Nobody’s permanent. Everything’s on loan here. Even your wife and kids could be gone next year.- Chrissie Hynde

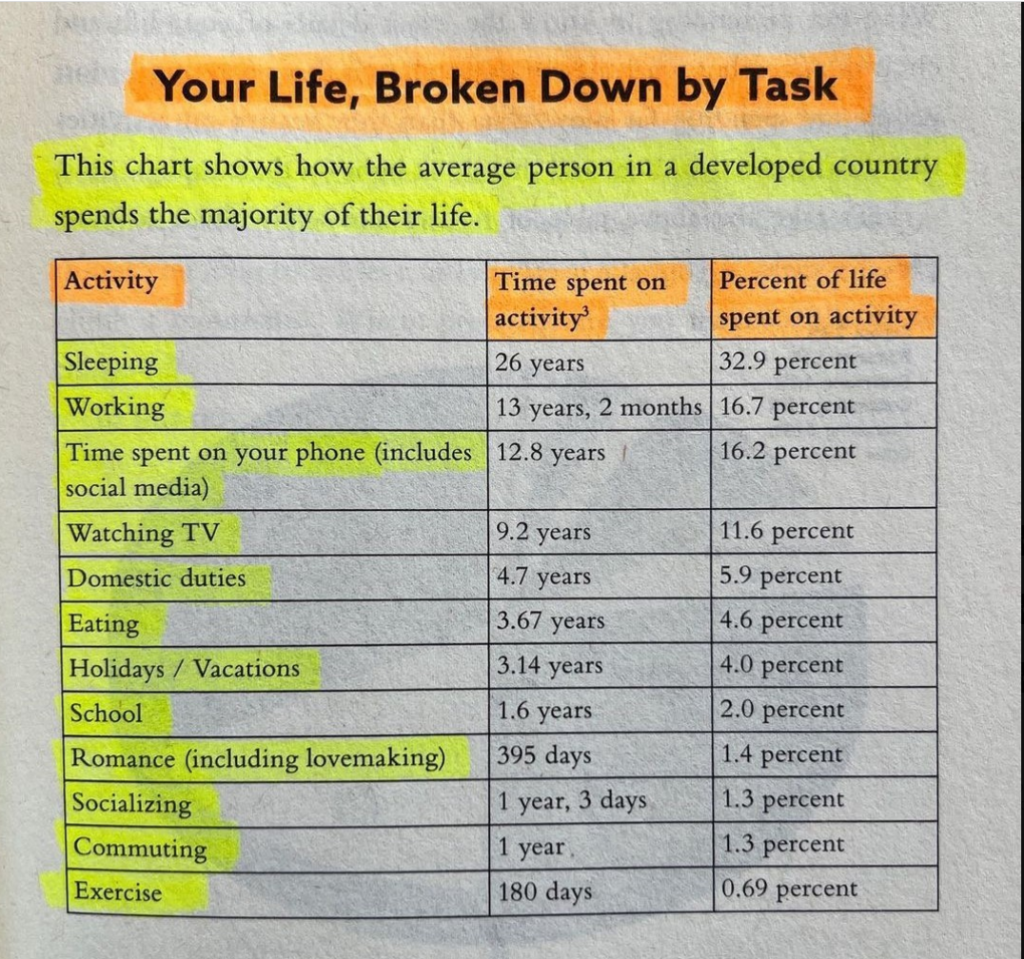

Only you decide how to spend time. Don’t take this irreversible decision lightly.

Last month we made a rare journey into NYC. Nothing personal. It’s just not my cup of tea at this stage of life.

We began our journey on the notorious LIRR, first to visit an old friend and then onto the Beacon Theater for Bono’s limited engagement show- Stories of Surrender.

We had a great time, but Bono wasn’t the star of the evening. The award goes to our car ride home.

Instead of, god forbid, leaving the show early or taking the 11:30 PM train to Stony Brook, involving two changes and an arrival time of 1:30 AM, we made a wise time choice.

The car picked us up at 10:30, and we were home at 11:45. If there were no delays (A big if), we would’ve been in Long Island City instead of our living room choosing mass transit. This doesn’t account for our travel companions, composed of late-night drunken morons and cell phone screamers.

This luxury added about $200 to the bill. It was the best money I spent all year.

Spending enormous amounts of bandwidth pleading with clients to spend their money before their mind/body fails them, this decision struck a chord.

Not everyone has power over ingrained habits.

Some well-off acquiantances decided not to turn on their air-conditioners in the same week because it was only April. The fact that it was 90 degrees failed to penetrate the fixed thought process.

Despite having ample funds to cover a slight uptick in their monthly bill, the decision was – Let’s Suffer Instead.

It’s hard breaking lifelong frugality. One way to change this mindset is to view spending as buying time. My time is worth way more than $200. The decision to take the car was a no-brainer.

As people age, this price spikes because one has less time on the planet each day. Supply and demand need to be weighed against reflexive frugality.

Source: Time Magic by Melissa Amrosini and Nick Broadhurst

Having the ability to make this choice is a blessing. Too many retirees view their good fortune not as good luck but as a curse. The idea of spending generates more suffering than improving an otherwise unpleasant experience.

If you have the means view this freedom as true wealth, not frivolous spending.

Upgrading a hotel room or airplane ticket might not increase your time, but it certainly makes this limited resource more pleasurable.

If you have the means, order the Lobster or Filet Mignon, not the Chicken Francese.

Did you toil away your whole life to deny yourself a few minor luxuries as time slips away?

This isn’t saying to be a careless spendthrift.

Spending to buy time or improve its quality isn’t excessive consumption; it’s common sense.

Nobody lives forever. This whole experience might be the final act, not a dress rehearsal for an afterlife.

If you have the means, go for it. You’ve more than earned it.

One thing’s sure; life comes with an unpredictable expiration date. Delaying gratification as we age is a dicey proposition.

Remember that the next time you’re trapped in a train delay with obnoxious strangers or your bedroom is 87 degrees.

Possesing control over time is the ultimate superpower.

Use it wisely.