To paraphrase President Kennedy – Ask not questions about why the unknowable occurs – ask what you can do to focus on the controllable.

Why questions invite belief systems to the curiosity party. Not a good thing.

Depending on who you ask about the same topic, the answer is often completely different.

Competing responses presented with the same enthusiasm is a dangerous combination.

Ask a Vegan about dieting and meat is the enemy.

Ask a Paleo guy the same question and meat saves your life.

Cross-fit is a religion to some exercise enthusiasts while long-distance running is the cure-all for others.

It all depends on the source.

“Why is your system the best?” is a loaded question.

The same goes for investing.

The why’s can get you in heaps of trouble.

As advisors, we tend to hear an All-Star list of bad questions.

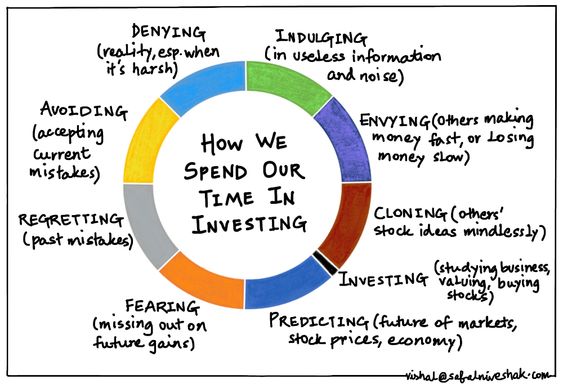

Too many investors spend their precious time trying to answer the unknowable.

This becomes a one-way ticket to Regretville – or worse.

Why did the market go down today?

Why didn’t I invest in Apple stock twenty years ago?

Why didn’t I make more money than my neighbour Fred this year?

Why should I invest in boring index funds instead of that hot IPO?

Why didn’t I pay off my credit card balance sooner?

Why is the Federal Reserve manipulating the markets?

Why are this month’s employment numbers so important?

Why is the President tweeting so much?

Why didn’t I start saving earlier for retirement?

Why does the market hate me?

Might have been and never was aren’t the best components for a sound financial plan.

We tend to focus on all the wrong stuff for all the wrong reasons.

Our job is steering clients inquisitive nature into the “what” category. This simple change transforms the entire tone of the conversation, in a good way.

Newsflash – The one thing that influences short term market gyrations is everything and nothing.

What questions force clients to be specific while guiding them back to reality. Why often involves the unknowable. What provides concrete answers.

Notice the difference in the quality of these questions.

What are your most important goals for your money?

What makes you happy?

What does your ideal day in retirement look like?

What are the alternatives to NOT investing in stocks for the long term?

What are some ways to decrease spending and increase saving?

What are the benefits of delaying taking Social Security?

What type of insurance would protect your family the best from an unforeseen tragedy?

What are the best methods to save for a college education?

What can you do right now to make up for your retirement shortfall?

When searching for financial advice, be aware of strong belief systems.

Not all are harmful. Data and zealotry are two completely different things. Mixing them together creates a toxic brew.

There’s a big difference between being a messiah for low-cost index investing and a rabid political partisan enticing you to throw money into their latest ETF.

Avoid questions that tug on the heart of someone’s strongly ingrained beliefs.

What is in my best interests? is the ideal way to begin any conversation.

This is especially true regarding your hard-earned money.