Sound investing leans into the future, not the past.

Whether building a football team or allocating hard-earned capital, this strategy is timeless.

NFL Champions are built in March and April. General managers pick talent through Free Agency and April’s draft. The criteria they implement to construct their team determines whether they visit the Super Bowl or go to the unemployment line.

N.Y Giants Guard tweeted this:

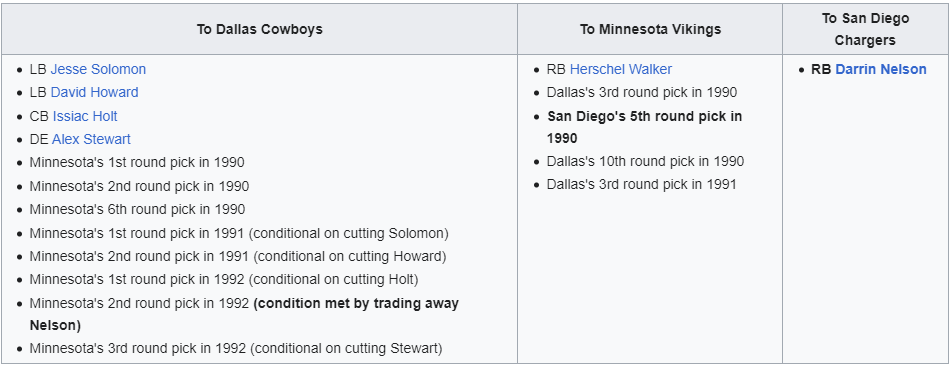

On October 12, 1989, the Dallas Cowboys transformed their franchise in one dramatic swoop. They traded Superstar Running Back Herschel Walker to the Minnesota Vikings. In return, they acquired multiple draft picks and chose players who led them to three championships during the 1990s.

The Vikings never made it to the championship game with Walker.

The Cowboys gambled that Walker’s best days had passed him by, and the Vikings coughed up a treasure for past performance.

The Cowboys also received players in the deal that could be exchanged for more draft picks if they were cut from the team. The Vikings assumed the Cowboys would keep the players. Cowboys coach Jimmy Johnson was only interested in the draft picks; they cut the players, and the rest was history.

Like many short-term views, the trade was initially interpreted as a Viking’s heist. Jonson was proven correct when he categorized it as “The Great Train Robbery “ after the deal was consummated.

Savvy investors should look at their holdings like Jimmy Johnson helped build the Cowboy dynasty.

Correctly applying DCF, or discounted cash flow, is like successfully constructing your team through the draft.

DCF estimates the value of an investment by its expected future cash flows. Implementing this strategy involves discounting or adjusting for the time value of money. This is accomplished by taking the future cash flows back to their present value using a discount rate, often the investors’ required rate of return.

This formula permits investors to judge if an investment is worth pursuing based on its projected returns compared to its current cost.

The Vikings used a low Discount rate to acquire Walker, overvaluing his present value. They misjudged the future value of the draft picks.

Ordinary investors do stuff like this all of the time.

Putting far too much emphasis on the present and underestimating the degree of future change is often the modus operandi.

The stock market may rocket despite a heinous unemployment rate flashing across the screen.

Investors have already looked six months into the future and assumed lower interest rates and stimulative fiscal policy. These are both stock market tailwinds.

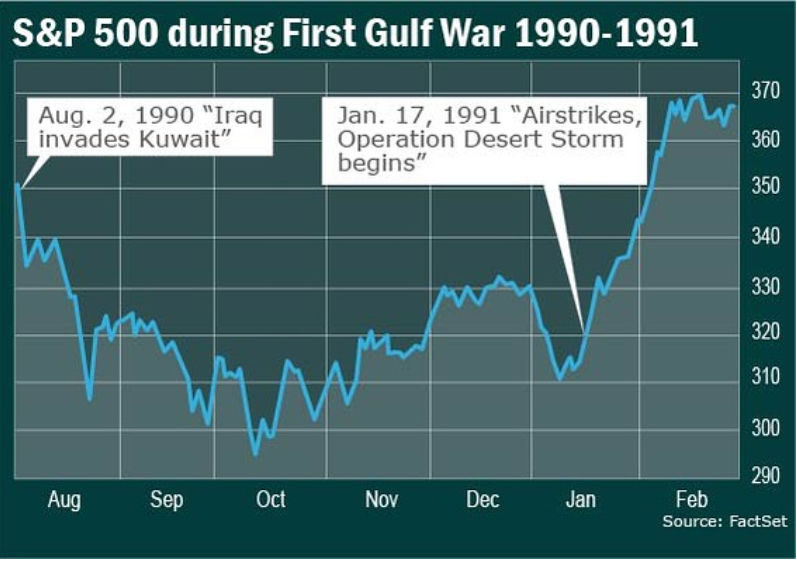

The market floundered before the 1990 Gulf War. Oil supplies and global stability gnawed at investors’ psyches. When air strikes began, the market rallied.

Why?

Investors realized the worst fears were unfounded and the allies would achieve a decisive victory. They were looking six months ahead, not at the present-day carnage.

When emotions are involved, choosing the appropriate discount rate to build a team or manage money is challenging.

Morgan Housel observes: Every investment price and every market valuation is just a number from today multiplied by a story about tomorrow. The stories are often bizarre reflections of people’s hopes, dreams, fears, insecurities, and tribal affiliations, and they’re getting more bizarre as social media amplifies the most emotionally appealing views.

My colleague Ben Carlson adds:

No one lives life in the long term. Long-term returns are the only ones that matter, but you have to survive a series of short-terms to get there. The good strategy you can stick with in those short-terms is preferable to the perfect strategy you can’t stick with.

This is excellent advice for managing your emotions during turbulent times. If you take on more risk than you can handle, you’ll likely overreact to inevitable market mayhem.

Betting the farm and bailing out at the worst possible moment is a terrific investment strategy- said no one ever.

It’s no way to build an NFL team or portfolio.

If you think otherwise, ask the Minnesota Vikings.