Owning stuff builds wealth; renters pay the bills.

Young people must develop an ownership mindset.

Recently, I helped a young person fund their first investment account- A Roth IRA.

Naturally, young people who work hard and save their money have trepidations about moving from relative safety into a world filled with the language they were never taught.

After explaining the basics, the meat of this issue popped into my head.

My pitch went something like this:

Working for someone else and keeping your money in the bank is fine if you want to pay the bills and be average. If not, you must own stuff. Ownership can be expressed in a variety of ways.

- Stocks

- Real Estate

- Your own business

- Collectibles

- Patents

There are others, but you get the idea. People build wealth by investing in these assets because they take on risk (No risk, No Return) and benefit from the laws of compounding. Not to mention the many tax benefits owners have over renters.

If you work for somebody, they keep most of the profits. Ownership changes the dynamics and distribution of income distribution in your favor. With the accompanying risk, of course.

The significant part about ownership is you don’t have to go 100% Steve Jobs to reap the benefits. You can hold a steady job in a public or private corporation and grow wealth with company retirement plans, brokerage accounts, or outside real estate investments.

The choice is yours regarding how far you venture on the risk curve.

Owning a business isn’t for everyone. There’s no shame in that.

Implanting this in your brain early is comparable to planting an acorn. You’ll be amazed at what transpires in a few decades. The beauty of a Roth IRA is a young person can always access the principal. It’s an ideal way to save for a purchase that can reach its full potential while feeding on the energy and vitality of youth.

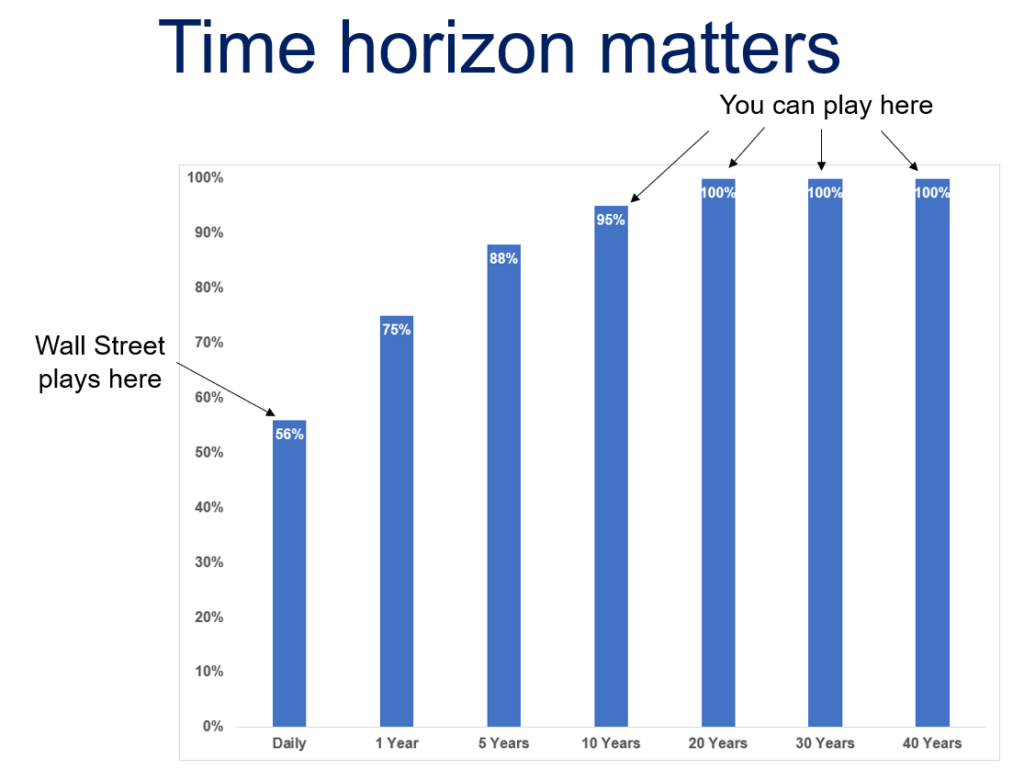

An underrated aspect of early ownership is a young person doesn’t have to play under the same rules as everyone else. The guradrails are much broader, allowing more risk and wealth to flourish.

My colleague Ben Carlson sums this up beautifully.

You can set it and forget it.

You can ignore macro predictions.

You can stop looking at your statements if you’d like.

And perhaps the most significant advantage you have as an individual investor over the behemoth institutional investors is the ability to think and act for the long term:

Young people don’t grasp their most significant risk isn’t taking one. Keeping up with or failing to earn returns matching inflation leads to nowhere.

I can report the results of the impassioned plea were fruitful. A fully funded Roth is ready to go, with a bright financial future soon to follow.

Pass this along to any young person you think might heed this message.

The pie is big enough for everybody to eat from.

Capitalism isn’t dead; it needs more members.

Especially the younger variety.