32% of Americans believe they don’t pay any investment fees or have no clue what they are.

Newsflash – your local financial salesperson doesn’t work for a non-profit. Unless you include your retirement account but I digress.

Public school teachers deserve an F in fee comprehension. They have terrific tutors in conflicted annuity salespeople who tirelessly to make sure there’s no improvement in their grades.

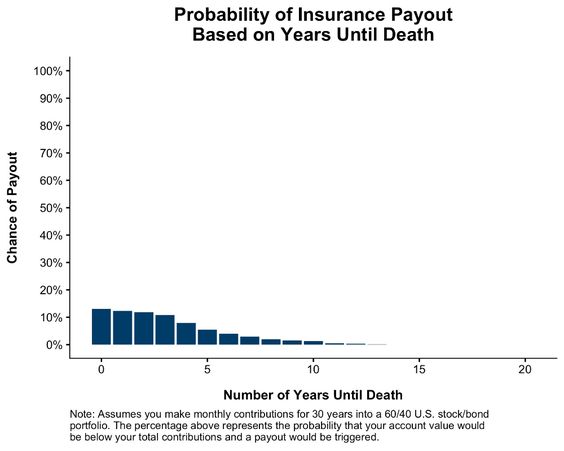

For example, most teachers own variable annuities with annual expenses north of 2%. A big chunk of these fees includes something called M/E insurance. This guarantees the beneficiaries of teacher’s 403(b) accounts receive no less than the number of premiums they contributed.

What are the chances these two perfect storms (Untimely death alongside a market crash) occur? The answer – almost zero.

I asked Nick Maggiulli, our data ninja to run some numbers.

What would happen if a teacher saved for 30 years in a 60/40 portfolio and died immediately upon retirement at age 60?

What is the probability their beneficiaries would collect the M/E insurance?

Was this probability worth the cost of sacrificing almost 50% of real returns over 30 years?

Take a look at Nick’s results.

The odds of this happening are quite small and disappear completely 10 years into retirement.

Moshe Milevsky and Steven E. Posner completed a study in order to determine the true value of this death benefit. Milevsky is a Mathematician and Physicist, while Possner works for Goldman Sachs.

In their April 4 report, The Titanic Option: Valuation of the Guaranteed Minimum Death Benefit in Variable Annuities and Mutual Funds, they reach the conclusion that a simple return-of-premium death benefit is worth from 1 to 10 basis points a year, depending on gender, purchase age and asset volatility. In contrast, the median mortality and expense charge for return-of-premium variable annuities is 115 basis points, according to the report.

Salespeople are overcharging teachers ten-fold on this product!

How do the rest of us fare regarding the costs of our investments?

A Report of the National Financial Capability Study provides some disturbing facts. Some of the highlights include:

Only 33% of investors can more than 50% of a 10 question quiz on investing. The average score is 4.7.

14% believe they don’t pay any investment fees.

17% have no idea what they are paying.

32% of mutual fund investors think they pay no fees.

Only 4% think their portfolios will underperform the market.

29% feel they will beat the market.

Men are more likely to think they will beat the market 32%-25%.

46% mistakenly think past performance is a good indicator of future results.

70% didn’t understand the main advantage of index funds is their generally lower fees and expenses.

Wow! Maybe we should stop picking on the teachers.

Why in God’s name are time and effort devoted to making more complex products like private equity and hedge funds available to retail investors?

Before making these products widely available to the masses wouldn’t it make sense to make sure they knew the benefits of simple index funds first?

Hey Mom! I just failed the G.E.D., what medical school should I apply to?

These stats are more than numbers. Billions of dollars are wasted annually on unnecessary investment fees. This is due to ignorance and deliberate tactics designed to keep investors uninformed about investment costs.

Call this the Everett Dirksen effect. This deceased politician once stated, “A billion here, a billion there, and pretty soon you’re talking about real money.”

Starting new conversations about investment fees before its too late is imperative.

Unfortunately for some, it already is.