Life always finds a way.

Nature is fantastic at devising numerous methods to continue the propagation of the species. Thermonasty is a case in point.

In Long Island, where I live, many Rhododendrons populate the residents’ gardens. Rhododendrons are evergreen shrubs that bloom in large blooms of various colors in the spring. What’s interesting about this species is how it survives the frigid winter.

Thermonasty takes place when temperatures drop below freezing. In effect, its leaves become living thermometers. When the temperature plummets, the leaves curl inward, causing the leaf to roll up and drop. The leaves tightly curl when temperatures are below twenty degrees.

Here is an example of this from a shrub in my garden.

Thermonasty is an adaptation that helps plants survive harsh conditions. The tightly curled leaves protect the shrub from winter winds by decreasing the available surface area. Rolled leaves also provide a shield from accumulating snow. The cylinder shape allows snow to roll off the leaves instead of piling on and breaking branches.

Shrubs and trees also have a summer arsenal to shield them from the elements. According to Peter Wohlleben in his acclaimed book The Hidden Life of Trees:

Trees can also mount their defense. Oaks, for example, carry bitter, toxic tannins in their bark and leaves. These either kill chewing insects outright or at least affect the leaves’ taste to such an extent that instead of being deliciously crunchy, they become bitter.

What can investors learn from nature about shielding their investments from the harsh Artic market winds?

Sometimes, playing defense is your best offense.

It’s impossible to build wealth if you cannot ride out the inevitable market storms.

Establishing a reasonable emergency fund is a good first step in formulating an impregnable moat around your money.

Typically, this includes keeping a salary of 3-6 months in an FDIC-insured savings account. If your income is more variable, adjust accordingly.

Selling stocks at their lows to pay monthly bills is a great idea – said no one ever.

For your emergency fund, focus on the return on your capital, not the return on it.

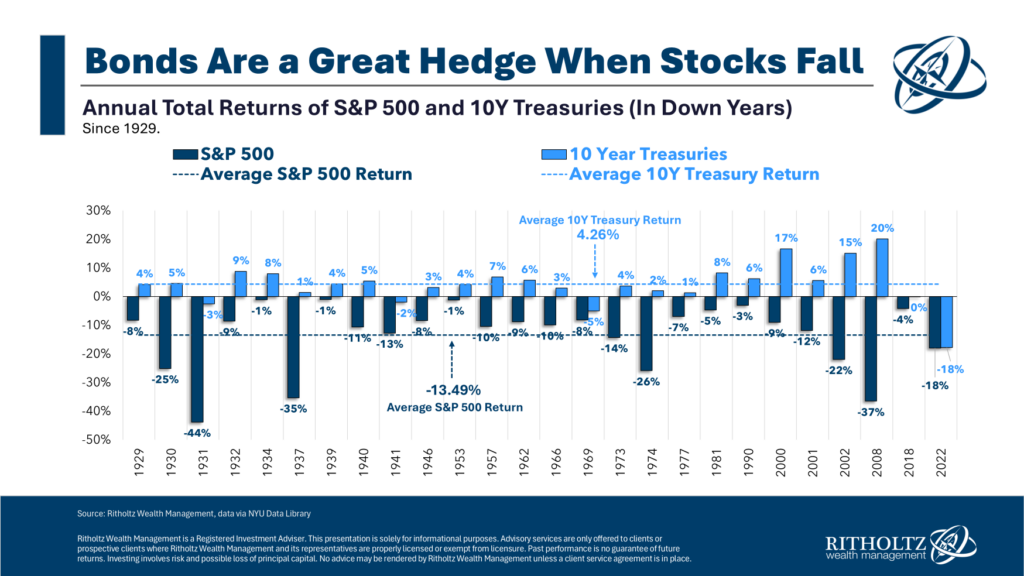

A second way to protect yourself from the nasty elements Mr. Market will throw your way is to ensure that you own the right types of bonds in your portfolio.

For example, the average investor owns an asset allocation strategy comprising 60% stock and 40% bonds. Investors can adjust this ratio based on risk level and their time horizon for when they need their funds.

There are many types of bonds, including corporate, municipal, high-yield or junk bonds, and U.S. Treasuries.

While treasury bonds provide little sex appeal, they spice up your portfolio for all the right reasons. When the stock market falls, investors often flock to secure, safe U.S. Treasury bonds as shelter from the storm.

The last thing you want during market mayhem is for your stocks and bonds to go down simultaneously. While High Yield and Corporate Bonds entice investors with higher interest rates, when the shit hits the fan, they tend to act more like stocks than bonds. The extra point or two in yield becomes a distant memory as you watch your whole portfolio fall into immolation.

Creating your version of Portfolio Thermonasty lets investors ride out the winter and enjoy the eventual spring blooms.

It’s hard to score more than your opponents if you can’t play defense. The game of wealth plays by the same rules.