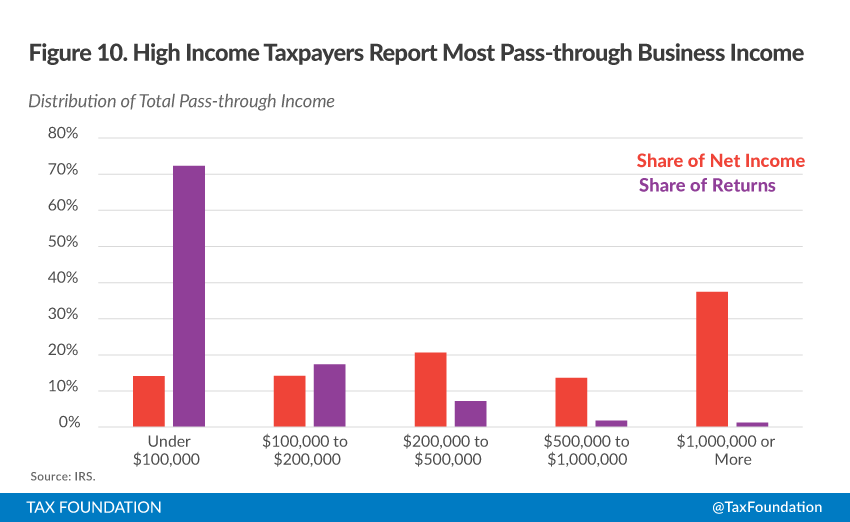

Many business owners pass-through their corporate income to their individual tax forms. This strategy can lead to a lower overall tax bill. This new proposal will make this more tempting. High-income earners are big fans of pass-throughs.

The pass-through rate is considerably below the proposed new top marginal rate income tax rate of 35%.

Why does this matter and how would this rate differential serve as a disincentive for employers to establish 401(k) plans?

According to Brian Graff, CEO of the American Retirement Association, “This 10% difference amounts to a ‘tax penalty’ on deferred retirement savings, and would make paying the tax up front more appealing.”

Mr. Graff brings up another interesting point, “Why would a business owner opt to pay a “penalty” on retirement deferrals, maintain fiduciary liability for sponsoring a 401(k) plan and assume the administrative costs?”

Some small business owners might forego the hassle of setting up a plan because this proposal could have a negative effect on their tax situation.

This could also eliminate the incentive to provide so-called “employee matches.” Some employers match a certain percentage of their workers’ contributions.

If a business owner assumes he/she will be in the top 35% bracket when they retire, it might make tax sense to pay 25% on the pass-through income now rather than pay 35% on 401k withdrawals later.

In our experience, the main reason many business owners set up retirement plans is to benefit them. They are usually the ones making the largest contributions and getting the most advantages regarding lowered taxation and tax-deferred growth.

If these separate tax rates are implemented the effects may not be employee friendly. According to Mr. Graff, “There’s never any financial scenario where it makes sense to defer at that point.”

On the other hand, there is some pretty convincing evidence that taxes are not the sole reason for business owners to offer a retirement plan.

According to Greg Iacurci of The InvestmentNews, “However, a survey published this year by the Pew Charitable Trusts shows that while taxes do factor into employers’ reasoning for offering a retirement plan, it’s not necessarily the determining reason.”

He continues, “Nearly 60% of the 1,600 small and midsize employers surveyed indicated providing tax advantages for company management was a reason for offering a plan, but that was fourth in line behind helping employees save for retirement, having a positive impact on employee performance, and helping attract and retain employees. Only 5% said it was the main reason for offering a plan.”

Unfortunately, similar to the recently defeated plan for Health Care Reform, the administration has a pattern of not completely thinking things through before proposing massive changes that affect the lives of millions of people.

This proposal may cause some business owners to forego implementing retirement plans for their employees due to the benefits of tax arbitrage.

Many people are relieved the tax deductions for retirement contributions were preserved in this initial proposal.

Let’s not break out the champagne just yet. Middle-class retirement savers might still get screwed; in this case, by a tax anomaly.

We will have to wait and see how things eventually play out. Hopefully, retirement investors will not be the ones getting played.

If you would like to read more about the other details of this proposal, my colleague and tax Guru, Bill Sweet, wrote this excellent piece.

If you are an investor and would like to find out more about tax-efficient investing, give us a shout.

Sources: Tax reform anomaly could diminish some companies need for 401(k) plan, Greg Iacurci; Bill Sweet, Ritholtz Wealth Management Tax Expert Extraordinaire.