Am I going to lose all my money?

I used to hear that question a lot, not so much anymore.

Progress!

A while back, we had a client meeting. It was during another one of our quarterly extinction-level financial events (heavy sarcasm). I can’t recall what the crisis du jour was, but I remember what the client asked.

Looking at me like she was about to cry, she implored, “What’s the backstop?

My response, “you’re looking at it.”

Fear arrived in its full fury.

“Here’s the deal. We focus on what we can control. Your portfolio is diversified by asset class, geography, and investment style. You have a significant allocation to high-quality bonds covering several years of spending. Your investments are a bet on the world’s economies, not individual companies. Capitalism has done pretty well over the best 200 years despite wars, natural disasters, disease, and political turmoil. I don’t know what the markets will do in the short term, but over the long haul, they go up.”

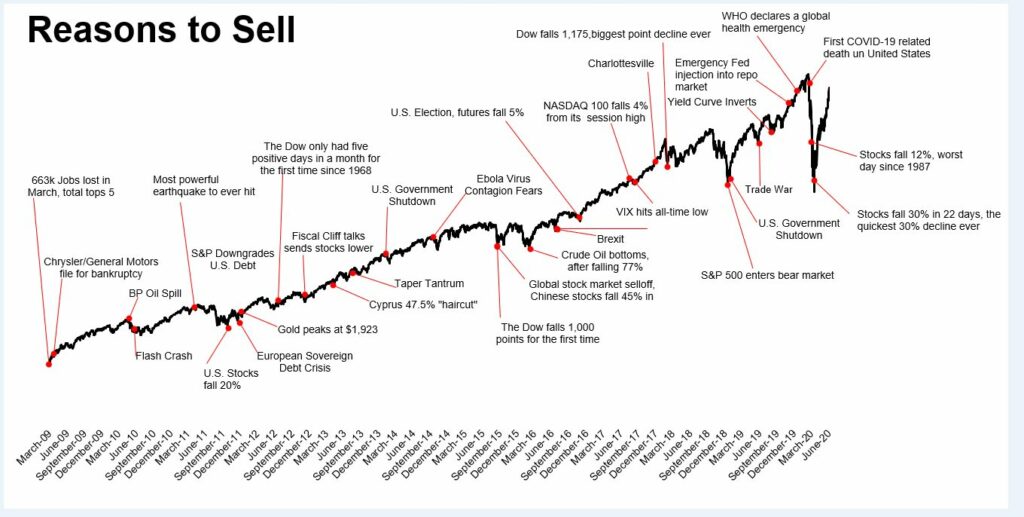

Temporary bad news attracts a lot more eyeballs than long-term good news.

Source: Michael Batnick

Anticipating her next question, I continued.

“What are the alternatives to our strategy you may be thinking? There are none.”

Getting more of her attention with each sentence, I kept going.

“If your worst fears come to pass, and your current stock and bond holdings are wiped out. It’s game over for everything else, including my firm and family.”

Her eyes widened.

“The banks you think are safe are toast. They’re wiped out from all the unpaid loans from bankrupt companies. Forget about FDIC insurance. Since the government bonds you owned defaulted, how are they going to pay the claims?”

Things got real.

“Since society has collapsed, there’s no rule of law. Who is going to pay the police and the military? Bitcoin doesn’t work very well without power.”

Her horror was off the charts.

“Maybe gold will help, but I doubt it. The cannibalistic gangs marauding our countryside would most likely kill you if they knew you had bullion stashed on your property. Maybe you could use it to buy a private army?”

We’re now entering uncharted territory. Zombie Apocalypse here we come!

“We would probably be back to the barter system. Like prison, cigarettes may be the prime medium of exchange.”

It was time to bring it down a notch.

“Let’s talk about reality. Here’s the most likely scenario. If the market falls 50%, you’ll most likely temporarily lose less than 25% of your current wealth. Meaning you’ll still have 75% of your money to get through the next 3-5 years while we wait for the world’s economy to rebound and get back your paper losses before most likely going on to new highs. Is this really the end of the world? Do you think it’s worth sacrificing your most valuable asset, your health? Worrying and elevating your stress levels over events that have virtually no possibility of happening and which you have no control over isn’t a good use of your precious time.”

A funny thing happened. She looked right at me and said. “You’re right.”

I’m not at all making light of her concerns. Putting things in proper perspective helps level the emotional playing field.

Since that conversation, this client has made remarkable inroads. Her transformation gives me tremendous satisfaction and verifies the need to occasionally use a scared straight approach to help clients help themselves.

I bring this up since today is election day, and according to many pundits, the Mayan’s apocalypse prophecy may finally come to pass. Ain’t Extinction level events grand!

I expect I may have to give some people a reality check.

Unfortunately, there’s no Plan B.

On the plus side, I know of one client who probably won’t be calling me.