High fees, illiquid investments, free buffets, and sleazy salespeople.

Variable annuity, anyone?

Welcome to the domain of “investment” timeshares.

The timeshare industry was created in the 1970’s. Instead of selling one condo unit to a solitary buyer, 52 people could purchase them for one week, each paying a share of the price.

According to the American Resort Development Association, there are more than 1,500 timeshare developers in the United States and more than 9.2 million timeshare owners.

While some are happy, others suffer from financial abuse of the highest degree.

According to AARP, “The industry has long been dogged by a reputation for unscrupulous sales practices. And owners often encounter unforeseen challenges. Along with being responsible for annual maintenance fees, they may be saddled with an asset (essentially, the right to use a condo for one specific week of the year) that has little resale value. Often, time-share companies are unwilling to buy back sold units, and reselling a time-share can be difficult.”

Like the realm of annuity providers, the timeshare industry is teeming with financial predators.

“Unethical salespeople use that fact to imply, or even assert, that the timeshare you buy will increase in value. That’s not true. On the resale market, the typical timeshare sells for 10% or less of what the original owner paid, Rogers says. TUG, eBay and other sites are full of “for sale” ads from owners willing to sell for just a penny.” – NerdWallet

“Become a real estate investor with couch change” is missing from the glossy brochures.

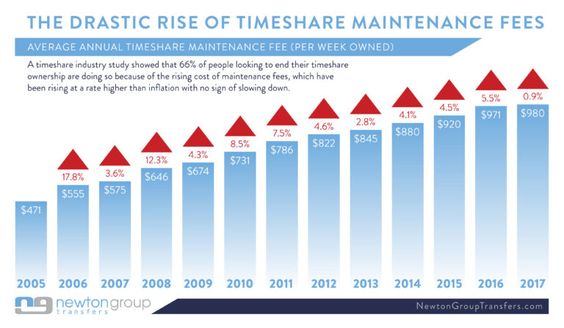

Their non-existent resale value is due to maintenance fees which increase annually. Fees average about $900, but higher-end properties can run up to $3,000 or more.

From 2005-2015, fees increased by an average of 95%!

10% annual increases in maintenance fees plus 3% inflation means a 13% break-even rate.

Where do I sign up?

No wonder “investors” are happy to give these properties away to discard the satanic tithe.

Like many annuities, timeshares are sold not bought. The“free” vacation sets the lure; victims are in a relaxed state of mind. Who cares about contracts, rising maintenance fees, or exchange options when “free” margaritas are part of the deal?

According to a former salesperson, “the primary objective of a “liner” (opening salesperson) is to basically just get the people to like you. Make them your friend. Make them have fun. Then make them give you their credit card. You take them to a “nice” buffet lunch and then tour the property with them.”

Sounds like a plan.

“Predators run for their dinner; prey runs for their lives. The Vampires win every time.” – Peter Watts

God help you if you can’t afford the property. Many companies provide financing at onerous terms.

The same salesman continued, “Then the manager comes in and does a back and forth dance with your client acting as a miracle worker as you pray to the gods of fortune that you have landed a person who can’t do the math. If you get lucky, the person buckles and the “room boy” brings over a bottle of cheap champagne and balloons. Everyone then claps, cheers, and congratulates our newest members.”

An industry metastasized to take advantage of those desperate to sell their blood-draining properties.

These sleazoids pretend to represent a company that helps owners move their timeshares. “We have a legit buyer lined up. All you have to do is sign the paperwork.” None of this occurs unless you send in a hefty upfront fee.

Checkmate.

In 2013, the FTC filed 191 cases against timeshare resellers.

If you are interested in real estate, my colleague Ben Carlson has some great tips.

But don’t look for timeshares on Ben’s list, you won’t find them.

Sources: “Are Timeshares Worth It,” by Liz Weston, NerdWallet, June 28, 2018;”Time-Share Bandits,” by Doug Shadel, AARP The Magazine, June-July 2017; and “Timeshare Sales Job: A Day In The Life Of A Salesman,” ATW80 Blog, February 27, 2018.