Purchasing an expensive Peloton provides no guarantees regarding optimal health. Fancy tracking devices function on data. It’s hard to collect info if you don’t pedal.

The same goes for investing. Expensive Hedge and Actively Managed Funds are terrific at generating wealth – for their sponsors.

Listen to Vanguard legend Jack Bogle – “Over long periods, hardly any fund managers have beaten the market averages. And all the while, they charge their clients’ big fees for the privilege of losing their money.”

Simple beats complex in most aspects of life. Your health is no exception.

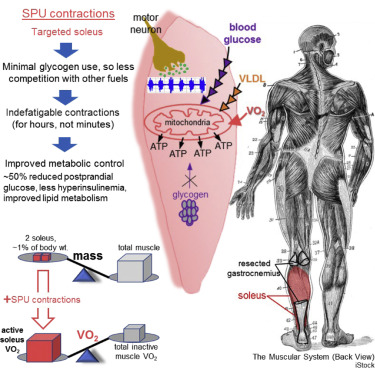

A recent study proved doing simple calf raises using the soleus muscle while seated for extended periods provided terrific beneficial effects.

These results indicate that the human soleus muscle can raise, and sustain for hours, the local rate of oxidative metabolism to high levels. From a physiological perspective, this kind of contractile activity effectively improved systemic metabolic regulation quickly and by a biochemically meaningful amount to improve glucose regulation.

A muscle representing less than one percent of body weight can regulate sugar and fat metabolism. With type 2 diabetes reaching epidemic proportions, this could be a miraculous revelation for many sedentary Americans.

Breathing is another topic in which simple, inexpensive solutions bring enormous benefits.

Extended mouth breathing is toxic. A simple switch to nasal breathing provides the following benefits:

- Filtering, warming, and humidifying air before it is drawn into the lungs.

- Reducing the heart rate

- Bringing nitric oxide into the lungs to open airways and blood vessels

- Better oxygen delivery throughout the body

- Reduced lactic acid as more oxygen is delivered to working muscles.

What are the investment equivalences to seated calf raises and nasal breathing?

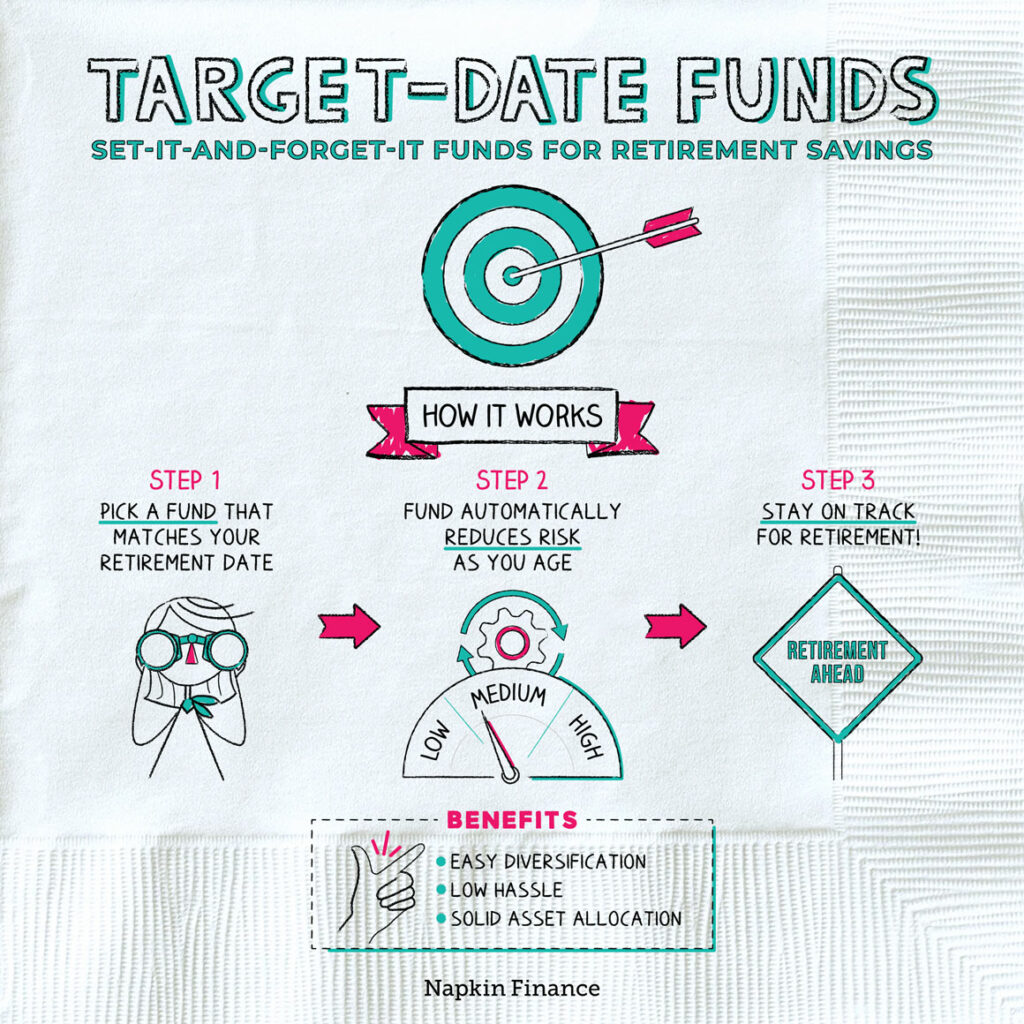

Target-date funds provide cheap, diversified, and age-based one-stop shopping solutions for workplace retirement plans. There’s little need for costly annuities and expensive actively managed mutual funds with this option on the table.

There are worse things than putting your retirement plan on autopilot.

Just make sure you check the expense ratio of your target date fund. Some providers try to jack up the costs by using their proprietary products instead of index funds.

Index funds tend to smoke their more expensive stock-picking counterparts because they’re cheaper and more user-friendly.

Many investors try market timing instead of implementing a dollar-cost-averaging strategy. DCA entails investing a set amount of funds monthly. This guarantees to buy more shares when stocks fall and less as they rise. Buying low and selling high is investor-friendly behavior. Index funds are the perfect tool for this strategy.

More expensive and time-consuming methods often fall far short

Finally, term life insurance is the right policy for almost all families. Costly and complicated whole-life procedures are ubiquitous in typical middle-class households. Perverse incentives regarding commission-based sales are the reason for this misallocation of family resources.

It’s rare to find a situation where simplifying lifestyle or financial choices doesn’t result in a better outcome for end-users.

Surgeries and medications are sometimes the only alternatives. Proper lifestyle changes may prevent these hard choices and their unpredictable side effects.

The same goes for investing. Trying harder by creating costly complexities is a poor substitute for bare-boned and easy-to-understand investments.

Complicated gym equipment and impossible-to-understand investment strategies create obstacles in your quest to optimize your health and wealth.

Making simplicity, your default choice is the proper antidote in both circumstances.