Money shouldn’t be an instrument of torture but often is.

Suffering rears its head in a variety of flavors.

Most are generated by attachment and clinging.

Everything is impermanent. Eastern wisdom professes, “Whatever has the nature to arise will soon pass away.”

So finding lasting joy from temporary things is nothing more than fool’s gold.

We crave certainty, stability, and satisfaction though it’s nowhere to be found.

“We are ignorant of the truth. We think we can be made happy by fulfilling our attachment to a specific person, place, thing, or feeling. Inevitably we are disappointed, and then aversion dislike or even hatred rears its ugly head” – Yongey Rinpoche

label this under the bulging category of – Simple to follow, difficult to implement.

Delusion is our reality. We can’t accept our bodies are constantly in flux. There’s no escaping the aging process.

Some spend big bucks on plastic surgery to regain the fountain of youth.

This is a costly defense mechanism.

Time isn’t the enemy; fixation on youth is.

Attaching ourselves to glory days ends in a trail of tears.

What about our money?

Investors cling to various aspects of their financial plans, not realizing this isn’t discipline – it’s dangerous.

Let change be your financial bodyguard.

Financial plans are created to be adjusted.

Consider the following:

Not keeping up with the latest tax laws is a stealth bear market for your returns.

For example, direct indexing can save you a ton of money in a taxable account. However, attaching yourself to products created decades ago isn’t a wealth-building strategy.

Leaving government bonds in your taxable instead of tax-deferred account drastically lowers their main appeal, their income.

The same can be said for REITs.

Estate planning is a prime example of attachment gone wrong.

Getting divorced and not removing your Ex as a beneficiary is a recipe for disaster.

Insurance provides opportunities for similar debacles.

Keeping the same life insurance policy after having three kids and purchasing a home is asking for trouble.

Retirement planning is no place for a fixed mindset.

Clinging to a set retirement age deprives you of achieving maximum life satisfaction.

Why not ask your employer about reducing your hours? Working on projects that inspire instead of deadening the brain is a game-changer.

Delaying retirement by detaching yourself from dogma works wonders.

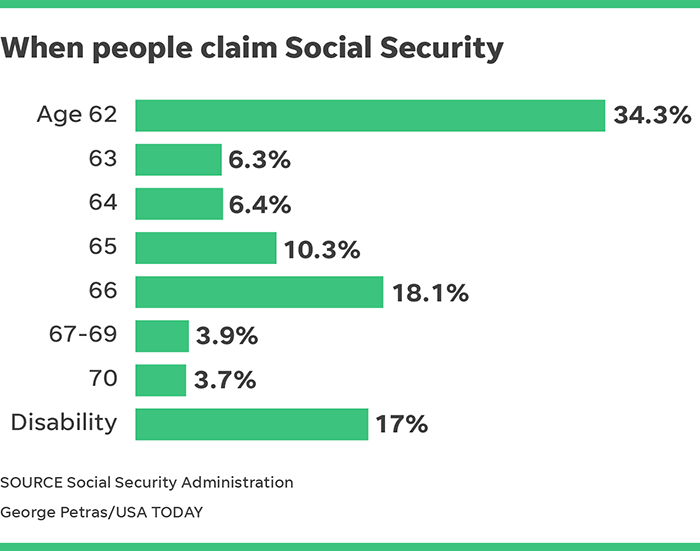

Wedding yourself to an inflexible policy of claiming social security early results in lopping a big chunk off your monthly check.

Following a fixed mindset created by past generations isn’t in your best interests.

Speaking of your best interests, hanging with your current financial advisor might not be a wonderful idea.

Being a great guy or golf buddy isn’t worth paying egregious fees and sacrificing your retirement goals.

Commission chasing salespeople are poster boys for financial non-attachment.

Attachment and clinging are poor wealth-creating and life strategies.

Focus on spending time on financial change rather than frozen processes.

Clinging and fixation lead to disappointment and worse.

Impermanence is a feature, not a bug, of all of our systems.

Avoid needless suffering.

Think that nothing lasts.

Worshipping at the altar of the great law of change is a start.

Finances become complicated when you think the answers are simple.