Robinhood is a murder hole waiting to happen.

I’m not speaking about its stock price.

Gamification of real money doesn’t benefit inexperienced end-users.

Millions of young people flocking to the site isn’t an indication the concept works.

The multitudes indulged in past marathon bouts of chain-smoking. But, unfortunately, it didn’t make it right.

Robinhood incentivizes addiction over education.

What’s going on here???

The facts show RH isn’t the destination for attaining money nirvana.

The conflicts of interest and fines regarding order flow are just the tip of the iceberg.

Scott Galloway eviscerates their business model in his brilliant post $HOOD.

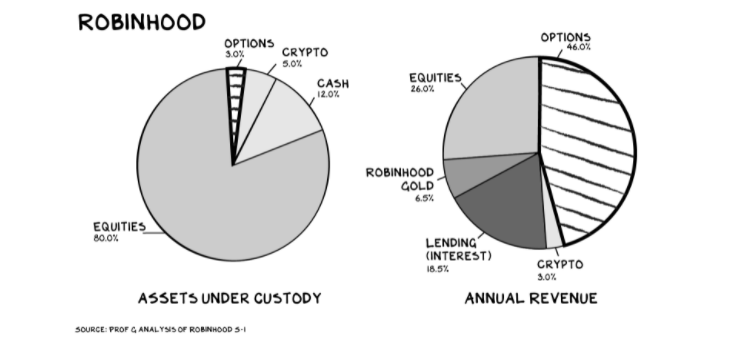

Pointing out their main source of revenue comes from the most speculative type of trading – Options.

If day trading ends in tears, naked options are the Niagra Falls of sorrow.

A business model dependent on these activities isn’t doing a public good.

Democratizing the wealth destruction of young investors needs scrutiny, not adulation.

Galloway points out.

The company operates a mobile app that enables consumers to trade stocks, options, and crypto. These orders are the company’s inventory, which it sells to “market makers” — large financial institutions that pare (execute) the trades in the market. As with Google or Facebook, Robinhood’s users are not its customers but its supply.

This means Robinhood is incentivized to keep its users trading … a lot. The goal: make stock trading as addictive as social media scrolling. RH has enjoyed success here. The proportion of users who check it daily rivals those of Twitter, Snapchat, and Facebook.

Most young adults don’t understand the blocking and tackling needed to build lasting wealth. PWC findings state only 24% of Millenials possess basic financial literacy.

Robinhood won’t improve this number.

Young investors’ illiteracy provides the perfect bait. Gambling disguised as investing.

43% of Robinhood’s investing app users possess credit scores below 650.

Losing money trading crypto or SPACs isn’t going to propel their scores higher.

Using margin makes the situation worse.

Don’t let financial freedom become another word for nothing left to lose.

Whats is the answer to preventing young people from becoming cannon fodder to their corporate overloads?

How about our public school system?

Imagine a world where a first-grade class includes a financial literacy component and builds from there?

Some states are already requiring personal finance classes to be a part of the K-12 curriculum.

This must be made mandatory – Yesterday.

Kids love learning about money. They don’t need to be exploited in the process.

I taught in public schools for over twenty years. So making Lesson plans, including money matters, is a win-win.

The only people who enjoyed it more than the students were their parents.

The problem is there aren’t enough qualified teachers to make this the rule rather than an exception.

My friend Tim Ranzetta is at the vanguard of making this a reality with his non-profit NGPF. He provides free training and curriculum for any public school teacher interested in making a difference.

On a side note, Tim receives zero payment for order flows. Instead, his compensation is funded by the gratitude of thousands of public school teachers.

There’s a better way. It won’t be easy but what other choice do we have?

Teachers and parents need to take ownership – Now.

Galloway doesn’t mince words about the stakes involved.

The food industrial complex wants you to be fat, social media wants you to be divided, and RH wants you to believe you can get rich quick by day trading. Rebel.

Incite the insurrection today by applying some of these proven resources.

Would you please help save the kids so they can save themselves?

Powerpoint

Blogs

How Much Time Should You Spend on Your Finances?

Games

Videos

Warren Buffet and Lebron James

Websites