Is free will just another human delusion?

There are potent arguments that we have much less clout over our actions than we realize.

Physiologists conducted several fascinating experiments that lean against human free will. Benjamin Lever demonstrated subconscious brain activity is the prime driver of movement.

He used EEG to display activity in the brain’s motor cortex to prove activity 300 milliseconds before someone thinks they decided to move.

Another study used MRI to show similar findings.

Subjects were instructed to press one of two buttons while observing a clock of random sequences of letters appearing on a screen. They identified what letter was in sight the instant they determined to press either button.

It was determined that the two brain regions that held the data concerning the decision of what button to push activated seven to ten seconds before the decision was made!

Your brain determines your actions, but you conclude you’re steering the ship.

The implications of these studies are wide-ranging, concerning everything from our criminal justice system religion, and our finances.

We often give far more credit to high-powered individuals than they deserve.

Sam Harris points this out in the aptly titled book Free Will. (Not only is this book fantastic, but it’s only 65 pages!)

You did not pick your parents or the time and place of your birth. You didn’t choose your gender or most of your life experiences. You had no control over your genome or the development of your brain. And now your brain makes choices based on preferences and beliefs hammered into it over a lifetime.

Some acquire great wealth, but their work ethic or smarts aren’t the sole factor.

Working for a prominent RIA firm with over $4 billion in client assets is considered by many to be a successful career. Hard work, resilience, and seizing opportunity played a role in this result.

They aren’t the only ones by any measure of estimation.

Much of my accomplishments were decided by forces beyond my or anyone’s control.

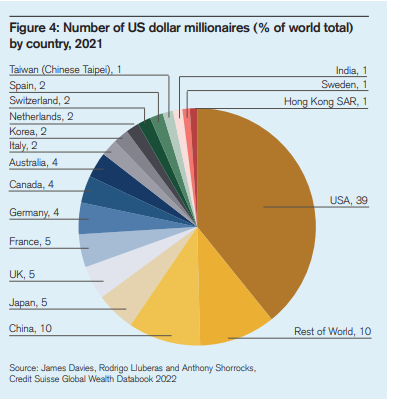

Being born into the wealthiest country on the planet is the equivalent of winning the genetic lottery. Good fortune didn’t stop there.

Growing up in a stable home with two parents devoid of alcohol or physical abuse is equivalent to beginning 10 yards past the starting line. Having the ability to attend college and observe positive work role models with connections is the equivalent of rounding third base compared to the planet’s other 8 billion inhabitants.

Would I be in the same situation if I was born in North Korea to drug-addicted parents who lived in a homeless shelter?

I doubt it.

Having nothing to do with either option is what’s fascinating.

There’s a path to wealth that isn’t complex. Find a decent-paying job, save 10-20% of your salary, invest in low-cost index funds, and let it compound over thirty years.

Voila– You’re a millionaire.

Like Warren Buffet once said, Investing is simple but not easy. Growing up in a physically abusive environment infected by violence, drugs, and alcohol filled with negative role models often provides insurmountable roadblocks to dollar cost averaging.

Past experiences and your gene pool are determined by fate, not free will.

Sam Harris elaborates:

Many seem unaware of how fortunate one must be to succeed at anything in life, no matter how hard one works. One must be lucky to be able to work. One must be lucky to be intelligent, physically able, and not bankrupted in middle age by the illnesses of a spouse.

It’s not to say wealthy, successful investors aren’t intelligent and hard-working.

Never underestimate the role of luck in any billionaire’s equation.

If you’re reading this post, fortune has smiled upon you.

Being self-aware enough to appreciate this bestows riches beyond your wildest dreams.

Gratitude is the most potent force in the universe.