Should you self-insure for Long Term Care?

Like most answers to complex personal finance issues, it depends.

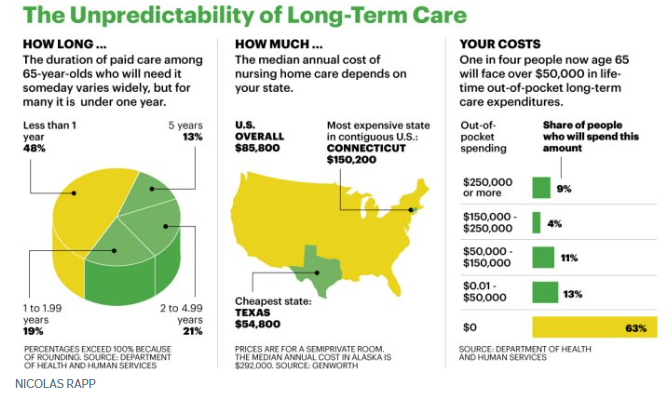

The probability you’ll need some form of Long Term Care is high. According to LongTermCare.gov, there’s almost a 70% chance of requiring some service or support in your golden years. More concerning is twenty percent of people will need care for longer than five years.

LTC isn’t part of Medicare.

Assuming we can’t predict the future, the choice requires deep thought and consideration.

Should you drastically reduce your lifestyle to prepare for something unexpected?

Did you work your whole life to fund the lowest quality of existence during your final days?

What is the number you need to attain to self-insure

Educated guesses may be the best attempts at solving the riddle.

Source: AARP

The Wall Street Journal takes a stab at this complex issue.

“It’s not a perfect science to know whether or not to self-insure,” says Jordan Niefeld, a certified financial planner with Raymond James & Associates in Aventura, Fla. Which route you choose can depend on factors such as your finances, asset mix, policy costs, life expectancy, health history, and risk tolerance.

Let’s examine the pros and cons of self-insuring for Long Term Care.

Pros:

- Cost Control: Direct control over funds lets you control what’s allocated toward LTC. It’s possible to build a more significant stockpile compared to paying insurance premiums.

- Flexibility: There are no restrictions to allocating funds like those in an insurance policy. You can allocate resources based on your needs, preferences, and priorities.

- No Premium Payments: If you never need LTC or use it for a short duration, not paying years of costly premiums is a huge benefit.

- Asset Control: Unlike traditional insurance, you retain control over your assets, where premiums are paid and may be lost if care isn’t needed. These funds will be available to your heirs or other pursuits.

Cons:

- Financial Risk: You assume entire financial risk for LTC. Economic catastrophe may result if you require extensive care for a long duration.

- Uncertainty: There’s no way to predict if you will need care. The anxiety and stress of worrying about the future may not be worth any cost savings.

- Investment Risk: Poor investment performance could derail any savings plan. Since these funds will need long-term growth, this is a distinct possibility.

- Lack of Protection: Unlike traditional insurance, self-insurance doesn’t provide the same protection or guarantees. Changes in your health condition are an unhedged risk.

What is one to do?

There’s always a middle way. There are hybrid policies that combine life insurance and LTC. Individuals can also purchase a standard LTC policy that covers a portion of expected expenses and self-insure the remainder. These strategies cover some naked risks of going full turbo self insure and provide a compromise that balances present enjoyment with future worry.

Ultimately, the best decision is always to be honest with yourself.

The Wall Street Journal provides some color.

It is a trade-off that often comes down to personal comfort. “Would you be bothered if, at age 72, you were in a nursing home for 20 years and had to shell out upwards of $100,000 a year?” Pierce says. “Even if you could handle it financially, would you prefer that money be reserved for something else?”

A spreadsheet provides numbers, but emotions give you the answers.