There’s always a silver lining to every crisis. The Covid-19 Pandemic is no different.

The lockdown might be the antidote for one of the most obnoxious features of our society – Helicopter Parents.

These Parents act as human snowplows, clearing away all obstacles enabling their tribe to crush the competition.

This behavior, designed to boost the self-esteem of both parent and child, is a disaster in waiting.

Parents often go to extreme measures.

Inappropriate support includes calling their kids colleges to solve disputes with roommates and arguing with professors over grades.

Psychologists warn about the dangers of extreme parenting. Doing everything for your child crushes their ability to develop problem-solving skills and forge their own identity.

A funny thing happened on their way to that yell at the teacher/grade changing meeting – a pandemic broke out.

Quarantine serves as a colossal chill pill for these well-meaning but misguided individuals.

With hyper-scheduling canceled, parents needed to create their own space for paying the bills.

Desperate times call for drastic measures. According to the Wall Steet Journal:

About half of 2,067 adults said they are allowing their children to go to bed later (46%), wake up then (51%), and are allowing more screen time (49%), according to a May survey conducted by Harris Poll on behalf of the University of Phoenix. A separate poll found that nearly 30% of parents said their child-rearing styles are at least somewhat or much more relaxed than average, according to a June survey of almost 900 parents by Pittsburgh-based consumer-research firm CivicScience.

A more relaxed approach pays dividends. It’s essential children develop their unique personalities, learning valuable lessons from their mistakes. Growing up believing they’re little princes or princesses is a recipe for a bitterly disappointing life.

Doing next to nothing is a very underrated strategy for most situations.

The same goes for investments. Once allocated in a low cost globally diversified portfolio, your portfolio needs little attention. The exception is adding a regular flow of contributions.

Investors obsess over asset classes, strategies, and geographic considerations, not realizing most strategies work. Changing them at the worst possible time is the reason they fail.

Rebalancing falls under this category. Rebalancing involves taking action to return to pre-determined asset allocation. For example, a portfolio consisting of 60% stock and 40% bonds needs some minimal attention to maintain the status quo. Volatile markets can wreak havoc with the best-designed plans.

How much checking should you do?

Should it be done monthly, quarterly, or God forbid hourly!

It turns out like most investment obsessions, fretting over them is a waste of precious time.

My colleague, Michael Batnick, wrote a brilliant post on this very topic. He looked at a variety of rebalancing and timing methods. (If you’re interested in the details, read the post.)

Michael came to a startling conclusion.

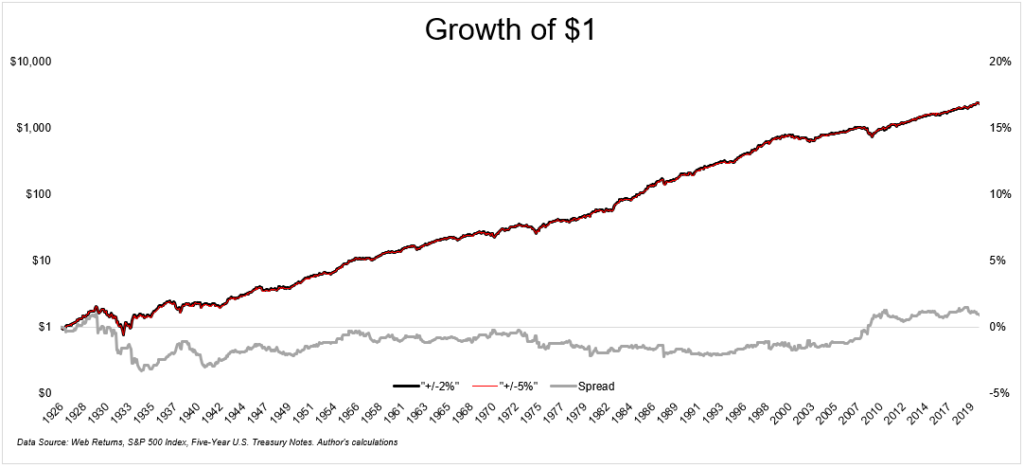

So how did one of these portfolios perform versus the other? They were identical, as you can see in the chart below. One of these portfolios did 8.58% annual growth, the additional 8.59%. I had to make the red line so thin because otherwise, there was a direct overlap. The gray line shows the difference at every point in time between the different rebalancing strategies. At no point in time would you have been much better or worse off by using one versus the other.

Rebalancing once or twice a year on a pre-determined date is more than good enough for most of us.

Letting your kids play outside without acting like a private detective tracking their every move is a wise decision.

So is leaving your portfolio alone for 95% of its existence.

Incessantly hassling your kids, and your investments turn life into a living hell.

If you think your teenager is driving you crazy, wait until you see the consequences of too much portfolio meddling.