“Everywhere there’s a large commission, there’s a high probability of a rip-off.” Charlie Munger

Brokers work for whoever is cutting them a check. This iron law of finance is indisputable.

Selling health insurance plans serves as Hiroshima to the Nagasaki of broker-pushed financial products; these are the twin ground zeros for financial exploitation.

NPR recently disclosed conflicts of interests and perverse incentives infecting the marketing of health insurance to corporations.

“Set sail for Bermuda,” says insurance giant Cigna, offering top-selling brokers five days at one of the island’s luxury resorts.

If surfing’s your thing – how’s about this gem:

Health Net of California’s pitch is not subtle: A smiling woman in a business suit rides a giant $100 bill like it’s a surfboard. “Sell more, enroll more, get paid more!” In some cases, its ad says, a broker can “power up” the bonus to $150,000 per employer group.

Sticking with the sports-related theme:

Not to be outdone, New York’s EmblemHealth promises top-selling brokers “the chance of a lifetime”: going to bat against the retired legendary New York Yankees pitcher Mariano Rivera.

Finally, the same company touts its own definition of limitless:

“The more subscribers you enroll … the bigger the payout.” Bonuses, it says, top out at $100,000 per group, and “there’s no limit to the number of bonuses you can earn.”

Incentives determine the choice of plans brokers present to clients. The costs of the commissions are built into the premiums clients pay. Replace health insurance with annuities and you get the distribution model of many financial products.

Eric Campbell, director of research at the University Of Colorado Center for Bioethics and Humanities, sums this situation up. “It’s a classic conflict of interest … Denying this effect is like denying that gravity exists.”

Incentives like these motivate brokers to “churn” accounts and constantly look to change health plans or investments to collect a fresh batch of commissions. This is great for salespeople but damaging to the health and wealth of consumers.

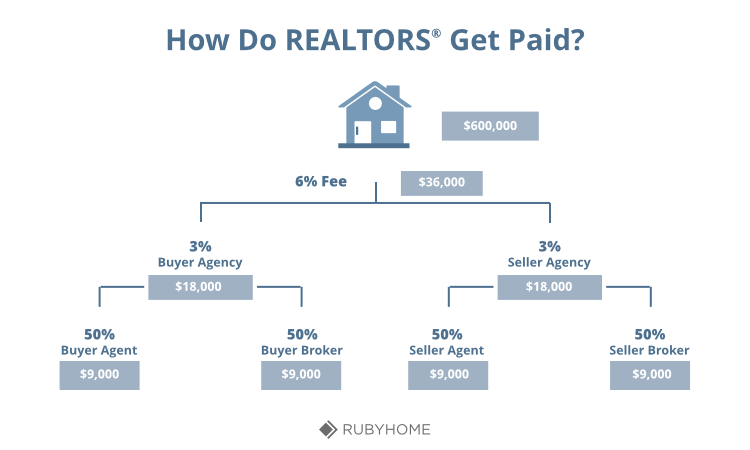

A big problem in health care and financial services is, unlike in real estate, there’s no distinction between buyers’ or sellers’ agents.

Though not perfect, as my colleague Michael Batnick points out, real estate transactions are much more transparent than those in financial services or health care.

In a real estate transaction, brokers are required to clearly state who they are working for, the buyer or the seller of the home. Revealing this information enables potential home buyers to understand their true motivations.

This isn’t the case when investors purchase expensive mutual funds or insurance products from a financial salesperson. Most are clueless about commission scales.

Often, salespeople will give the impression that they are representing you, the buyer (though they won’t come out and actually confirm that). As the investor, you might believe that they are representing your best interest. In reality, they may be sellers’ agents, pushing products that generate the highest fees or fancy vacations. These perks are subsidized by YOU.

In health insurance and finance, murky rules at best mislead clients about inherent conflicts of interest. At worst, encourage them.

When in doubt, ask this simple question to your salesperson regarding compensation: Who is writing you a check?

The answer speaks volumes about which side he/she is on.

Source: “Insurers Hand Out Cash and Gifts To Sway Brokers Who Sell Employer Health Plans by Marshall Allen”, NPR