Is spending harder than saving?

For many retirees, the answer is a resounding – YES.

Even though affluent retirees fail to spend their annual income, the problem persists.

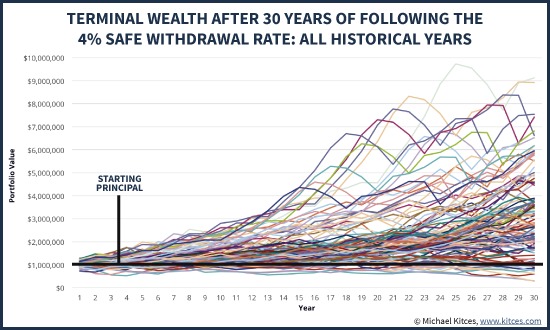

Part of the fear is due to the wide range of withdrawal rates, 3-5%. Others are spooked by the media drumbeat of how woefully unprepared most Americans are for their golden years.

This problem is accurate, not a fantasy.

I spend most of my time with clients pleading to spend more. Early inheritance, charitable giving, vacations, and flight upgrades are all in the mix. Sometimes it works, but teaching an old dog new tricks is difficult.

Turning on the spending spigot after decades of frugality doesn’t happen overnight.

“Lifetime habits of discipline and prudence aren’t easily dismissed just because you reach what you’re told is a different ‘stage’ of life,” Dr. Brian Portnoy, founder of Shaping Wealth, an advisory consultancy, told me. “Habits are part of our identity, and each of us defends our identity fiercely.”

Sometimes, the more numerate the clients, the more complex the spending decision.

Engineers fall into this category.

Viewing the world through closed systems and predictable outcomes is ideal for building bridges, not so much for enjoying retirement.

Financial planning is more an art than a skill, requiring numerous adjustments.

Forecasting what’s going to happen thirty years into the future is to be kind – very difficult.

Spreadsheets are lovely, but they are a tough place to locate fulfillment.

I recently pointed this out to a mathematically inclined client concerned about overspending.

It’s hard for most people to look beyond the numbers and focus on what matters. Luckily, my impassioned plea worked, and I look forward to seeing more photos of their journeys with friends and family.

Doug Liptak calls this the 96% problem.

The 96% Problem,” suggesting that the myopic focus on a sustainable withdrawal rate ignores the purpose of the money in the first place.

“The stark reality of the 96% problem isn’t just about unused wealth,” Liptak says. “It’s about unlived lives. It’s about the moments we didn’t seize, the hands we didn’t hold, the places we didn’t go, and the changes we didn’t make. It’s about looking back and wondering, ‘Did I truly live?'”

Withdrawal rates are more than numbers on a spreadsheet.