Figuring out how to take a pension can be a life or death decision.

Mistakes cost millions of possible future dollars.

Many New York school districts are tendering teachers early retirement packages.

The pandemic tossed the state’s finances into chaos. A way to save money is by offering the highest-paid teachers financial incentives to retire.

N.Y is focusing on replacing experienced teachers with young people earning significantly less or eliminating the job help states narrow gaping budget deficits.

We worked with several teachers last week, looking at their packages and determining if retirement was a feasible option.

Personally, experiencing decisions helps when guiding others. I ‘m collecting a pension after putting in twenty years in the classroom. Teachers are often only given a few days to respond.

I was eligible for a pension that would pay me about $38,000 a year for the rest of my life. I’m certainly not complaining.

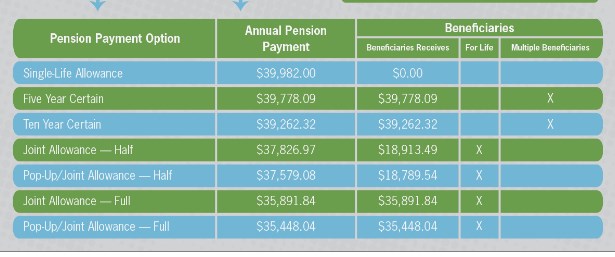

There are several ways to take NYS pension.

Source N.Y. Retirement News

They vary based on the full amount and what percentage to leave a spouse.

I chose the full Pop-Up option, receiving a slightly reduced version of $36,000. In return, upon my demise, my wife Dina receives the full 36k for the remainder of her life.

Also, if something happens to Dina, my original pension will Pop-Up back to the higher 38k figure.

There’s no way of getting any reasonable term policy in the later stages of life; this benefit provided insurance and so much more.

That said, I was not required to take my pension at age 55. I could let it accumulate modestly, kind of like social security, and receive a higher amount in my sixties.

This money wasn’t essential for my daily needs since I’m gainfully employed. I seriously considered waiting to take the pension at a later date and save some money on taxes while receiving a higher payout.

I found out there was one big caveat to this process. If I died before taking my pension, Dina would only be eligible for a lump sum payout of three times my last year’s salary.

While I am relatively young and in good shape – You never know. Meeting my demise by tripping over my son’s X-box wires or strangled in bed by our crazed kitten are unforeseen future possibilities.

Let’s do the Math.

$120,000 x 3 = $360,000 paid out over three years.

Compare that to my $36,000 pension X 40 years life expectancy for Dina = $1,440,000 in expected payouts!

This decision could potentially have cost Dina over $1 million!

Many teachers come to us and haven’t a clue about the risk involved in hanging around to teach a little bit more. Working an additional year leads to a slightly higher pension, but the risk/reward ratio is off the charts.

Older teachers receive pensions double my amount after working 30 years or more in the system and growing the risk factor of premature death exponentially.

We’ve built plans for several teachers taking various variables into account. In every case advised them to take the buyout eliminating the untimely death scenario.

Mitigating some risk with term life insurance is possible, but not all of it. Some teachers in the late fifties and early sixties may have underlying conditions making them uninsurable.

Healthy teachers may not be able to get insurance due to pandemic related underwriting issues. Our advice, don’t try to pick up nickels in front of a steam roller.

Deciding between a pension and an early retirement package shouldn’t be taken lightly.

If you need some help, let us know.

It’s not out first time at the rodeo.