The financial services industry is facing a tipping point. People desperately need unbiased fiduciary advice, yet the industry feeds them commission-laden products.

Something has got to give.

The industry’s moment of truth has arrived; not much different from the medical industry more than a century ago.

150 years ago, we faced an epidemic of overprescribed painkillers. The current opioid epidemic is not unprecedented.

Opiate-addiction became widespread during the 1860s and 1870s. According to Stephen Mihm’s article in Bloomberg, “…there was ‘scarcely one morbid affection or disordered condition’ that would fail to respond to its wonder-working powers.”

The invention of the hypodermic needle made things worse, delivering immediate results like a “magic wand.” Complaints of pain were treated using highly addictive morphine with disastrous results.

While some doctors preached against this practice, others jumped aboard the gravy train.

One well-regarded M.D. put it this way: “Opium is often the lazy physician’s remedy.”

Eventually, the medical profession solved the problem. Medical schools changed their curriculum. Morphine was only to be applied “under carefully controlled circumstances.” Aspirin became the safer alternative.

Doctors who believed in evidence-based medicine embraced this idea. Older and poorly trained ones did not.

“A study in 1919, for example, found that 90 percent of opiate prescriptions in Pennsylvania came from only a third of the state’s doctors, most of whom were over 50 years old.”

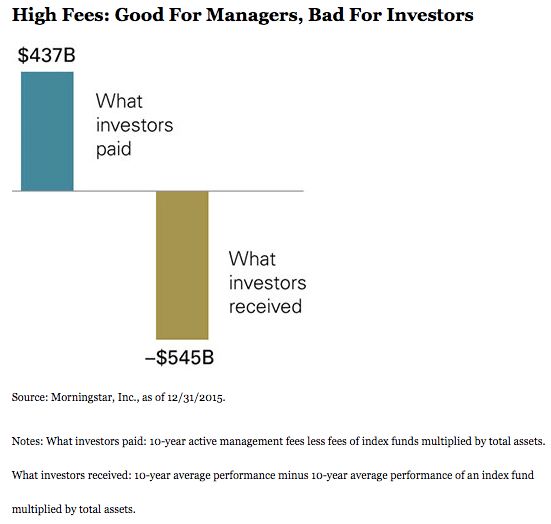

In 2018, we have a similar crisis in financial services. Fee-only fiduciary RIA firms prescribe low-cost, evidence-based investments. Old school brokers and insurance salespeople, addicted to commissions, don’t look out for clients’ best interests.

Why bother with holistic comprehensive financial planning? Doesn’t everyone need an expensive annuity? 10% commissions are a hard habit to kick.

Unlike the medical field, financial salespeople are fighting fiduciary standards tooth and nail.

Powerful financial services trade groups like FSI, SIFMA, and the U.S. Chamber of Commerce successfully blocked a federal court from reconsidering the Department of Labor’s fiduciary rule.

This is not much different than the old school doctors who continued to prescribe addictive and harmful morphine for any minor ache or pain.

According to Barbara Roper, “The industry has spent decades trying to persuade the public that brokers are trusted investment advisers who just happen to be paid through commissions, rather than fees.”

Just take a look at the verbiage on the Wells Fargo Advisors retail brokerage website and judge for yourself.

“We provide advice and guidance to help maximize all elements of your financial life, whenever and however you need it.”

Roper sums things up, “In short, industry lobbyists are back to trying to hoodwink the investing public into believing salespeople are really advisers, sales pitches are really advice, and an obligation to make recommendations that are suitable, but not optimum, is really the best interest standard.”

The profit margins at many firms are addicted to overpriced destructive investment products aimed at the heart of middle-class retirement portfolios.

Don’t hold your breath waiting for them to stop anytime soon.

“Do No Harm” is nowhere to be found in this sales pitch.

Sources: “This Isn’t The First U.S. Opiate Addiction Crisis” by Stephen Mihm, Bloomberg; “SIFMA, FSI And Allies Seek To Block Rehearing Of DOL Fiduciary Rule, by Kenneth Corbin, Financial Planning; “5th Circuit ‘Victory’ Exposes Fiction Behind Brokers’ Claims To Act As Trusted Advisers” by Barbra Roper, Morning Consult.