Retirement investors needing the most help often get the least.

Or worse!

Investors with accounts between $100,000 and $500,000 end up becoming fee pinatas.

For many big brokers and insurers, the only way to make these “small accounts” worthwhile is bleeding them dry.

There’s nothing more obnoxious than when a salesperson says, “Your a tiny account but Ill do you a favor and take you on.”

Variable annuity and whole life insurance policy here we come.

Biting the hand that feeds you should be their tag-line.

That wouldn’t play well with mixing Palm Trees and Pina-Coladas in their Super Bowl Commercials.

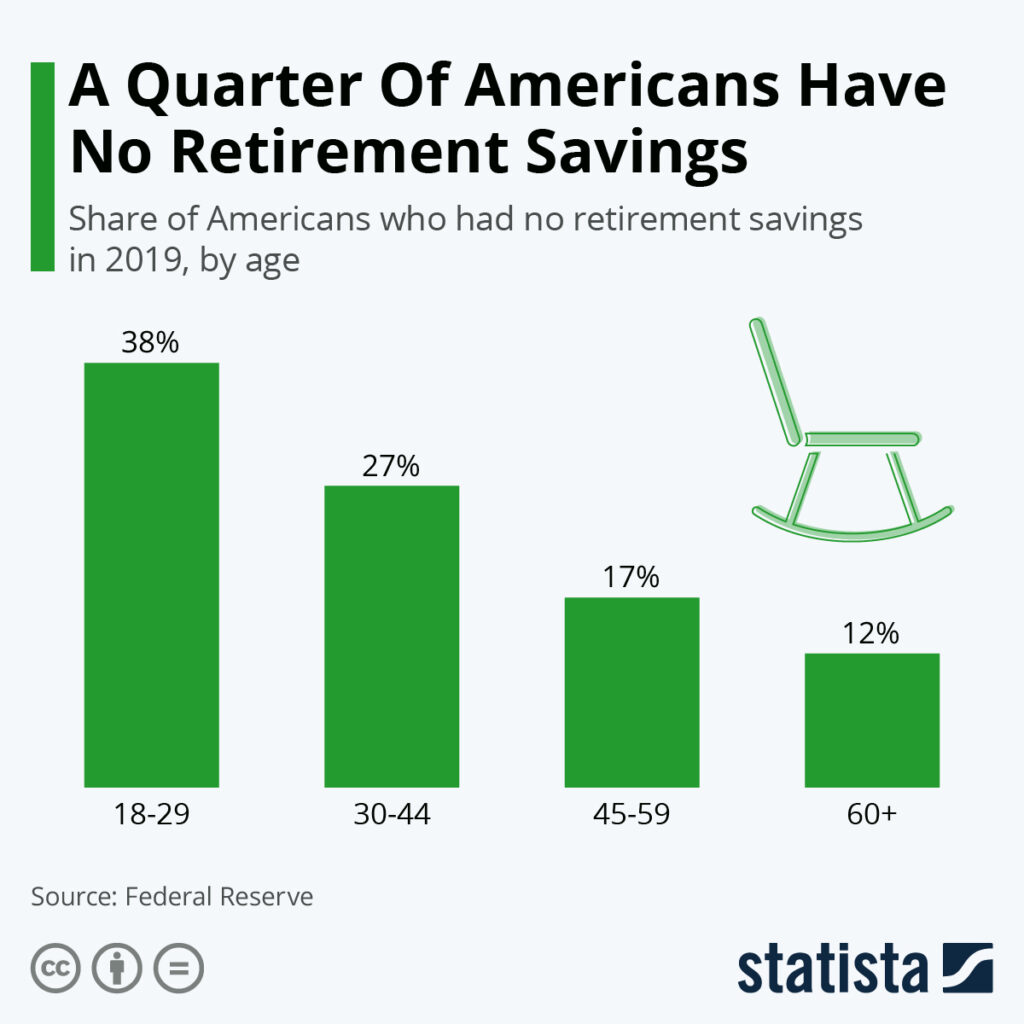

There’s a not-so-good reason more people aren’t ripped off.

They have no savings!

We’re changing this dynamic with public school teachers, and now it’s time to help everyone else.

My colleague, Ben Carlson, just wrote a terrific book, Everything You Need to Know About Saving For Retirement.

Ben’s book is jargon-free and relatable. Pretense or condescension needn’t apply.

This 100-page retirement knowledge drop for regular people is exactly what the doctor ordered. Ben masterfully deciphers the secret language of money.

Dina and I were thrilled to help Ben out. If you’re a teacher, you will recognize plenty of our rantings in the 403(b) chapter.

Normal people aren’t concerned with the small-cap value premium or how to generate alpha.

They want to know if they’ll be O.K. when they stop working.

Here’s some of the stuff that bothers them.

When can I stop working?

How do I take Social Security?

If I retire before 65, how do I pay for my healthcare?

Am I saving enough?

How can I help out my aging parents?

How do I decipher my retirement plan options?

Does my pension adequately cover my needs?

Should I save more for retirement or my kid’s education?

What’s my retirement number?

Can I reach my goals in my current situation?

If any of these questions sound familiar, Ben’s book is your first step toward getting a wealth of common sense investing advice.

Even better, It costs less than a Latte at Starbucks. The good news – You can afford them both.

Are you an expert on retirement savings? Don’t be a Scrooge with your knowledge.

How about using this book as a stocking stuffer for your kids or sharing the wealth Secret-Santa gift for a colleague?

Retirement planning doesn’t require a rocket science degree or an event-driven Hedge Fund.

What people need is an empathetic listener who takes them seriously.

Unfortunately, this is rare in a sea of financial predators looking to dump high commission products onto working families’ straining backs trying to make ends meet.

RWM is looking at 2021 as the year for diving into this neglected pool of vulnerable investors.

Our Liftoff program is the antidote to the various conflicted investment advice viruses circulating about

We’re looking to expand this program and provide services that hit the mark of what people need.

We’ll have much more about this soon.

For now, here’s your homework.

We designed Liftoff as a counterbalance to ignoring or exploiting average investors. Check it out. You won’t be disappointed.

This is the ideal place to create an action plan for all the terrific stuff you just read about in Ben’s book.

Knowledge isn’t power unless you apply it.

Enough is enough. There’s a secure retirement awaiting you, and we can help.

What are you waiting for?