Many retirees are house-rich but cash poor.

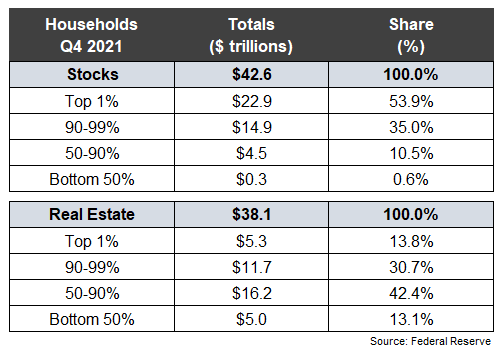

My colleague Ben Carlson points out the chasm between the wealthy and everyone else between real estate and financial assets.

Most Americans struggle to add their housing wealth into a retirement plan.

Source: A Wealth of Common Sense

For some, the answer might lie in a reverse mortgage line of credit.

A reverse mortgage permits homeowners at least 62 years of age to borrow part of their home equity to use as tax-free income. Unlike a standard mortgage, the lender pays the homeowner. A typical FHA reverse mortgage might make sense for homeowners planning on staying in their homes, possessing retirement planning gaps, and owning financial assets under the two million threshold and unable to self-insure.

The debt is repaid upon the owner’s death before the beneficiaries receive anything.

Before government-backed FHA reverse mortgages arrived, this field was populated with swindlers and miscreants cheating seniors with reduced mental capacity by selling them high-fee products. Though times have changed, many remember those bleak days and refuse to consider any reverse mortgage product.

Many homeowners find adding debt to their residences during retirement a psychological roadblock.

Despite these caveats, considering a Reverse Mortgage Line of Credit might make sense during retirement.

Many safeguards are in place to protect consumers from the Yucch factor.

These include:

Mandatory FHA counseling by a counselor not paid by the lender and who checks applicants’ mental capacity.

The loan is Non-recourse.

The Borrower retains the title.

All equity belongs to the heirs.

The loan can be refinanced.

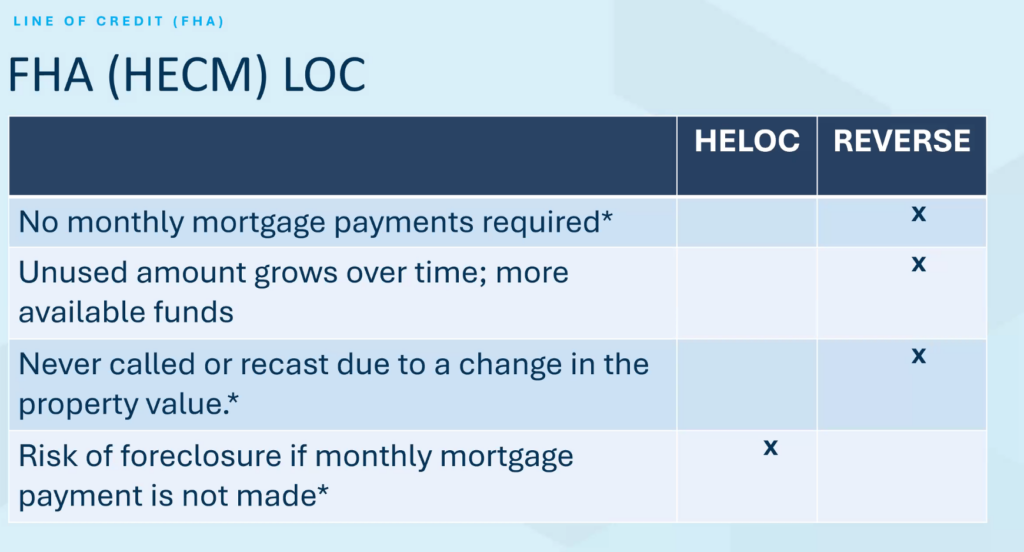

Significant differences exist between the Reverse Mortgage Line of Credit and the standard product.

Source: Stephen Resch

Besides the fact no payments are required until the line is drawn, the value increases over time. A variable interest rate enables the unused balance to grow. The rate is usually slightly above the long-term appreciation rate of residential housing. If the rate is set at around 3.5%, there’s potential for a substantial increase in the amount available to tap.

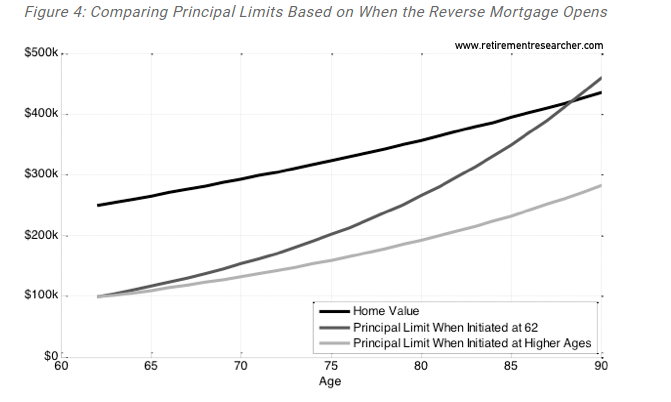

The planning possibilities emerge if the homeowner establishes the line at age 62, doesn’t draw funds, and taps into it at a much later period.

Instead of purchasing a Long Term Care policy with expensive premiums and possibly not adjusting for inflation, the owner can use the line as a self-funded no-premium policy.

During the Great Recession, struggling banks reduced or eliminated many lines of credit. This isn’t the case using this strategy. The line’s growth is based on the long-term appreciation of your home. It’s impossible to owe more money on your residence than it’s worth due to government insurance if you use a HECM only available through an FHA-approved lender.

In addition to LTC, the line could fund retirement plans, delay social security or maintain distribution rates during down markets. Social security increases by nearly 8% yearly; retirees waiting until age 70 receive significantly higher checks. The Line of Credit could be used as supplemental income during the first few years of retirement to ensure a significant inflation-adjusted cash flow for the long term.

If there’s a shortfall in retirement savings, the line could augment income to take advantage of increased catch-up provisions beginning in 2025, included in the recently enacted Secure Act 2.0.

Finally, retirees could temporarily use the line to avoid taking distributions from their qualified accounts during down markets.

This strategy isn’t for everyone. There are costs involved in setting up which aren’t negligible. The variable rate fluctuates over time and is not guaranteed to grow the available credit when needed substantially.

If you want to leave your home to your children, the money borrowed must be paid back to the lender before your beneficiaries receive their share. There are limitations on the amount of home equity included in the formula determining the line available.

Not all reverse mortgages are federally insured. If you don’t use the HECM, there are additional risk factors.

Like anything else, you need to research and determine what’s best for your situation. Use this blog as a starting point, not the gospel.

Despite these drawbacks, this strategy might be a hidden gem to maximizing lifestyle goals for the right person.