“I guess it comes down to a simple choice – get busy living or get busy dying.” The Shawshank Redemption (1994)

Retirement is more than just years.

The two most integral terms regarding your retirement have zero to do with stocks and bonds.

Understanding the difference between Healthspan and Lifespan drives the quality of your retirement, regardless of how much money you’ve accumulated.

A simple definition of Healthspan is the number of years we feel good. How long can we continue doing the activities that produce the most pleasure? To increase Healthspan, we need freedom from disability and disease.

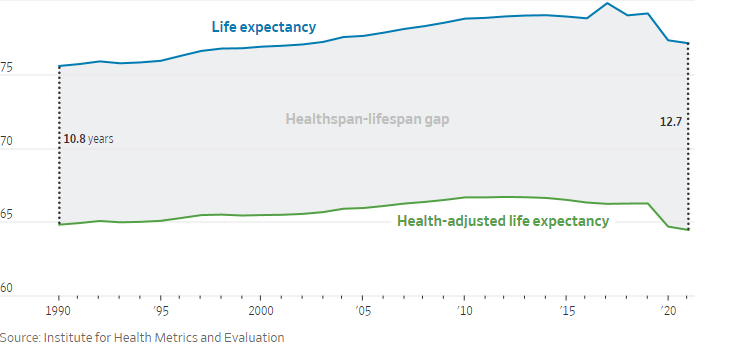

Lifespan is the length of time we live, disregarding health. The gap between these has noticeably increased over the last 30 years, surging from 10.8 to 12.7 years over this timeframe.

A dominant reason for the increased gap is Americans are living longer. Old age presents more opportunities for developing chronic health conditions.

The dilemma is not all of the disparity is explained by age-related causes. Substance Abuse, Obesity, and Diabetes are becoming more prevalent in younger people. The same applies to mental health disorders.

According to a Centers for Disease Control and Prevention study in 2018, roughly 27% of U.S. adults had multiple chronic conditions, up from 25% in 2012 and 22% in 2001.

Health conditions can wreck the retirement of any individual. Seven-figure portfolios aren’t immune from chronic diseases’ devastating toll.

The data on the importance of Healthspan vs. Lifespan should serve as a wake-up call to anyone who believes a bull market is the prime ingredient for a successful retirement plan.

According to the Wall Street Journal:

Developing health conditions takes more than a physical toll. A substantial health problem reduces life satisfaction more than losing a job or becoming widowed, divorced, or separated, according to a 2022 study published in the Journal of Economic Behavior and Organization.

Do you want to live to be a centenarian if the price includes 20-25 years of existing with chronic painful conditions slowly decaying your cognitive and physical abilities?

That’s the distinction between Healthspan and Lifespan.

Most people define their lives as participating in the things that give them the most pleasure. There’s a crater between being alive and living.

What are some things you can do to increase the probability of a longer Healthspan?

Here are ten quick tips to invest in. Unlike random markets, Doing a few lifestyle changes guarantees a positive return on our investment.

- Eat clean. Avoid processed foods. Especially those with added sugar. 6-8 servings of fresh fruits and vegetables is desirable

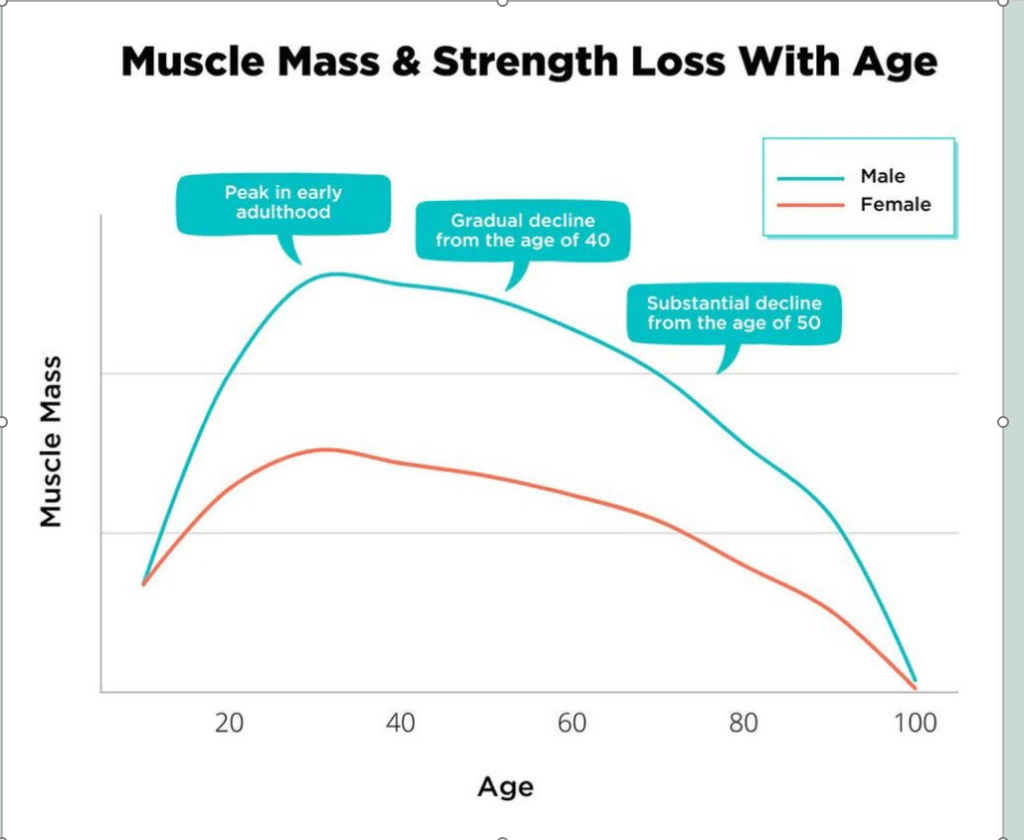

- Exercise consistently. Muscle mass declines about 3-10% a year after age forty. Add resistance training to your regiment immediately. 3-4 weekly workouts are fine.

- Establish a regular sleep routine and get 6-8 hours nightly.

- Get outside. Not counting the benefits of Vitamin D, regular walks in nature relieve stress and lower blood pressure.

- Stay Hydrated. Water and tea are great options. Try to drink about half your body weight in ounces daily.

- Move your body. Use it or lose it. If step counting is your thing, 8-10,000 steps daily is a good starting point.

- Breathe through your nose. This filters the air to prevent disease. Mouth breathing is a significant cause of Sleep Apnea and related health issues.

- Limit your alcohol consumption to two drinks per week. Alcohol is a toxin that provides no benefits to the human body.

- Structure your eating periods to 8-12 hours a day. This helps the body repair itself by having a respite from using energy for digestion.

- Eat more protein. A goal of one gram per body weight helps prevent muscle mass loss and satiates hunger.

No need to be a Puritan. Follow the 80/20 rule. Try behaving yourself 80% of the time. That should be sufficient to keep you on track while still being able to relish some guilty pleasures.

The Roman Stoic Philosopher Seneca said it best. There is no ground for thinking that because of his white hairs or wrinkles someone has lived too long: he has not lived a long time but existed a long time.

There’s nothing more valuable for your retirement plan than increasing the length of your Healthspan.

Start today by making this the number one priority in your list of retirement goals.