It’s foolish to try and quench your thirst by drinking salt water.

The same goes for looking to the Stock Market for eternal bliss.

A significant detriment to a fulfilling life is searching for things we think make us happy but are just transitory experiences.

The more we allow our mind to indulge in these fantasies, the more it degenerates. The more money we want, the harder it becomes to satisfy our cravings.

Think of life as a kaleidoscope. The delight is forever fleeting if this is the game you decide to play.

Even the things we think make us happy are often disguised as suffering.

Food, movies, music, etc all provide temporary joy, which soon fades. When we’re hungry, we eat to satisfy our craving. Soon, we are satisfied, and the cycle repeats itself. At best, our quest for material desires gives us a lower grade of suffering.

It’s impossible to find lasting joy from things outside of us. That’s just the way it is. It’s hard to change how we think and view the world, so we continue to play a game we will never win.

When we die, the only certainty in life is that all of our treasured possessions vanish, never to be seen again. The same goes for our body. Imagine spending more time and energy cultivating our minds to become more present instead of devoting all our resources to things that are certain to vanish.

It’s frightening to imagine all the ideas ingrained in our heads concerning attaining status and wealth was incorrect. Giving this up is next to impossible.

While forfeiting our possessions isn’t a realistic option, taking time to ponder the possibilities of finding lasting happiness is well spent.

Think of the Stock Market. Some days, it goes up, others down. Latching your mood or self-esteem to this financial Yo-Yo is fool’s gold. Yet so many of us do just this.

Even though the market rises over long periods, everything in between anchors our mood. Being human, we focus on the misery more than the new highs. There’s zero chance relying on these impermanent fluctuations brings joy to anyone.

Just like depending on others for approval, this strategy takes away all agency and leaves your contentment up to the whims of the market Gods or other people,

Before you can determine a sustainable path, it’s helpful to eliminate the destinations you wish to steer clear of.

Focusing on the market to provide pleasure is the top place to avoid.

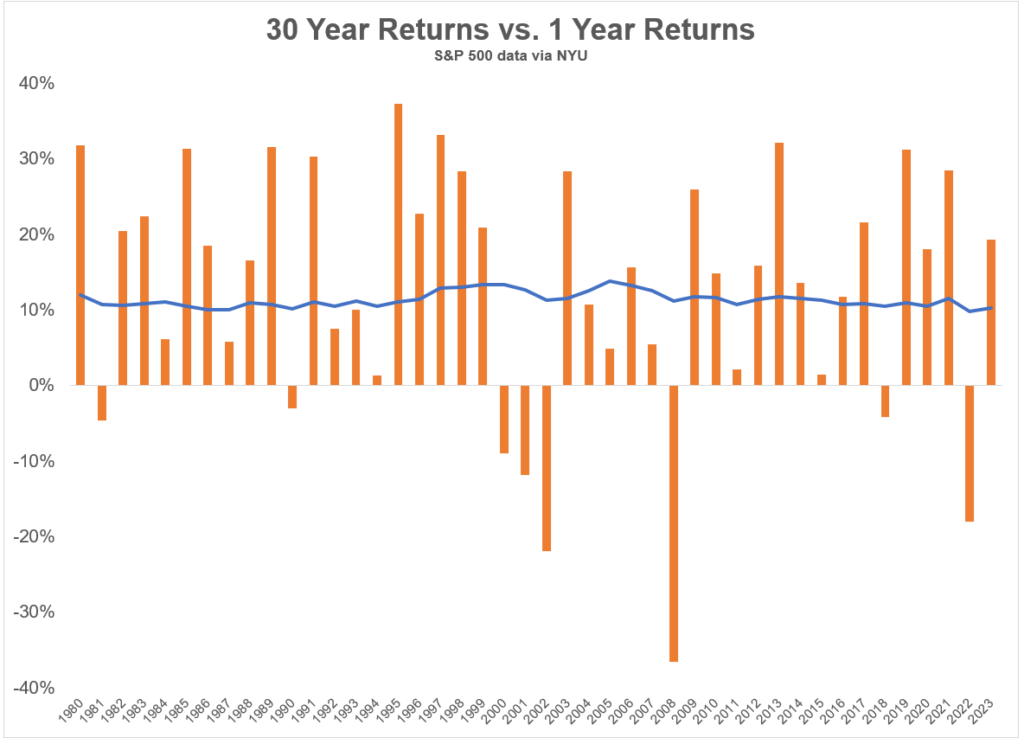

My colleague Ben Carlson put together this terrific chart displaying how the long-term market return varies slightly, but the short-term is a complete crap shoot.

Take a look at the rolling 30 year returns1 on the S&P 500 since 1950 (the blue line) compared to the latest one-year returns (the orange bars) for every 30 years: Returns in a given year are all over the map, but 30-year returns don’t change all that much from year-to-year.

Even though investors have made a ton of money over this period, many feel disaster is just around the corner. Not exactly a recipe for peace and tranquility. Those drawdowns leave scars that never heal.

The Stoic philosopher Seneca famously stated what all fools have in common: “They are always getting ready to live. They are always thinking that they have plenty of time.”

Focus on the now. The past is extinct, and the future is uncertain.

Most of all, don’t rely on the markets to deposit happiness into your life.