It doesn’t matter what the stock market does if you’re not happy.

Focus on building an anti-bucket list.

Desires sabotage our peace of mind. We take what we have for granted. Stefan Zweig summarizes our Achilles heel. Darkness must fall before we are aware of the majesty of the stars above our heads.

Why are so many wealthy people dissatisfied with their lives?

Enduring happiness is a myth. Blame evolution for that perk. Arthur Brooks comments. It’s almost as if our brains are programmed to prevent us from enjoying anything for very long.

For humanity to survive, we need stability. Homeostasis is a bitch. Humans possess preordained circuit breakers regulating body temperature, oxygen, sugar, fat, amongst other functions. There’s a reason why drug addicts and alcoholics need more and more toxicity to function, not get high.

The same is true for our emotions. Hitch a ride on the hedonic treadmill. We continue chasing money and material goods, thinking they will lead to enduring satisfaction. Psychologists Philip Brickman and Donald Campbell describe this paradox. “to seek new levels of stimulation merely to maintain old levels of subjective pleasure, never to achieve any kind of permanent happiness or satisfaction.”

No matter how much we buy, we can’t stop this process. Nouveau Riche cave dwellers hoarded extra food and skins to survive tough times and attract suitable mates. Happiness wasn’t on the checklist. Like investing losses, we feel more pain from seeing others pile up more stuff than we get from the pleasure of hedonic purchases. We can’t win this game.

Joy isn’t a prerequisite for survival. The good news – the problem isn’t insurmountable. We need a new equation in our financial plans. Investors cling to a Captain Ahab pursuit for portfolio alpha. The quest to outperform the market. Failing to realize that achieving investment management’s version of The Fountain of Youth isn’t the answer. The dopamine high disappears no matter how much money piles up.

We’re all searching in the wrong places for true wealth.

Albert Brooks may have discovered the North Star of contentment. This tidy formula possesses enormous implications.

Satisfaction = what you have ÷ what you want

Looking for an exit off the Hedonic Treadmill? Slashing our wants gives us a fighting chance for attaining tranquility.

Reverse your bucket list by decreasing the denominator. Numbers don’t lie. Eliminate wants designed to impress others or bring temporary fame and prestige. Of course, everyone needs some fun but weeding the garden of desire isn’t a waste of time.

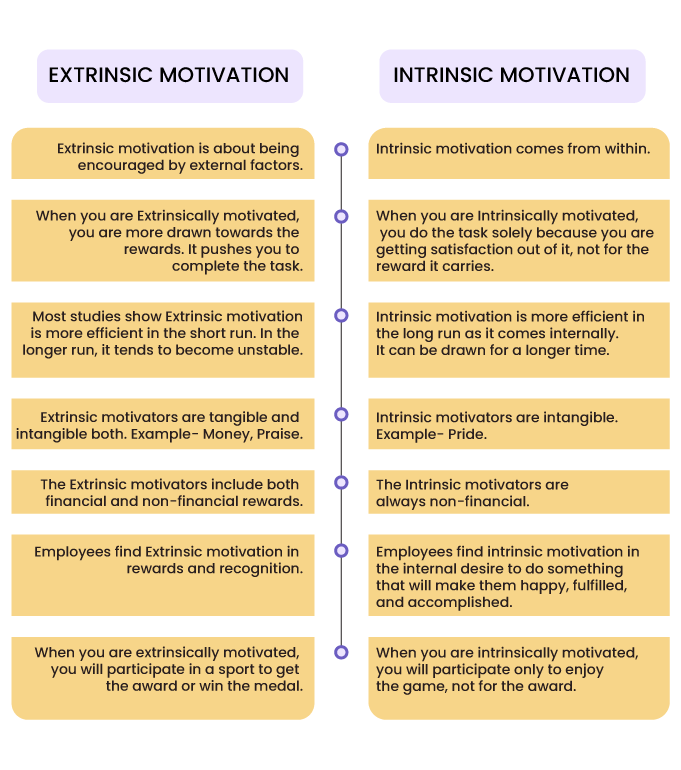

Replace them with inner passions. Human connection and meaningful work are terrific starts. Intrinsic rewards come from forces inside. Extrinsic pleasure relies on the approval of others. The data shows there’s a far greater chance of lasting happiness when your bucket list overflows with the former.

Source: Vantage Circle

There’s no higher return than that on your inner capital.

Dopamine is a strong addiction, but changing anything worthwhile isn’t easy.

Brooks sums things up perfectly.

Each of us can ride the waves of attachments and urges, hoping futilely that someday, somehow, we will get and keep that satisfaction we crave. Or we can take a shot at free will and self-mastery. It’s a lifelong battle against our inner caveman. Often, he wins. But with determination and practice, we can find respite from that chronic dissatisfaction and experience the joy that is true human freedom.

You won’t find this type of alpha in any hedge fund, no matter how hard you try.

Act now. As the Stoics say, Don’t wait; the time that passes belongs to death.

Source: How To Want Less by Arthur C. Brooks, The Atlantic