The most significant impediment to building wealth is being spooked out of the market. Investor self-defense needs to be centered around counterpunching The Fear Merchants.

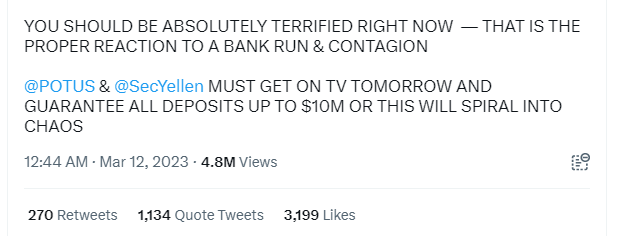

Some Fear Merchants are nefarious. Certain Hedge Fund managers and others seeking their 15 minutes of fame tend to arise from the darkness, fueling the crisis du jour. Often this benefits a bet they made on the market continuing its descent. Conveniently, they omit this tidbit from the small print of their latest terror tweet.

Others are just financially ignorant. Friends and relatives tend to flex their imaginary PhDs in economics at the worst possible moments. When your brother-in-law chimes in on monetary policy during your niece’s birthday party, rushing home and shifting your retirement portfolio into gold isn’t advised.

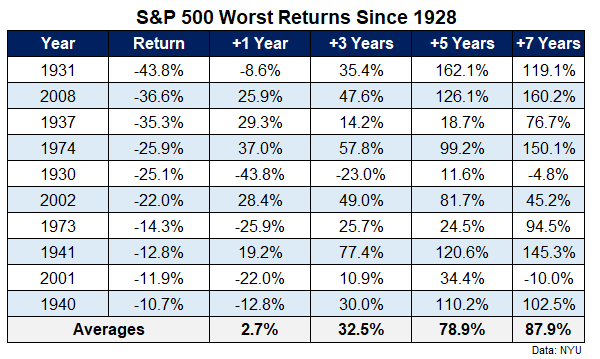

Having watched numerous extinction-level events come and go over the years, I’ve observed a few familiar patterns. The common thread, ignoring the prophets of doom, never failed. Despite war, bank runs, plague, defaults, and other natural and unnatural disasters, a well-diversified global portfolio accompanied by appropriate cash reserves emerged from the ashes, each time stronger than ever.

Here are ten tips for stashing in your investor self-defense toolbox.

- The system Isn’t collapsing. The mega-wealthy run the world. The people that control and profit the most from the markets have much more to lose than an IRA account. They will do anything in their power to keep the machine in place. It may take a while, but the cavalry eventually arrives, putting humpty dumpty back together again.

- See rule #1.

- If things go south, and the banks and corporate borrowers vaporize, it’s game over. Unless you’re a card-carrying member of some Montana Militia or a Wrangler on the Yellowstone Ranch, your chances of survival are slim. Annuities and structured notes won’t do much good against cannibalistic raiders in a Last Of Us landscape. Either things get better, or ALL your worries disappear if door #2 opens.

- Social media isn’t the place to gather data. Aside from a few respected content providers (like our firm), the terrain is overflowing with bots, trolls, fear mongers, incels, and other miscreants trying to get a few likes and attention from your misery.

- Bad stuff tends to follow concentrated bets. You’ll be fine despite the temporary hiccups if your portfolio doesn’t solely consist of Silicon Valley Banks, Meme Stocks, and Bored Apes.

- The crisis is a blip in the arch of time. Unless you are a day trader (not advisable), long-term decisions should never be based upon short-term events, even if you’re 65 years old. Your market participation may last another 35 years. Don’t let a screaming Jim Cramer influence the process.

- The media’s job is to terrify you. Human biology dictates we pay much more attention to threats than sunny skies. It’s incredible how they pivot from one catastrophe to another without skipping a beat. Throwing misery against the wall to see what sticks generates higher ratings but has an inverse effect on your portfolio balance.

- Watching overweight, sleep-deprived people with high blood pressure and other chronic diseases hyperventilating about the dangers of the markets always fascinates me. Without your health, NOTHING else matters. Keeping proper perspective during stressful times is a game-changer. Turn off the TV and go for a walk.

- Time isn’t infinite. We live an average of about 4,000 weeks. Suppose you have a well-balanced diverse portfolio based on your risk tolerance and time horizon. Is wasting precious seconds on the markets’ inevitable and perfectly normal boom and bust cycles beneficial?

- Bad news travels like Novacaine. It stings initially, but eventually, people get numb as it becomes more familiar. When the news becomes less dreadful, it’s viewed as a positive, and markets rally. Rinse and repeat.

Nobody is saying falling markets aren’t scary. It’s better to face fears realistically than let the fear merchants define them.

Choose wisely.