What do clients want most from their financial advisor?

The overwhelming answer: A human being who cares about them.

Tom Nally of TD Ameritrade nails it here:

“In today’s age of technology, advisors should be automating everything they possibly can, whether it’s trading, rebalancing, planning, you name it. Because the least scalable resource they have is the most valuable, and that’s their people. That empathetic human relationship between advisor and client is where all that value gets delivered, and that’s where the focus should be.”

Not surprisingly the same criteria hold for conventional therapy.

David Morris discusses this in his brilliant book, The Evil Hours – A Biography of Post-Traumatic Stress Disorder.

“Therapeutic alliance established between patient and client is the most important thing about any therapy, and that such an alliance is, in fact, more important than the therapeutic protocol being used, an argument supported by several studies.”

The argument goes further. Psychotherapists without empathetic skills were no better at establishing patient relationships than a group of English professors.

“One stunningly illuminating study took professional therapists from a variety of theoretical backgrounds and pitted them against a group of English professors, telling them to use basic therapeutic techniques and to establish an empathetic, understanding relationship with their patients. The English professors performed as well as the experienced psychotherapists.”

Like PTS patients, financial planning clients need someone they can relate to.

“In shamanic societies, which represent some of the world’s oldest healing traditions, healers were often trauma survivors themselves. Wisdom was presumed to flow from the experience of surviving into the healers’ thought process. In the West today, the opposite is true. It is the most protected, the most insulated, the most innocent who are presumed to be the most knowledgeable about loss, terror and moral chaos.”

Wealthy clients like to speak to advisors who understand the experience of owning significant assets themselves. That’s just part of it. Marriage, divorce, the physical decline and death of one’s parents, home ownership, raising children, and the cruel unpredictability of life top their list of non-financial concerns.

The only way to really understand these issues is to experience them yourself.

Supply and demand prove there aren’t too many of these types of quality fiduciary advisors out there. The price adjusts accordingly.

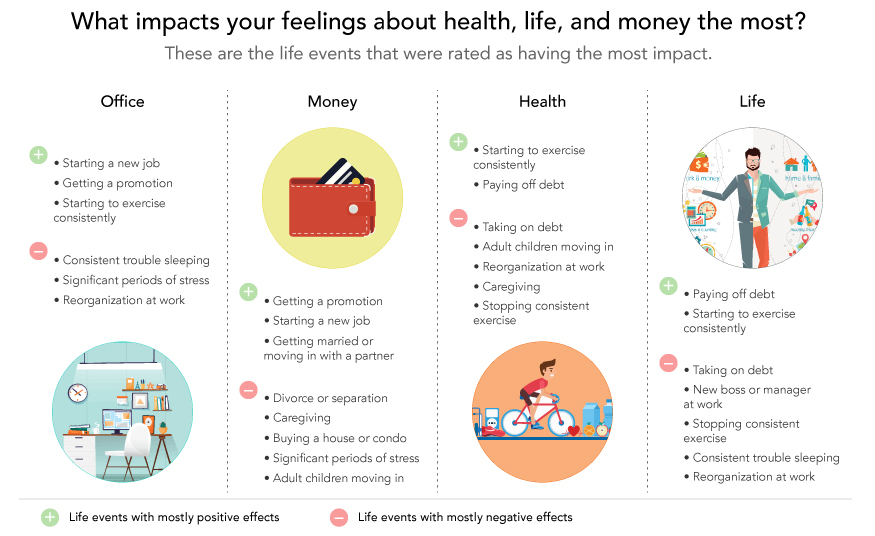

People want to be happy and money plays a big factor.

Source: Fidelity

We waste little time discussing the short-term market noise with clients. Instead, we try to answer these questions:

- How do I pay for and mentally deal with the cognitive and physical decline of aging parents?

- Should I take this new job with lower pay but less stress?

- How will a possible divorce impact my finances?

- What is the best way to teach my kids about money?

- How do I stop my constant anxiety about the markets and life in general?

- How will I spend my time when I retire?

- What are the best ways to protect my children financially if their marriage goes south?

- Should I give money to my children now instead of waiting until I pass away?

- How do I know my children will be responsible for the money they inherit?

- Should I move in retirement to lower my taxes or is it more important to be near my friends and family?

- Can we meet with you on a weekend or evening because these are the only times our schedules allow?

Some questions don’t’ have answers. Clients know this. That’s why they desperately want the next best thing – someone who will listen to their concerns.

I’m not sure if a $30 monthly fee includes taking frantic calls on a Sunday from a client’s accountant or early AM wakeups concerning hardcore marital issues.

We had a client who came to us with a mammoth legacy micr0-stock position. In order not to crash the market, the stock had to be liquidated slowly and carefully over a period of several days. We saved the client about a million bucks with our coordinated precision trading. Thanks, Patrick Haley!

Would this kind of service be included in a subscription?

Not to mention the nitty-gritty details of acting as a QB for their financial life. Meeting and constantly consulting with wealthy client’s accountants, estate lawyers, insurance providers, bankers, and the philanthropic team is part of the job description.

Many of these conversations go way beyond a cookie-cutter financial plan.

Personally, I think a low-cost subscription program is terrific for most investors. It’s light years ahead of the conflicted brokers model, which is predicated on grossly overcharging small accounts.

My colleague, Josh Brown, called it out as The Most Horrendous Lie on Wall Street.

Subscription programs directly contradict false broker arguments, which claim that the fiduciary rule leaves the small investor underserved.

We need to see more innovative solutions to service average Americans, not less.

There is room for different types of payment models, hourly rate, subscription, or AUM fees. All of these serve investors better than the dominant non-fiduciary, product-based distribution model.

The complicated financial/personal situations of high-net-worth investors are unique.

For these people, empathetic fiduciary advisors are worth their weight in gold.