The biggest myth concerning financing a college education is saving is a bad idea. Say What????

An urban legend states colleges withhold money if parents accumulate assets. Yes, and mostly no.

Many parents can’t distinguish the differences between need versus merit-based aid.

Colleges dole out money in two ways. Funds for students from low-income families and monies distributed to high-income students through merit aid are two distinct items.

Most readers of this blog belong to the latter. It’s a terrible mistake not to save for Junior’s education. Merit aid is unrelated to income or assets. Grades, activities, sports, demographics, and other factors enable even the wealthiest students to receive gobs of free money. The wide availability of merit aid is a big reason college tuition has been in a decade-long decline.

According to Forbes:

In all institutional types, the inflation-adjusted average of published tuition and fees peaked in 2019-20, while the Consumer Price Index increased by 23 percent during this period.

College tuition has been declining for the last decade.

The decrease is primarily due to the preponderance of widely disbursed merit aid. (The exception is the elite Ivy League and a few other institutions.)

Despite what you may hear, saving for college will not jeopardize eligibility for merit aid.

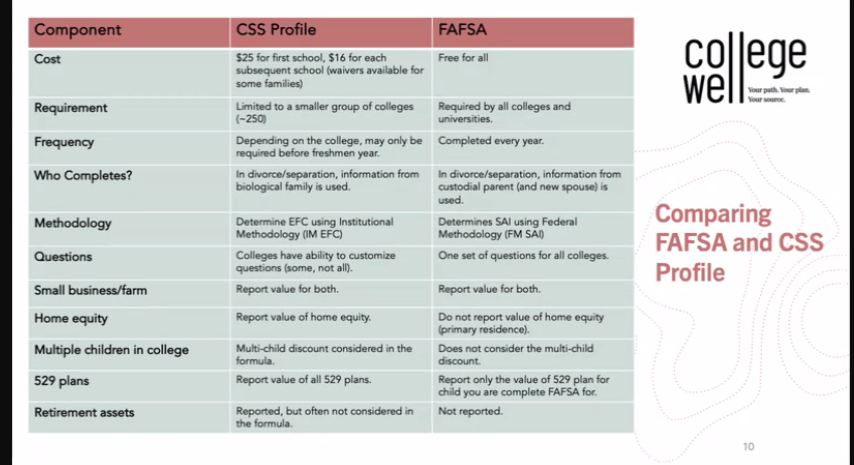

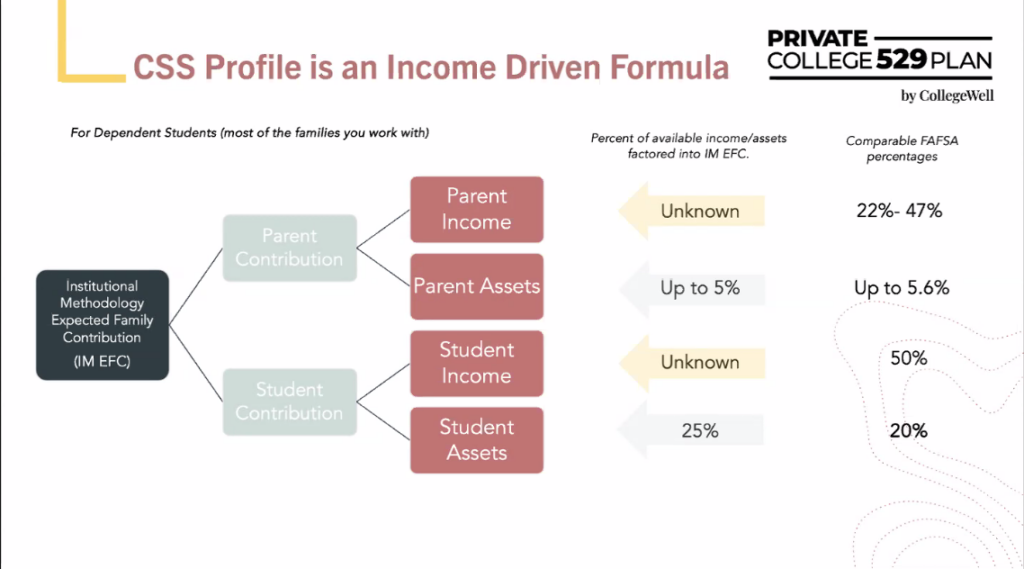

Here’s a mathematical reason why saving for college makes sense regarding the FAFSA and CSS formulas. The FAFSA is how most schools determine aid, while CSS is the additional marker for pricier private institutions.

Income, not assets, largely determines if your child receives financial aid. In both formulas, income reduces assistance by up to 47% while assets peak at a penalty of 5.6%.

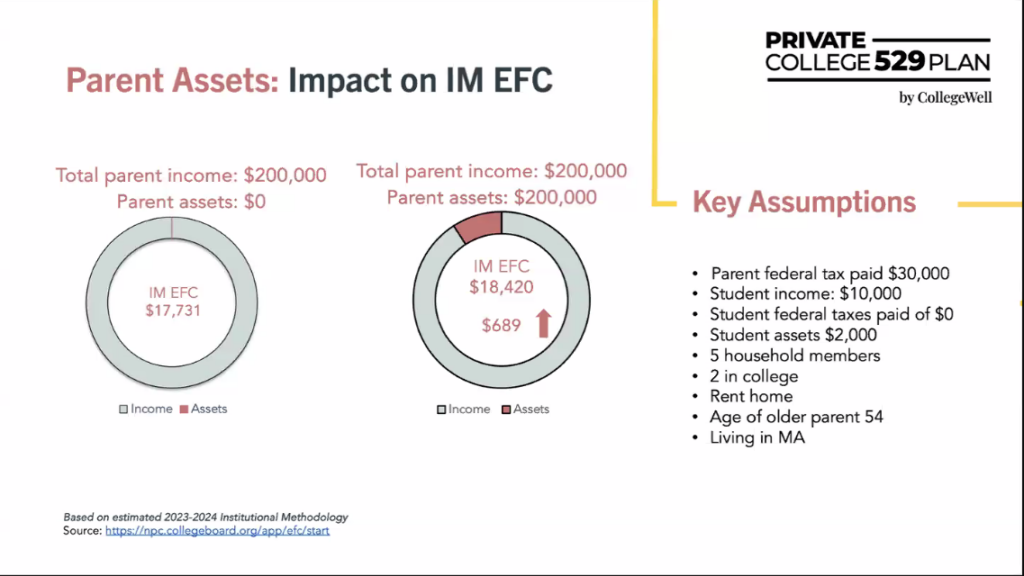

To simplify things, parents who save $10,000 for their child’s education have their potential needs-based aid reduced by $560. There’s zero effect on merit-aid.

Here is another real-world case: If parents have two children in college, a total income of $200,000, and $200k in assets, they would pay a financial aid penalty of $689 compared to another family with the same income and zero assets. Assets are a significantly smaller component of the aid equation than income. (This is the CSS calculation, not FAFSA)

Late-stage college funding is a misunderstood aspect of personal finance. Incredibly, parents know little about the intricacies of purchasing something that is only second to their mortgage regarding cost.

Here are some takeaways that High School Guidance counselors should make available to parents of college-age children. (This won’t happen because counselors aren’t required to take one course on late-stage college financing, but we will save that for another day.)

- Fill out the FAFSA. Some schools will not give out merit if you don’t, and it’s impossible to receive needs-based aid without completing this form. The launch date is December 1 for the 2025-26 academic year.

- If you have younger children and make a decent income, start saving for college. The penalties for saving are minor compared to owing thousands of dollars in high-interest student debt.

- Most friends and neighbors may be well-meaning, but, in most cases, they have no idea what they’re talking about when the topic is paying for college.

- It’s rare to pay the sticker price. Costs have been coming down, and except for the most elite universities, there’s plenty of free money out there despite what you may hear in the media. It’s a buyers’ market. Many schools have difficulty filling their first-year classes.

In many examples, conventional wisdom is neither wisdom nor conventional. Paying for college is no exception.