Fun Fact – College is a buyer’s market.

Parents are enamored with the elite 1%. There’s a better way.

The average college struggles to meet its recruitment goals.

Not taking advantage of this situation is flushing money down the toilet.

According to Horsesmouth:

75% of students get into their first-choice college.

4.1% of first-year students end up in elite universities, which account for 3.4% of all schools.

Only 61 colleges accept less than 25% of applicants.

Elite schools aren’t doling out a penny in aid without excellent grades AND high financial need.

Why?

Due to their waiting lists, they possess monopoly-like pricing power.

Harvard could charge a million dollars a year and fill their freshman class.

Attacking an opponent’s strength is never a good strategy.

The solution – Cast a wider college net.

Paying full price is a terrible idea for most families.

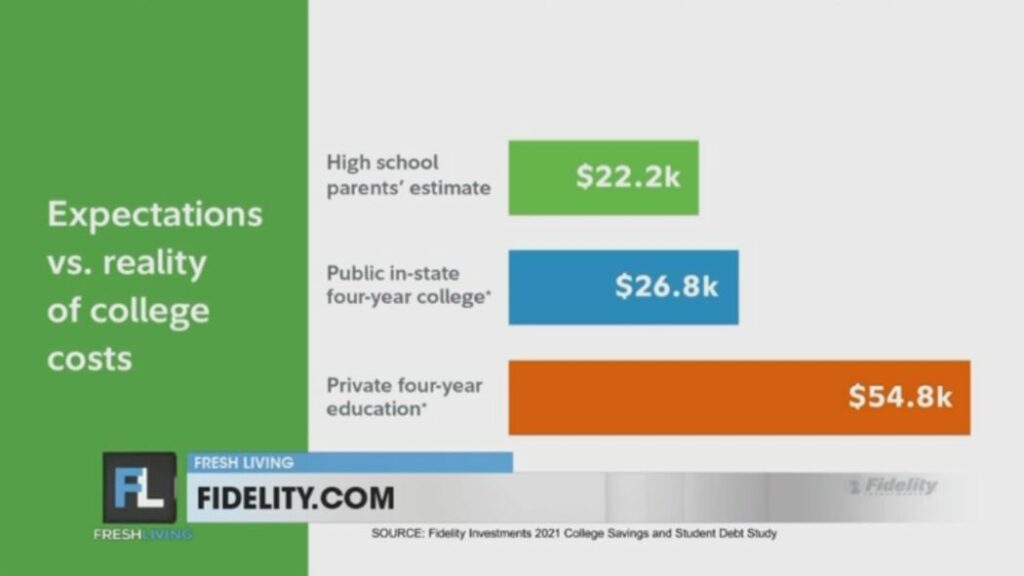

Not setting the right expectations is worse.

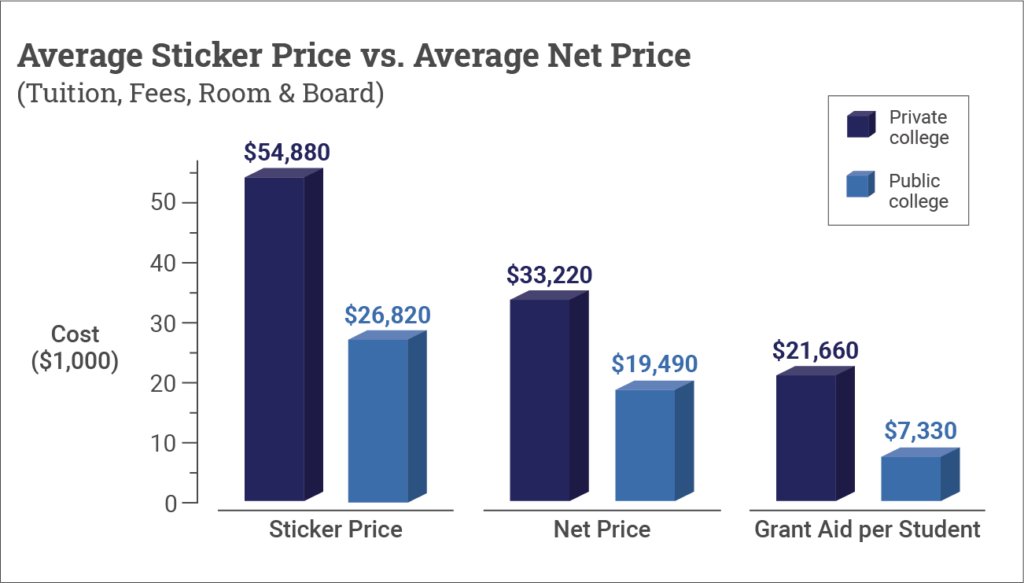

47% of students at state universities and 80% at private colleges receive “scholarships.”

Nothing more than an old-fashioned discount.

Overcharging and subsequently lowering the price is one of the oldest tricks in the books.

Schools grasp padding egos is a terrific motivational tool.

Sizable checks tend to follow.

Source: CollegeData

Who gets the most money in this deal?

Drum roll, RICH PEOPLE!

Most schools prefer offering $10,000 to six wealthy students than $60,000 to a lower-income household.

Schools collect more revenue by gifting money to one-percenters.

The majority of colleges create affirmative action programs for the wealthy, despite what you might hear.

Hoping to move up into elite status in flawed rankings provides rocket fuel to the madness.

Rich kids often have better grades due to tutors and other advantages. They tend to graduate on time and find jobs in part to family connections.

College ranking formulas and wealthy families are a match made in heaven.

Knowing the rules of the game before playing is shrewd.

Most families don’t.

Going through this bewildering process with our twin sons, we witnessed sausage making rivaling congressional follies.

Families need real-world, practical advice.

Not accepting the first offer is at the top of the list.

Schools hire consultants creating algorithms determining what families are willing to pay. Admissions are more art than science.

Our son’s first choice offered him 10k in merit aid. A few other lesser-rated schools offered him more.

We crafted a polite email stating that he would love to attend, but we had other options. We hoped they would reconsider their offer.

It didn’t hurt attaching the award letter.

Voila- In a couple of days, we received an additional $7500k annually.

His brother also was considering this school, so we went back to the well.

Another email – this time asking if things changed if both our sons enrolled as freshmen.

Sure enough, this added another 5k. Our strategy saved $50,000 on both sons’ 4-year college costs.

How did we do this?

We asked.

Be polite. Please don’t make it a negotiation. Providing data is critical.

Few realize the price is open for discussion.

Teaching public school for 20 years provides me with a unique perspective.

Dispatching two sons off to college provided valuable real-time perspective. Too many families are unprepared to navigate these murky waters.

Many pricey college consultants don’t cover the intricacies of college financing. School guidance counselors aren’t required to take one course in this subject.

Would you like to learn more?

Nobody should pay more than they need to for an undergraduate degree.